Should Fed End QE With Low Inflation/High Unemployment?

Chris Ciovacco | Nov 14, 2013 03:58PM ET

The longer you are involved with the financial markets, the more you respect the market’s obsession with the Fed. The quantitative easing process (QE) pumps money into the global financial system. The money can find a home in stocks, real estate, gold, etc. Handicapping the Fed is a big part of successfully navigating through the financial market waters. Therefore, it is prudent to understand what drives the QE decision making process at the Federal Reserve.

Primary Fed Objectives

The Federal Reserve Act was altered by Congress in 1997 adding the “dual mandate” clause:

“The Board of Governors of the Federal Reserve System and the Federal Open Market Committee shall maintain long run growth of the monetary and credit aggregates commensurate with the economy’s long run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices and moderate long-term interest rates.”

The Fed’s dual mandate in short form is “maximum employment and stable prices”. Stable prices speak to low inflation.

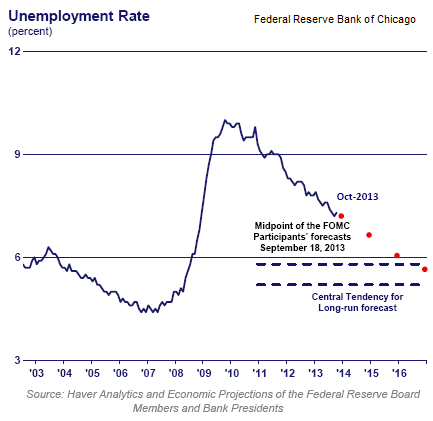

How Are They Doing With Maximum Employment?

The chart below is posted on the website of the Federal Reserve Bank of Chicago. It shows the unemployment rate dating back to 2002. The current unemployment rate is higher than it was at any point between 2003 and early-2008, meaning unemployment remains high relative to recent historical standards.

How About Inflation?

From a distance, it may seem as if no inflation would be the best case scenario. That is not the case in the central bank world in which we live. Central bankers have nightmares about Japan-like deflationary spirals. A deflationary spiral occurs when prices are falling and consumers sit on their wallets hoping for a better deal. As they wait, prices fall even further, creating a negative economic feedback loop. Falling prices can disrupt the balance between assets and liabilities, which in turn speaks to credit worthiness and solvency. Therefore, central bankers prefer to see annual inflation running closer to 2%, rather than 0%. The chart below shows inflation continues to hover near levels that make central bankers worried about slipping into deflation.

Why Taper Then?

If the Fed is failing to meet the mandated maximum employment target and inflation, if anything, is too low, why would the Fed cut back on QE? The answers: fear of asset bubbles and fear of a rapid spike in interest rates. Interest rates have been and are being artificially held down via the Fed’s QE-induced demand for Treasuries (TLT). The longer QE goes on and the larger the Fed’s balance sheet becomes, the harder it is to avoid a taper-induced spike in interest rates. The Fed caught a glimpse of just how difficult it will be to taper their way out of the QE business earlier this year. In late May, during a Q&A session Ben Bernanke said it was possible the Fed would begin reducing their monthly bond purchases (taper) before the end of the year. Interest rates spiked on the news, which is exactly what the Fed wants to avoid. If you want to see what can happen when rates spike, November 12 , we would like to see some improvement in emerging markets. Should EEM remain weak, we may reduce our exposure for a second time before the markets close this Friday.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.