Single Touch Systems: Mobile Media Group With IP Option Value

Edison | May 16, 2014 12:14PM ET

Mobile media group with IP option value

Single Touch Systems (SITO) is rolling out new messaging services and has diversified into the fast-growing mobile media market – we forecast strong revenue growth to continue. Furthermore, the strategic value of the Walmart relationship and the IP adds an option value to the share; last month’s deal with a major US broadcaster is a strong validation that there is value in its patents and further deals could follow. In our view, this is not fully reflected in the share price.

Mobile media and marketing – widening its reach

A mobile notification solution for Walmart’s pharmacies accounted for 87% of revenues in FY13. Management’s strategy is to widen its reach; Walmart recently renewed its contract with channel partner AT&T for another two years and it now offers over 40 different messaging programmes to Walmart customers. Furthermore, it has recently expanded into the fast-growing mobile media market with the launch of a location-based advertising (LBA) service ‘FollowMe’ which is being used by a growing roster of clients.

Patent monetisation – important validation

SITO also has a portfolio of 20 patents and pursues a strategy of IP monetisation. It reported its first success against Zoove in November and last month announced a deal with a US broadcaster regarding its streaming media patents. This validation from a high-profile participant in the industry could pave the way for future deals.

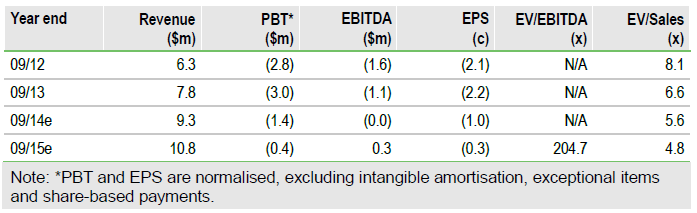

Forecasts: Pace of roll-out of new services

There is considerable scope for growth from the Walmart relationship; the pharmacy product is used by only 9% of customers and some of the new services, such as e-receipts, look promising. FY14 will also include inaugural media revenues where management reports a strong pipeline of deals plus first patent agreements. The operating division became profitable a year ago, and we forecast the group to become EBITDA positive during FY14 on revenue growth of 19%.

Valuation: Core and strategic value

The patents and the database of customers offer significant strategic value and add an option value to the share. We estimate the value of the operating division at 23-39c per share, which implies the market is attributing little value to the strategic assets. Catalysts to increase the valuation include news regarding the roll-out of new messaging and media services to new and existing customers, a transition of the Walmart database to enable push marketing, and further patent deals.

To Read the Entire Report Please Click on the pdf File Below

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.