Small Caps Maintain Gains While Tech Struggles

Declan Fallon | Nov 10, 2016 10:51PM ET

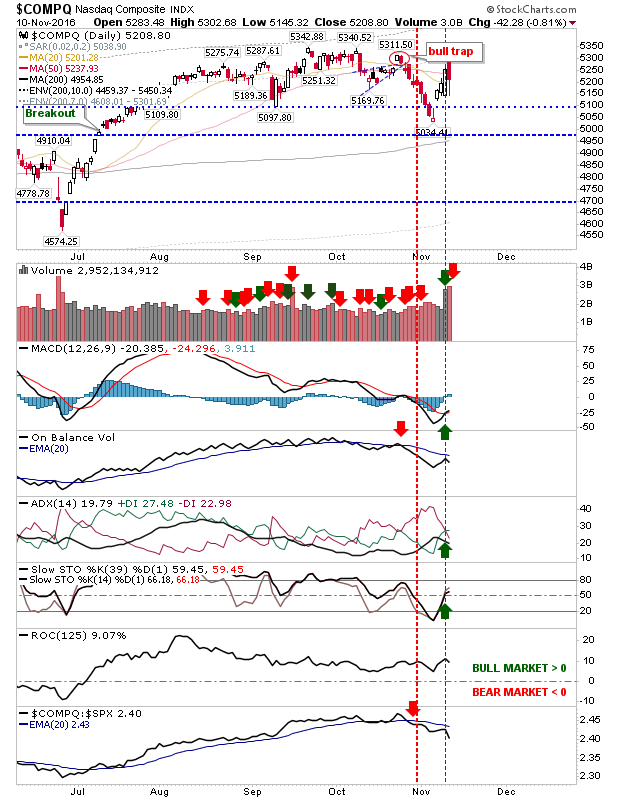

There was a big divergence in markets as the NASDAQ succumbed to fears of a Trump presidency as Blue Chips held fast. Volume climbed to register as distribution for Tech stocks. Unfortunately, this all occurred after my election night short position was stopped out, but new shorts may enjoy better fortune.

The NASDAQ turned a MACD and +DI/-DI 'buy' trigger. Relative performance accelerated lower as other indices enjoyed more positive days.

The S&P finished on a doji, but the index was unable to push past 2,180. However, the declining channel from August was decisively broken which should mark the start of an intermediate rally lasting 2-3 months. The chief worry is the sharp drop in relative performance against the Russell 2000.

Meanwhile, the Russell 2000 was able to close higher as it works on challenging new all-time highs. Thursday's action was the direct opposite of the NASDAQ (and S&P to a lesser degree) and delivered a massive swing in relative performance. This also marked a net bullish technical picture. Pullbacks in this index are buying opportunities.

With the divergence in activity it will now be down to whether bears can continue in driving Tech weakness, or if bulls can create new multi-years highs with Small Caps.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.