EUR/USD: Flat On Disappointing Growth

MarketPulse | May 16, 2014 07:55AM ET

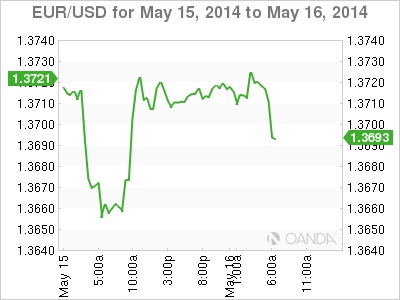

The euro is unchanged in Friday's European session, as EUR/USD trades in the low-1.37 range. Weak GDP numbers are weighing on the currency, which has had an uneventful week after last week's rollercoaster excitement. On Thursday, US Unemployment Claims were excellent, as the indicator plunged to a seven-year low. Taking a look at Friday's events, French Preliminary Non-Farm Payrolls came in at -0.1%, matching the estimate. In the US, today's highlights are Building Permits and the Preliminary UoM Consumer Sentiment.

Eurozone GDP releases, the primary gauge of economic growth, mostly disappointed in April. Eurozone Flash GDP dipped to 0.2%, short of the estimate of 0.3% French and Italian GDP releases both weakened and missed expectations. The one bright note was German Preliminary GDP, which jumped 0.8% in Q1, its best showing since Q1 in 2013. This edged above the estimate of 0.7%.

At last week's policy meeting, Mario Draghi, the ECB said it would be comfortable taking monetary action in June, the markets jumped, and the euro has been in a tailspin ever since. However, Draghi gave himself plenty of wiggle room, saying the ECB would take into account growth and inflation forecasts before making any moves. Eurozone Core CPI improved to 1.0% in April, up from 0.7% a month earlier. Eurozone CPI followed suit, as it improved to 0.7%, up from 05%. With both inflation indicators matching their estimates and pointing upwards, the ECB has some breathing room before having to take action. If upcoming inflation numbers meet expectations, we could see the ECB play it safe in June and remain on the sidelines yet again.

In the US, Thursday's employment and manufacturing numbers were strong. Unemployment Claims were outstanding, dropping to 297 thousand last week. This easily beat the estimate of 321 thousand and was the lowest level we've seen since May 2007. On the manufacturing front, the Philly Fed Manufacturing Index dipped to 15.4 points, but this was well above the estimate of 13.9 points. As well, Empire State Manufacturing Index climbed to 19.0 points, crushing the estimate of 5.5. This was the indicator's best showing in two years.

EUR/USD May 16 at 8:45 GMT

EUR/USD 1.3718 H: 1.3725 L: 1.3707

EUR/USD Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.3487 | 1.3585 | 1.3649 | 1.3786 | 1.3893 | 1.400 |

- EUR/USD is unchanged in Friday trade.

- 1.3649 is providing support. 1.3585 is stronger.

- 1.3786 continues to provide strong resistance.

Further levels in both directions:

- Below: 1.3649, 1.3585, 1.3487 and 1.3346

- Above: 1.3786, 1.3893, 1.4000, 1.4149

OANDA's Open Positions Ratio

EUR/USD ratio is unchanged in Friday trading. This is consistent with the pair's current movement, as the euro is drifting close to the 1.36 line. The ratio runs slightly in favor of long positions, indicative of a slight trader bias towards the euro reversing its downward spiral.

EUR/USD has looked quiet for most of the week, and this is continuing on Friday. The pair is unchanged in the European session.

EUR/USD Fundamentals

- 6:45 French Preliminary Non-Farm Payrolls. Estimate -0.1%. Actual -0.1%.

- 8:00 Italian Trade Balance. Estimate 2.47B.

- 9:00 Eurozone Trade Balance. Exp. 17.3B.

- 12:30 US Building Permits. Estimate 1.o1M.

- 12:30 US Housing Starts. Estimate 0.98M.

- 13.55 US Preliminary UoM Consumer Sentiment. Estimate 84.7 points.

- 13:55 US Preliminary UoM Consumer Expectations.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.