SO: A Safe High-Yield Dividend Stock

Brian Bollinger | Mar 12, 2016 05:23PM ET

Yield-starved investors should familiarize themselves with Southern Company (NYSE:SO), a highly dependable business that has paid dividends every quarter for more than 65 consecutive years.

With a high yield of 4.4%, low stock price volatility, and a track record for outperforming the S&P 500 Index over the last 30 years, Southern Company is the type of business that we like to review for our Conservative Retirees and Top 20 Dividend Stocks portfolios.

Business Overview

The Southern Company is a major producer of electricity in the U.S. that has been in business for more than 100 years. The holding company’s four retail regulated utilities serve approximately 4.5 million customers across Georgia, Alabama, Florida, and Mississippi. Approximately 90% of Southern Company’s earnings are from regulated subsidiaries, and the company also has a small wholesale energy company.

Industrial customers account for 28% of the company’s sales, followed by commercial (27%), residential (27%), and other retail and wholesale (17%).

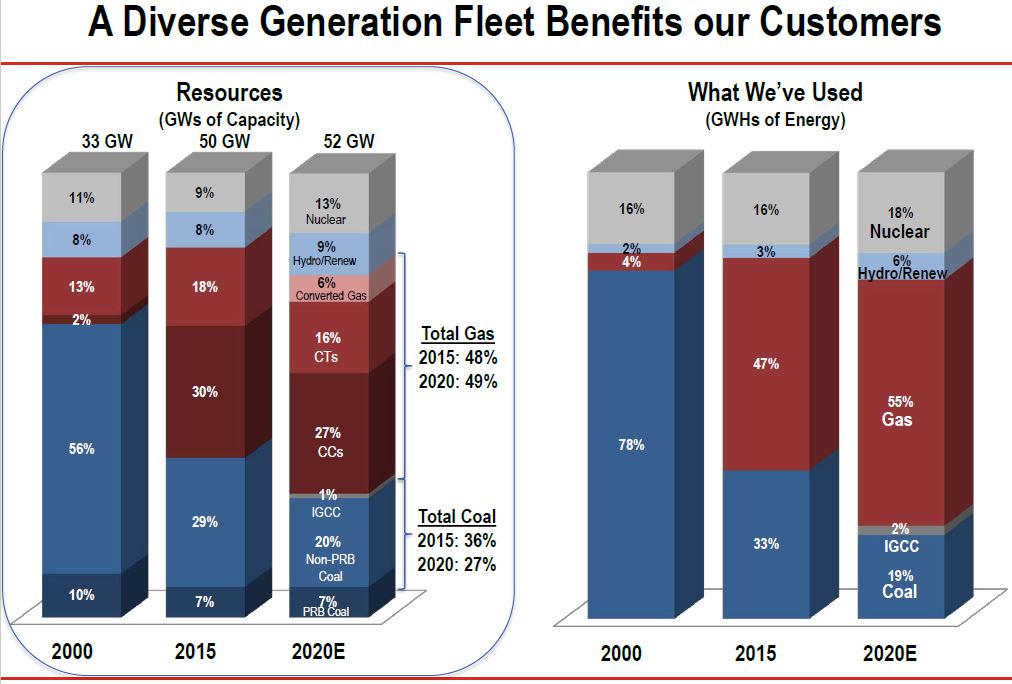

By power source, coal generated 33% of Southern Company’s total megawatt hours in 2015, gas accounted for 47%, nuclear was 16%, and hydro power was 3%.

The company’s mix of business and geographies will significantly change in the second half of 2016 when it closes its acquisition of natural gas utility AGL Resources (NYSE:GAS). Southern Company’s customer count will double to roughly 9 million, and its energy mix will shift from 100% electric to a 50/50 mix of electric and gas.

Business Analysis

Utility companies spend billions of dollars to build power plants and transmission lines and must comply with strict regulatory and environmental standards. As capital-intensive regulated entities, utility companies typically have a monopoly in the geographies they operate in.

As a result, the government controls the rates that utilities can charge to ensure they are fair to customers while still allowing the utility company to earn a reasonable return on their investments to continue providing quality service.

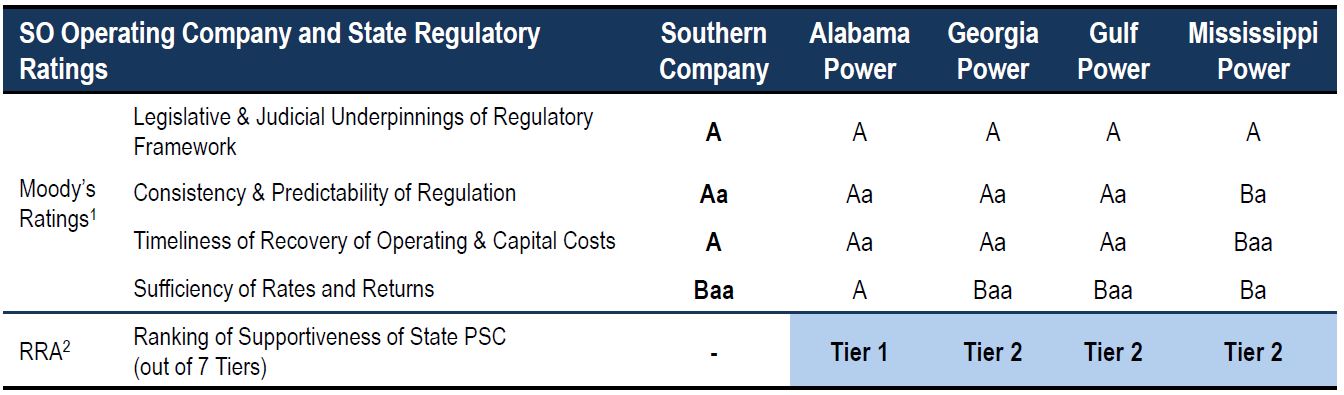

Each state’s regulatory body is different from the next, and some regions have been better to utilities than others. The Southeast region has been friendly to businesses, and Southern Company operates in four of the top eight most constructive state regulatory environments in the U.S. according to RRA:

Source: Southern Company Investor Presentation

Southern also maintains strong relationships with regulators in part due to its reputation and the reasonable rates it currently charges, which are below the national average and perceived as being more customer-friendly.

The South region is also one of the fastest-growing in the country, which makes Southern Company a relatively more attractive utility than many others.

While regulation protects Southern Company’s monopoly business and helps it generate consistent earnings, it also makes growth more difficult. The company’s earnings have grown by about 3% per year historically, but its planned merger with AGL Resources (NYSE:GAS) is expected to boost earnings growth to a 4-5% annual clip.

In late 2015, Southern Company announced plans to acquire AGL Resources for approximately $8 billion. AGL is the largest U.S. gas-only local distribution company, serving about 4.5 million customers in seven states and generating approximately 70% of its earnings from regulated operations.

The combined company will now serve roughly 9 million customers and diversify Southern Company’s revenue mix from being 100% electric to a 50/50 mix of electric and gas customers. The deal also somewhat reduces the impact from the company’s large construction projects that have been delayed and provides a new array of growth projects to invest in. Furthermore, we like that AGL will provide some regulatory diversification for Southern Company by expanding its reach into several new states.

Finally, it’s worth mentioning that Southern Company is the only electric utility in the country that is committed to a portfolio of nuclear, coal gasification, natural gas, solar, wind, and biomass. The company has committed $20 billion to developing a portfolio of low- and zero-carbon emission generating resources, including investments in natural gas, solar, wind, and integrated gasification combined cycle technology.

As seen below, the company’s mix of resources is expected to become more diversified over the next five years, reducing its dependency on coal. A diverse generation fleet reduces the company’s risk of being overly dependent on any one source of energy.

Source: Southern Company Investor Presentation

Southern Company’s Key Risks

Utility companies generally have lower business risk than many other types of businesses. Their biggest risks are usually regulatory in nature – customer rates are decided at the state level and materially impact the return a utility company gets on its major capital expenditures.

In Southern Company’s case, its main states in the Southeast have historically had generally favorable regulatory rulings. The acquisition of AGL Resources will also diversify the company’s regulatory risk.

EPA regulations are another challenge. There is increased scrutiny around coal and nuclear power, which could result in higher spending to remain compliant with safety and emissions standards. If Southern Company cannot pass these costs through to customers, shareholders would take the hit.

Project execution is another big risk facing the company. Southern Company has taken on several major capital projects in recent years. The company is building a coal-fired power plant in Kemper County, Mississippi, and two nuclear plants at Plant Vogtle in Georgia.

The coal gasification project in Mississippi was originally expected to cost $5 billion and go into service in 2014, but it has been delayed by two years and experienced over $1 billion in additional costs. While the Kemper County facility is finally nearing completion, it’s uncertain how the project will be paid for.

A later revised to 15% .

Southern Company is only about 26% finished with construction of its nuclear plants in Georgia. This project has seen its costs escalate from an estimated $14.1 billion in 2009 to over $20 billion today (Southern’s share of the project’s cost is less than $10 billion). It has also been delayed by more than three years.

While the cost overruns and delays on these massive projects are certainly a black eye for the company and do not help its regulatory relationships in the effected states, we do not believe they impair Southern’s long-term earnings power. However, there is risk that these projects receive unfavorable rate treatment with regulators.

Finally, Southern Company’s acquisition of AGL Resources creates some risk. This was a large deal that comes at a time when the management team is already facing challenges with the company’s large capital projects. AGL gets Southern into a new business (gas utility) and brings exposure to new states that have different regulatory bodies.

Dividend Analysis: Southern Company

We analyze 25+ years of dividend data and 10+ years of fundamental data to understand the safety and growth prospects of a dividend.

Dividend Safety Score

Our Safety Score answers the question, “Is the current dividend payment safe?” We look at factors such as current and historical EPS and FCF payout ratios, debt levels, free cash flow generation, industry cyclicality, ROIC trends, and more. Scores of 50 are average, 75 or higher is very good, and 25 or lower is considered weak.

Southern Company’s dividend payment appears very safe with a Dividend Safety Score of 86. If we exclude charges related to increased cost estimates for the company’s large construction projects, Southern’s earnings payout ratio in 2015 was 75%. While we prefer to see a lower payout ratio for most businesses, we can see that Southern Company’s payout ratio has remained between 70% and 80% for most of the last decade.

Source: Simply Safe Dividends

Utility companies can also maintain relatively high payout ratios compared to most businesses because their financial results are so stable. Customers still need to use a certain amount of electricity and gas regardless of economic conditions, making utilities one of the best stock sectors for dividend income.

As seen below, Southern Company’s sales only fell by 8% in fiscal year 2009, and its stock was flat in 2008, outperforming the S&P 500 by 37%. Utility companies are generally great investments to own during economic downturns.

Source: Simply Safe Dividends

We can also see that Southern Company’s reported earnings have remained remarkably stable over the last decade. The dip in recent years was caused by constructed-related charges. Otherwise, the steady earnings results look almost like interest payments coming in from a bond. Southern’s earnings growth isn’t exciting, but it’s dependable.

Source: Simply Safe Dividends

As a regulated utility company, Southern generates a moderate but predictable mid-single digit return on invested capital. The slight dip was due to write-offs on its capital projects, but the favorable regulatory environment in its key states has helped it earn somewhat higher returns than many other utility companies. We expect the company’s returns to improve as its large projects finally come on-line.

Source: Simply Safe Dividends

Utility companies maintain a lot of debt to maintain their capital-intensive businesses. Southern Company most recently reported $1.4 billion in cash compared to $27.4 billion in debt on its balance sheet. While this would be a concern for most companies, the stability of Southern’s earnings and strength of its moat alleviate much of this risk.

The company also has over $4 billion available in its credit facility and maintains investment grade credit ratings with the major agencies.

Source: Simply Safe Dividends

Despite the challenges Southern Company is facing with its major construction projects, the safety of its dividend still looks great. The company maintains a reasonable payout ratio for a utility company, earnings are predictable each year, and its key operating states have provided a historically favorable regulatory environment.

Dividend Growth Score

Our Growth Score answers the question, “How fast is the dividend likely to grow?” It considers many of the same fundamental factors as the Safety Score but places more weight on growth-centric metrics like sales and earnings growth and payout ratios. Scores of 50 are average, 75 or higher is very good, and 25 or lower is considered weak.

The dependability of utility companies’ dividends comes at the price of growth. Southern Company’s dividend has grown at a 3.9% annualized rate over the past decade, and the business has a very low Dividend Growth Score of 9. The company most recently increased its dividend by about 2% in April 2015, marking its 14th consecutive raise.

Source: Simply Safe Dividends

While Southern Company is 11 years away from joining the dividend aristocrats list, we believe it has a good chance of getting there. The company’s dividend growth rate could even increase in coming years. Management believes the AGL Resources merger could increase Southern’s long-term earnings per share growth from 3% to 4-5%, which would allow for slightly greater dividend raises.

Valuation

SO’s stock trades at 17.4x forward earnings estimates and has a dividend yield of 4.36%, which is below its five-year average dividend yield of 4.46%.

If the AGL merger increases the company’s long-term earnings growth rate to 4-5% as management expects, the stock appears to offer total return potential of 8-9% per year.

We think the stock looks to be about fairly valued today, and it’s worth noting how the predictability of Southern’s business has resulted in very low stock price volatility. The chart below shows the volatility of each of the 20 utilities in the Philadelphia Electric Utility Index (UTY). Southern Company had the lowest level of volatility through the five-year period ending on 12/31/2014.

Source: Southern Company Annual Report

Conclusion

Southern Company is a blue chip dividend stock in the utilities sector. The last few years have been disappointing due to delays and cost overruns with some of the company’s major construction projects, but the long-term outlook appears to be intact.

Southern Company’s stock appears to be reasonably priced and offers a dependable income stream for those living off dividends in retirement. It’s hard not to like a business as sturdy and reliable as this one.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.