Solid Follow Through By Bulls On Higher Volume

Declan Fallon | Apr 14, 2016 12:07AM ET

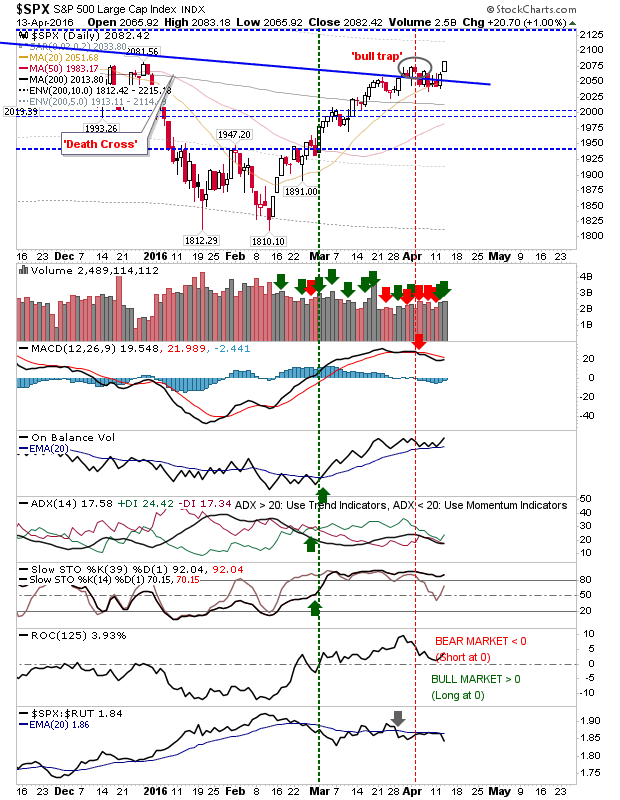

Yesterday we saw a good response from bulls, with higher volume accumulation marking action of buyers and not just short covering.

Gains in the S&P were paired with further losses in relative performance (against the Russell 2000). However, other technicals are improving and the only other 'sell' trigger in the MACD could turn into a strong 'buy' by the end of this week.

The NASDAQ finally pushed into the 4900+ zone yesterday, (taking my short position with it) as volume climbed in solid accumulation. Rate of Change bounced off the zero line in another tick for the bull column. As an added bonus, it also made relative strength gains against the S&P.

The Russel 2000 made a picture-perfect tag of the 200-day MA, but will it play as resistance? More importantly, the relative performance went from a possible breakdown to a bullish breakout.

Yesterday may have put to bed the indecision which has plagued the market for the past couple of weeks. This opens up possibility for moves to new 52-week/all-time highs.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.