Sector Check: S&P Consolidating Recent Advances

Carl Swenlin | Jun 02, 2013 02:08AM ET

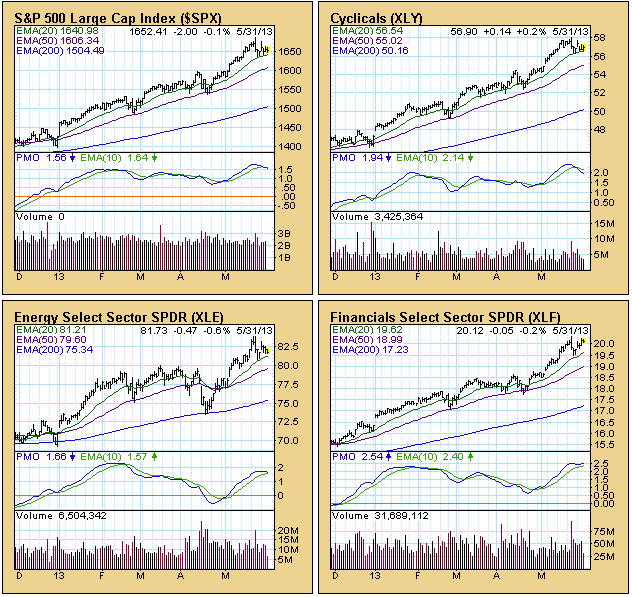

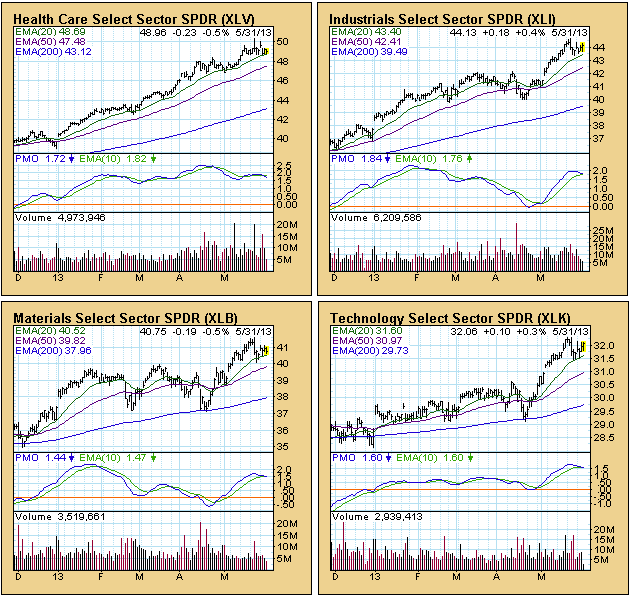

The S&P 500 component stocks are divided into nine sectors. All the stocks are used, and each stock is only used once. Those sector indexes are typically tracked using the nine SPDRs, which are essentially ETFs whereby the sectors can be traded. We thought it would be a good idea to take a quick look at charts of those nine sectors.

This article is a bit "chart intensive", but the idea is to demonstrate how you can gather information about a lot of stocks by reviewing their charts. The following charts are taken from one of our chart books.

In the first group we begin with the S&P 500 as the benchmark. It has been consolidating in the context of an extended advance. It remains above its 20-EMA, and remains steady. The seven sector charts in the group are similar to their host index in that they are consolidating above their 20-EMA. Some internal weakness is evident in that their PMOs (Price Momentum Oscillators) have topped, and a few of the PMOs have crossed down through their 10-EMAs.

For the two remaining sectors, it is a different story. Consumer Staples has broken down through its 20-EMA and is testing support on its 50-EMA. Utilities is experiencing a serious correction. It has broken through both its 20-EMA and 50-EMA, and appears to be finding support just above its 200-EMA.

Conclusion

: The S&P 500 is taking a little break, consolidating its recent advance. The price chart looks solid. Seven of the nine sectors are in similar condition and reflect no serious intermediate-term issues. Only two of the nine sectors are showing price weakness, and only one of those (Utilities) is in bad shape. In short, 78% of the sectors validate S&P 500 price action and do not reflect any serious weakness.

AFTER THE CLOSE UPDATE: So much for writing an article before the market closes. An update is in order. The SPX closed on its low for the day and broke down through its 20-EMA. Consumer Discretionary, Health Care, Energy, and Materials also broke their 20-EMAs. This has happened on most of the charts three other times in the last six months, and is still not a serious technical breach. But it is certainly not a great way to end the week.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.