Semiconductor M&A: The Best Takeover Targets

Wall Street Daily | Oct 30, 2015 06:28AM ET

If you’ll indulge me for a second, back in June I predicted that we’d see a groundswell of takeover activity in the semiconductor space.

Well, it’s happened. In fact, it’s turned into a full-on tidal wave.

At the time of my initial forecast, roughly $80 billion worth of chip mergers and acquisitions (M&A) had been announced for the year. That represented a 100% jump over the same period in 2014.

But a recent flurry of activity has jacked the total even higher. After British-based Dialog Semiconductor's (DE:DLGS) almost $5 billion deal for Atmel Corp. (O:ATML), total deal volume now stands at an all-time high of $110 billion, according to Bloomberg.

And with two months left in 2015, that total is poised to go higher still.

Here’s why the trend is set to continue – along with a shortlist of top takeover targets…

Hunt or Be Hunted

The intensifying pace of M&A activity has created a unique dynamic in the chip sector.

“It’s buy or be sold,” as Alex Lidow, Chief Executive of Efficient Power Conversion Corp., recently told The Wall Street Journal.

Or as I originally said, “Deal-making always begets more deal-making.” Why?

Well, at the simplest level, it’s the only way to stay competitive in a consolidating industry.

But there are other, more specific factors that drive the urge to merge in the chip sector.

A Smarter Way to Get Connected

Madonna was right when she said we’re “living in a material world.” But we’re also now living in a digital world.

With many more devices, systems, and networks connected, it requires more semiconductor chips. As a result, it means device makers want to simplify their supply chains by purchasing system solutions, not countless discrete chips from multiple parties.

In turn, it’s compelling chip companies to acquire complimentary technologies so they can provide those systems solutions.

“Customers more and more want to have fewer suppliers, more value, and pieces that work together,” says Jalal Bagherli, CEO of Dialog. (Remember, his company recently announced a deal to do just that.)

At the same time, chip companies are jockeying for position as the next major growth trend – the Internet of Things (IoT) – ramps up.

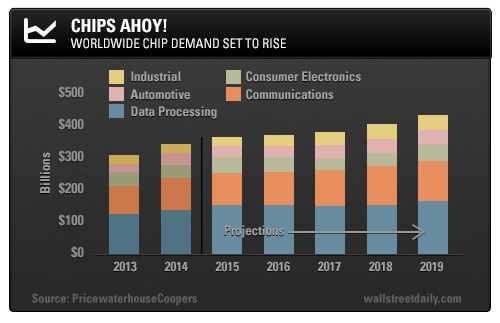

Chip demand is expected to increase by 30% to $432 billion by 2019, according to PricewaterhouseCoopers. And the main driver of that growth is IoT, including industrial and automotive applications.

Costs Down… Profits Up

Then there’s the classic motivation for a merger: to cut costs and increase profits.

Take Skyworks Solutions Inc.’s (O:SWKS) recent $2 billion offer for PMC-Sierra Inc. (O:PMCS), for example.

In the official press release, Skyworks pitched the deal to its shareholders as a way to cut costs and boost profits. Specifically, management forecast $75 million in annual cost savings and an additional $0.75 in earnings per share.

But what’s the biggest asset a company needs to complete a deal? Cash.

Right now, cash remains abundant, with almost limitless financing available, too. That provides all the ammunition necessary to keep funding the unprecedented levels of M&A activity.

In fact, Morgan Stanley (N:MS) analysts estimate the largest chip companies could individually take on as much as $82 billion in financing.

To put that in perspective, Avago Technologies Ltd.’s (O:AVGO) $37 billion acquisition of Broadcom Corp. (O:BRCM) on May 28 represented the largest tech acquisition in history at the time. So we’re talking about enough financing capacity to fund a deal more than twice that size.

Of course, with so many deals already in the books – 276 this year alone – the list of available targets keeps shrinking. But that’s good news for investors.

Slimmer Pickings, Higher Premiums

Fewer available targets means fierce bidding wars will become commonplace, forcing buyers to pay higher premiums to get deals done.

We’re already seeing that play out with PMC-Sierra.

At the beginning of October, Skyworks offered $10.50 per share. But last week, Microsemi Corp. (O:MSCC) submitted a competing bid worth $11.50 per share.

However, I fully expect Skyworks to sweeten its offer to win the bidding war for PMC. Even PMC realizes a higher bid is likely in the offing.

In a statement, the company said, “PMC’s board of directors believes, after consultation with its financial advisers and outside legal counsel, that the Microsemi proposal would reasonably be expected to lead to a Superior Proposal.”

The original bid from Skyworks represented a 37% premium to PMC’s share price. The Microsemi offer bumped that premium to 50%. But the final price could push shareholders’ payday north of 60%.

My point is this: Who doesn’t want to own a stock with that much upside potential in the near term?

So what chip companies are prime takeover targets?

The Most Likely Suspects

Here’s the list I originally provided in June, based on the names most frequently mentioned by multiple analysts as potential acquisition candidates.

- Xilinx Inc (O:XLNX)

- Maxim Integrated Products Inc (O:MXIM)

- Cavium Inc. (O:CAVM)

- Lattice Semiconductor Corp. (O:LSCC)

- M/A-Com Technology Solutions Holdings Inc. (O:MTSI)

- Skyworks Solutions (O:SWKS)

Speculation about Maxim and Cavium is picking up. Yet both stocks appear fairly valued, based on the consensus price targets. That suggests the upside is limited.

That being said, I never recommend buying a stock simply for the takeover potential. There need to be other factors, too.

With that in mind, Lattice has the most upside potential. Shares are trading at roughly a 70% discount to the consensus price target. And as a self-described leader in smart-connectivity solutions, the company’s broad end-market exposure makes it an attractive acquisition for a suitor’s product portfolio

As for the next mega-merger, I still think the $15 billion-market cap Skyworks is the most likely candidate, given its strong growth (20%-plus on both the top and bottom lines), systems solutions, and increasing exposure to the IoT.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.