Sinner Schrader

Edison | Jan 31, 2015 09:50AM ET

Improving margin profile

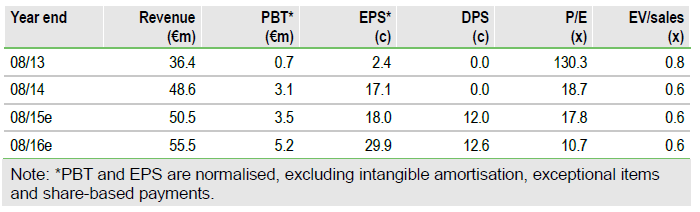

We forecast EBITA margins to almost double over the next three years through productivity gains and as the recently launched Next Audience (NA) platform starts to contribute to earnings. This is not reflected in the P/E rating, which at c 10x annualised 2015 earnings, excluding the investment in the NA platform, is half that of its peers. If management can deliver to forecasts, we see scope for 50-100% valuation upside.

FY15 should be another year of growth

Following 34% revenue growth for the year to August 2014, Q1 revenues increased by a solid 15%, which despite an increasingly difficult basis of comparison puts the group on track to deliver mid-single-digit revenue growth in FY15. Key to top-line performance will be the stuttering economic climate in Germany, as well as the recently launched NA platform – we are encouraged by the signing of a second customer, TUI Connect, during Q1.

Scope to significantly improve margins

EBITA margins of 6.3% in 2014, while up on 2013’s 1.9%, were affected by the use of more freelance workers in order to service the rapid pick-up in growth and the €1.6m investment in the NA platform. While this persisted in Q115, we see significant scope for margin improvement over the forecast period as the NA platform, which is now generating revenue, moves towards breakeven, together with improvements in productivity in a more normal revenue growth environment. Over the period FY08-11, EBITA margins averaged 13.3% on a revenue base half the current level and we expect margins to start to trend back up towards this level.

Valuation: 50% discount to peers unjustified

While 2015 is not without revenue risks, we expect another growth year and with a margin expansion profile, we forecast earnings to grow at a CAGR of 35% to 2017. The share trades on an annualised 2015 P/E of 14.4x, or 9.8x when we exclude the investment in NA, a 50% discount to digital agency peers. NA adds a degree of option value to the share and with a leading franchise in a growth market we believe this discount is unjustified. If management can deliver to forecasts, we believe there is scope for 50-100% upside to the share price, while the reinstatement of a €0.12 per share dividend should provide some downside support in the event of a further softening of the German economy. Key catalysts for a re-rating include news on the progress of the NA platform and evidence of productivity improvements in the agency business along with German GDP data.

To Read the Entire Report Please Click on the pdf File Below

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.