Solana Down 80% YTD As Transactions Dwindle

The Tokenist | Jul 12, 2022 05:16AM ET

Solana's downturn continues amidst fear over a looming

With an Solscan , the total transaction count for the entire network was around 80 million at the beginning of the year. Since then, the number has dropped over 56% to its current value of 35 million.

Source: Kaiko

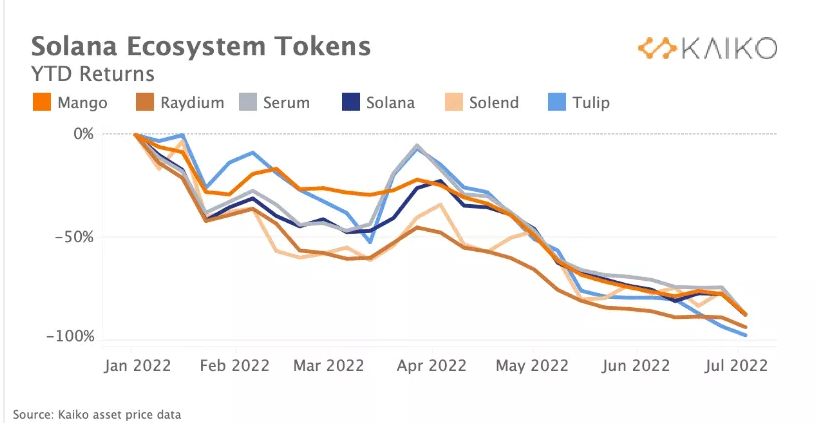

Furthermore, the decline in the number of transactions has had a cascading effect across the entire network. According to Kaiko, the price action of major protocol tokens within the ecosystem has seen significant drawdowns. As seen in the chart above, Tulip, Serum, Raydium, Solend, and Mango have all seen their prices fall by nearly 100%.

Source: Coinmarketcap

Not to be exempted, the SOL token has declined similarly to the various protocols on the blockchain. The chart shows that Solana started the year at $177. Since then, it has dropped over 80% to its current price of $33.6.

Consequently, its performance shows that the $80 mark was a significant support level in the year’s first quarter. After testing the support several times, the second quarter of the year saw a brief rally in price to $140. A further decline ensued, with the former support level failing to hold and the price reaching near $30 amidst broader issues within the crypto space.

However, the start of the third quarter has Solana trading within a tight range between $30 and $40. Nonetheless, the recent news of an impending lawsuit has seen investors look to sell their holdings, leading to a further decline in the price of the native Solana token.

Following the announcement of the impending class action suit, some crypto enthusiasts took to Twitter (NYSE:TWTR) to urge investors to dump their holdings. They claim that the court case may spell doom for Solana once FUD about the ecosystem kicks in.

However, Solana is not the only major crypto industry player with an impending court case. Binance, the largest crypto exchange, also faces severe scrutiny from government institutions. Meanwhile, Ripple has also had similar court filings made against them.

General Crypto Malaise Also to Blame

The impending court case and incessant halts of the Solana network have led to drawdowns in price and activities on the blockchain. However, another significant reason that has played an even more substantial role, is the crypto winter facing the entire market.

Since hitting a new all-time high in November 2021, Bitcoin and the entire crypto market have experienced massive selloffs. According to bear market in full swing.

Global macro headwinds like the Russia-Ukraine war, rising inflation globally, Covid lockdown in China, and interest rate hikes have all had an effect. Also, the recent investigation contributed massively to the price decline.

Source: Coinmarketcap

With the entire market declining, Solana’s price has simply followed suit. Over the last 24 hours, the digital asset has declined by over 6%. After trading in a tight range earlier in the day, the price plummeted to $35.35. Subsequently, it rallied to $33.94 before losing some of its gains and falling back to $33.56.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.