Shortest Stock Correction Ever

Sunshine Profits | Feb 24, 2021 10:10AM ET

What a day that was. What started off looking like a sea of red not seen in months ended with the Dow and S&P 500 in the green.

It was an overdue plummet – at least that’s what I thought at the start of the day. The Dow was down 360 points at one point, and the NASDAQ Composite was down 3%.

But by the end of the day, Jay Powell played the role of Fed chair and investor therapist, and eased the fears of the masses.

The Dow closed up, the S&P snapped a five-day losing streak, and the Nasdaq only closed down a half of a percent!

You really can’t make this up.

The day started gloomily with more fears from rising bond yields.

Sure, the rising bonds signal a return to normal. But they also signal inflation and rate hikes from the Fed.

But Powell said “not so fast” and eased market fears.

“Once we get this pandemic under control, we could be getting through this much more quickly than we had feared, and that would be terrific, but the job is not done,” Powell said .

He also alluded to the Fed maintaining its commitment to buy at least $120 billion a month in U.S. Treasuries and agency mortgage-backed securities until “substantial further progress is made with the recovery.

While the slowdown (I’d stop short of calling it a “downturn”) we’ve seen lately, namely with the Nasdaq, poses some desirable buying opportunities, there still could be some short-term pressure on stocks. That correction I’ve been calling for weeks may have potentially started, despite the sharp reversal we saw today.

Yes, we may see more green this week. But while I don’t foresee a crash like we saw last March and feel that the wheels are in motion for a healthy 2021, I still maintain that some correction before the end of Q1 could happen.

Bank of America (NYSE:BAC) also echoed this statement, saying:

“We expect a buyable 5-10% Q1 correction as the big ‘unknowns’ coincide with exuberant positioning, record equity supply and as good as it gets’ earnings revisions.”

With more earnings on tap for this week with NVIDIA (NASDAQ:NVDA) on Wednesday (Feb. 24) and Virgin Galactic (NYSE:SPCE) and Moderna (NASDAQ:MRNA) on Thursday (Feb. 25), buckle up.

The rest of this week could get very interesting.

Look. Don’t panic. We have a very market-friendly monetary policy, and corrections are more common than most realize. Corrections are also healthy and normal market behavior, and we are long overdue for one. Only twice in the last 38 years have we had years without a correction (1995 and 2017), and we haven’t seen one in a year.

A correction could also be an excellent buying opportunity for what could be a great second half of the year.

With that said, to sum it up:

While there is long-term optimism, there are short-term concerns. A short-term correction between now and the end of Q1 2021 is possible. I don’t think that a decline above ~20%, leading to a bear market, will happen.

Nasdaq: To Buy Or Not To Buy?

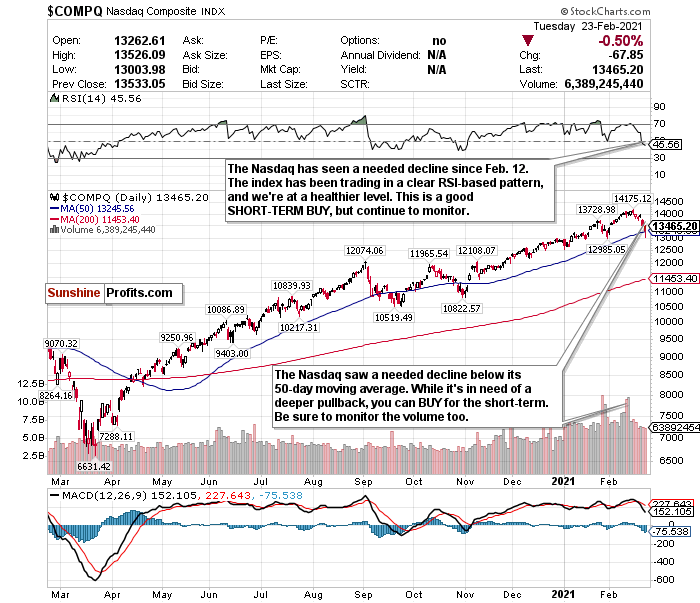

Figure 1- Nasdaq Composite Index $COMP

What a difference a few weeks can make!

Before, I was talking about the Nasdaq’s RSI and to watch out if it exceeds 70.

Now? As tracked by the Invesco QQQ Trust (NASDAQ:QQQ), the Nasdaq has plummeted by 4.5% since Feb.12 and is trending towards oversold levels! I hate to say I’m excited about this recent decline, but I am. This has been long overdue, and I’m sort of disappointed it didn’t end the day lower.

Now that would’ve been a legit buying opportunity.

While rising bond yields are concerning for high-flying tech stocks, I, along with much of the investing world, was somewhat comforted by Powell’s testimony. Inflation and rate hikes are definitely a long-term concern, but for now, if their inflation target isn’t met, who’s to fight the Fed?

Outside of the Russell 2000, the Nasdaq has been consistently the most overheated index. But after today, I feel more confident in the Nasdaq as a short-term 'buy.'

But remember. The RSI is king for the Nasdaq . If it pops over 70 again, that makes it a 'sell' in my book.

Why?

Because the Nasdaq is trading in a precise pattern.

In the past few months, when the Nasdaq has exceeded 70, it has consistently sold off.

- Dec. 9: exceeded an RSI of 70 and briefly pulled back.

- Jan. 4: exceeded a 70 RSI just before the new year and declined 1.47%.

- Jan. 11: declined by 1.45% after exceeding a 70 RSI.

- Week of Jan. 25: exceeded an RSI of over 73 before the week and declined 4.13% for the week.

I like that the Nasdaq is below the 13500-level, and especially that it’s below its 50-day moving average now. I also remain bullish on tech, especially for sub-sectors such as cloud computing, e-commerce and fintech.

But the pullback hasn’t been enough.

Because of the Nasdaq’s precise trading pattern and its recent decline, I am making this a short-term 'buy.' But follow the RSI literally.

For an ETF that attempts to directly correlate with the performance of the NASDAQ, the Invesco QQQ ETF (QQQ) is a good option.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.