Silver And WTI Face Make-Or-Break Moment

Dailyfx | Sep 09, 2014 06:03AM ET

Talking Points

- Gold and Silver At A Crossroads Near Key Technical Levels

- Crude Oil May Be Left Lacking Bullish Cues Amid Void Of Data

- WTI Faces Make-Or-Break Moment As Prices Compress

The precious metals are marginally weaker in Asian trading (silver -0.16%, Palladium -0.56%) as US Dollar strength permeates the broader market. A research note from the US Federal Reserve released on Monday suggested investors were underpricing a rate hike from the central bank, which has likely aided the greenback’s ascent.

A thin US economic docket lies ahead. This raises a question mark over whether the US Dollar bulls can continue their charge amid a void of supportive news flow. Nonetheless the tide has certainly turned in favor of the reserve currency over recent months as speculation over Fed tightening gathers pace. Alongside ebbing geopolitical concerns this leaves gold and silver in a precarious position near noteworthy technical levels of support.

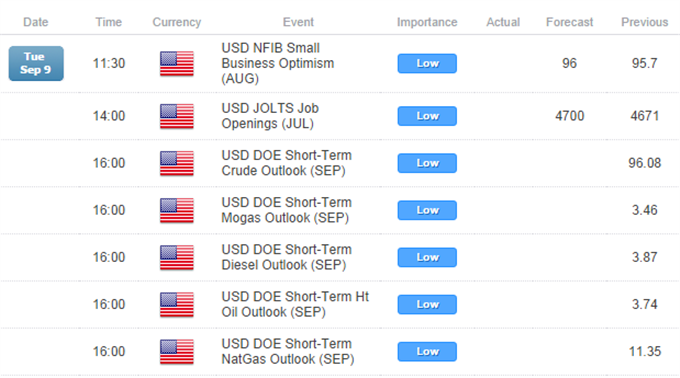

Crude oil and Copper have also likely suffered at the hands of their pricing currency. The DOE’s upcoming Monthly Short-Term Energy Outlook report may do little to inspire a recovery for the crude benchmarks. The set of global forecasts from the government agency for energy demand and consumption are often met with little fanfare by traders.

Coupled with fading Iraqi and Russian supply disruption fears WTI and Brent may be left lacking bullish fundamental cues. However, the potential for a “corrective bounce” should not be overlooked given the speed and magnitude of recent declines.

UPCOMING ECONOMIC DATA

CRUDE OIL TECHNICAL ANALYSIS

WTI is poised for a make-or-break moment as the commodity is compressed between its descending trendline and the 92.55 barrier. While a Hammer hints at potential shift in sentiment to the upside, it lacks confirmation from a successive up day. A downside break of the nearby floor would open a knock on the 91.20 mark.

Crude Oil: Faces Make-Or-Break Moment As Prices Compress

GOLD TECHNICAL ANALYSIS

Gold is threatening to maintain its downward trajectory after sliding below the 1,257 mark. Alongside signs of a short-term downtrend the spotlight is left on the June 2014 lows near 1,241. A daily close above the its descending trendline would be required to raise the prospect of a sustained recovery for the precious metal.

Gold: Threatens Retest of June Lows

SILVER TECHNICAL ANALYSIS

Silver is hanging by a thread as it probes below the critical 19.00 barrier with a core downtrend still intact. A daily close below the noteworthy floor would be seen as a fresh opportunity for short positions targeting the 18.50 mark. A corrective bounce to the 19.50 ceiling would offer an alternative entry point.

Silver: Awaiting Downside Break To Open 18.50

COPPER TECHNICAL ANALYSIS

Sellers appear intent on capping copper below its descending trendline on the daily. A Shooting Star formation and respect of the 3.19 ceiling suggests the upside may be limited for the base metal. Yet price action continues to be messy and a clean run lower may prove difficult. Buying interest may be renewed on a retest of the recent lows near 3.13.

Copper: Upside Capped By Trendline Resistance

PALLADIUM TECHNICAL ANALYSIS

Palladium’s upside momentum appears to be stalling with a Bullish Engulfing formation on the daily failing to find follow-through. Further, a Head and Shoulders reversal pattern is taking shape which would warn of a top if the 866 neckline were broken. Yet within the context of a core uptrend; while above 866 the risks are skewed to the upside.

Palladium: Head and Shoulders Pattern Takes Shape

PLATINUM TECHNICAL ANALYSIS

Platinum is threatening a breach of the 1,395 target offered in recent commodities reports. The support level may see some buying interest renewed, yet downside risks remain given the context of a sustained downtrend on the daily. A daily close below the barrier would set the scene for a run on the 1,360 handle.

Platinum: Awaiting Breakout To Open A Run On 1,360

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.