USD Seeking Policy Direction

MarketPulse | Oct 17, 2016 01:49AM ET

Yellen’s Speech

On the surface, Yellen’s speech could be construed as the Fed exploring new excuses to keep interest rates lower for longer, hinting that the economy has “a little more room to run” than previously thought. But more likely a tactic to calm markets as we draw closer to a very divise US political election.

Despite the ”lower of longer" rhetoric, the expected case for a December hike remains on the course, but given the division in the FOMC, it’s far from a done deal. While recent US economic data, specifically the employment metric, runs hot a few bruises in the data between now and December can easily tip the apple cart.

And while inflation is gradually picking up in the US, the Fed’s preferred measure, the core PCE inflation, is currently running at a tepid 1.6 percent, and well below the Fed’s 2 percent target. While this fact should minimally impact a December hike, it could affect the pace of rate hikes in 2017 and beyond.

Remember, the Fed has a dual mandate to maintain not only full employment, but also a sustainable rate of inflation.

Australian dollar

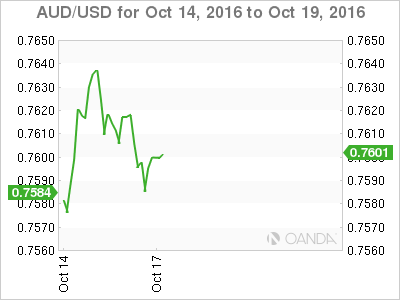

The Australian dollar remains remarkably hardy. After hitting technical support levels following last week’s weaker Chinese trade data, the high beta currencies rebounded resoundingly this despite the stronger USD. Trader pointed to both oil and commodity prices as the primary catalyst. But let’s not overlook AUD short-term interest rate curve which is pricing less than 50% chance of another rate cut, the lowest betting odds since May last year.

In the oil patch, WTI has been on a steady uptrend since the middle of last month on the back of OPEC production cut and a heavy dose of moral suasion from OPEC members. But oil prices gained immense traction on October 10th, when Russian President Vladimir Putin agreed to join the movement.

By all accounts, between now and November, the street will continue to buy into OPEC production cut mantra, despite the fact that production level remains high and global demand dwindles. Even Friday's Baker Hughes report which showed four more rigs came online failed to dent market bull sentiment despite the obvious fact more production is in the offing.

Also, the recent commodity splurge by China loading up on coal, and iron ore, despite lingering economic concerns, likely underpinned the Aussie appeal.

I guess the big question for the commodity basket of currencies which are trading on the heels of risk sensitivity, will the current risk rally continue especially with last weeks horrible China Trade Data still lingering.

So far in early trade, the Aussie is trading below .7600 but remains supported on dips.

Next up on the domestic front is the RBA meeting minutes on Oct 18th, which should attract some attention, given that it's Governor Lowe’s first meeting, but realistically it’s unlikely the RBA will detour from their "near neutral stance".

Japanese yen

The yen should continue to trade on the back of the US economic cycle, with interest rates and equities the primary driver. With all the Fed verbal gymnastics in the background, it’s becoming clear that the market is waiting for some constructive policy direction from the Feds. So the USD/JPY may become somewhat of a sideshow in the days to come, as the Fed tries to keep the market contained through moral suasion ahead of a very divisive US election.

Chinese yuan

The yuan faces considerable headwinds as we enter the final months of 2016. Steeper yield curves in the G-3 currencies will weigh on the yuan, which could struggle against broader USD positive moves as we approach the December lift off. The China PPI reading on Friday provided a supportive lifeline to global risk, yet the weak global economic climate and abysmal Chinese trade data could continue to add to market unease. While it’s unlikely, the RMB could experience a sudden bout of large depreciation. Traders are treading water with trepidation.

Malaysian ringgit

The MYR is reeling from Bank Negara data, which showed substantial sell-off of Malaysian bonds by foreign investors in September. This week’s budget could offer a lifeline by providing some additional economic boosts to the economy.

However, the budget is more likely, given that there could be an early 2017 election, to see Prime Minister Datuk Seri Najib Abdul Razak walk the thin line between fiscal prudence and appealing to voters. One possibility is for a reduction in Corporate Income Tax rates, so as to stay in line with recently proposed cuts in both the Philippines and Indonesia, which would be perceived favorably by the markets, despite the fact CIT rates are quite moderate.

THB

Thailand is still dealing with the distinctive storyline from the death of the highly revered King Bhumibol Adulyade. Political uncertainty is sure to pick up, as tensions could escalate between the Yellow and Red Shirts. In the meantime, the Thai market remains on solid footing and is considerably underweight from a foreign investment perspective, in both bonds and equities. If political noise can stay low, the markets should hold on to last week’s rebound.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.