Small Stall At All-Time Intraday High; Chart Review Madness

Dr. Duru | Jul 18, 2013 05:00AM ET

: 60.0%

VIX Status: 13.8

General (Short-term) Trading Call: Hold – Aggressive traders who got long the breakout can STILL stay long; otherwise, buy dips with tight stops

Active T2108 periods: Day #15 over 20% (overperiod), Day #1 over 60%, Day #42 under 70%

Commentary

I estimated last week that T2108 would reach overbought by today (Thursday). With T2108 at 60.0% as of yesterday's close, I think it is unlikely. The S&P 500 (SPY) has stalled out a bit right at the all-time intraday high, and it would take a strong rally to push T2108 through the overbought threshold over one more day. It is earnings season so anything can happen of course, but I am adjusting my forecast to Monday or Tuesday of next week.

In the meantime, all the bullish signals remain. T2108, and thus the S&P 500, still has room to run from here.

I will quickly finish this update with six stocks of interest which are providing (or should provide) the excitement that S&P 500 has not in the past four days.

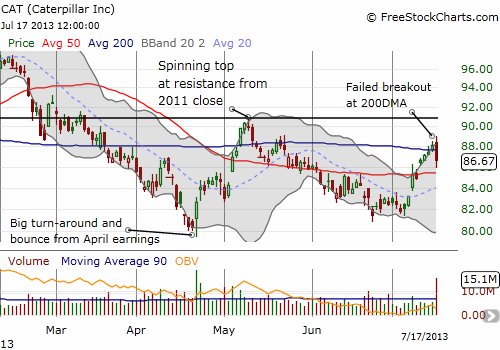

Jim Chanos has long been bearish on China, so I am surprised that his words were able to generate such a sharp and sudden surge in selling on Caterpillar (CAT). These fireworks demonstrate the power of Chanos. It will now be incredibly hard for me to remain long the few shares that I have. In the meantime, I will ride the puts I just bought last week anticipating CAT to fail at the 200DMA resistance. Going forward, I will likely get even more aggressive on my put buying on CAT.

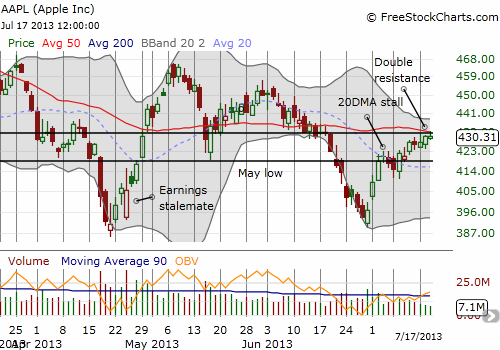

Apple (AAPL)

Yes, my favorite charting (and trading) stock. Hopefully, you are not getting too tired of my constant chatter about it. Anyway, AAPL had another strong start to the week, but it is clearly struggling to break through upper resistance at the convergence of the old $532 pivot and the 50DMA. I took a chance and held on to my calls for the start of the week's play; I am looking for the outside shot that AAPL manages to gap higher by Friday. I bought my puts a little early and they are essentially worthless right now.

SolarCity (SCTY) (and Tesla (TSLA))

SCTY broke out and started traveling the upper-Bollinger Band® almost according to “plan.” Goldman Sachs (GS) ruined things by slapping Tesla (TSLA) with an average target price across three scenarios of $86. In sympathy, fellow Elon Musk stock SCTY came tumbling down. I stretched out this play by holding on to my July $45 calls. Now the race to the buzzer is really hot. I am not likely to win on this one. Note how TSLA came roaring back on extremely high volume. The run on that one is far from over.

Baidu (BIDU)

This was the HUGE win of the week. The BIDU pop was a great reminder of how it can pay to be patient, stick to the technicals, and execute on the analysis. The moment of truth on BIDU transformed into a major breakout. The very next day, the stock zipped above 200DMA resistance and sliced through $100. On Tuesday, the stock gapped up about 6% on news of an acquisition, and I sold my call options into the open. They expire on Friday, so need to keep pressing my luck on that one.

GOOG reports earnings Thursday evening. For some reason, I do not feel particularly compelled to speculate on the earnings. I still believe that GOOG is heading soon to $1000, but I do not expect earnings to propel it there in one day. So, I am thinking I am fine waiting out the post-earnings reaction and making a move from there. Hopefully, I get a trigger-happy sell-off…down to the 20 or 50DMA would be perfect.The stock has conveniently stalled just like the S&P 500 the past three days around the former intraday all-time high.

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Be careful out there!

Disclosure: long SCTY calls; long CAT shares and puts; long AAPL shares, calls, and puts

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.