S&P: Rising Wedge Vs Ascending Triangle

Alan Bradley | May 21, 2015 02:24AM ET

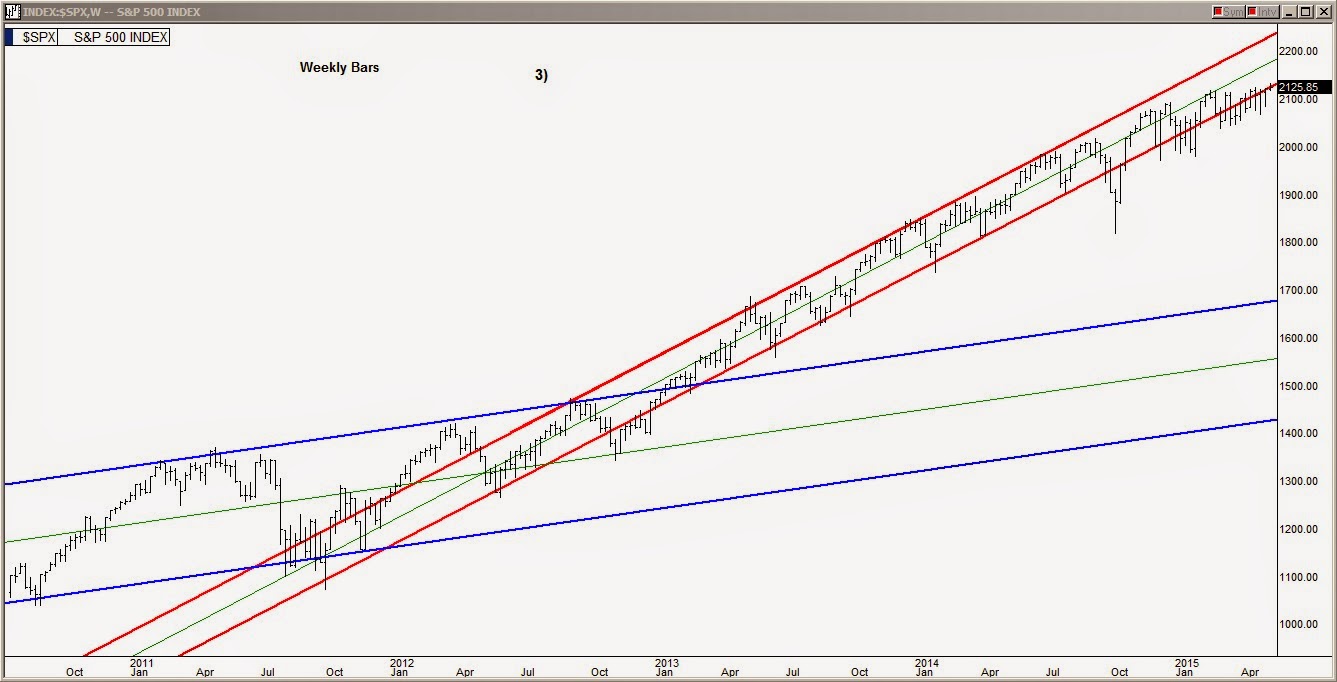

Over the past two months, we have seen the choppiest sideways action than we have seen in years. There are two clear camps of thought on where the market sits right now. The first group composed primarily of bears and those who recently exited after bagging a triple on the S&P 500 in six years are pointing to the ominous nine-month wide bearish rising wedge pattern or "exhaustion wedge" as many call it, as shown in the weekly bars chart of the S&P below.

The bulls are pushing the theory that we are breaking out of the day ascending triangle right now but the bears won't buy into it, reminding us that this S&P breakout just stopped at the upper line of the weekly rising wedge pattern.

Taking a look now at the Bernanke/Yellen four-year breakout channel shown in red lines in the chart below, we see that the S&P is continuing to work its way farther out of that channel with the upper level of its current trading range clinging to the lower line of that four-year channel by its fingertips.

Lastly, taking a look at the VIX (Volatility Index), we see that it has been shuffling sideways for the past couple of months around the 12.50 level, as shown in the chart below. This level in the past has corresponded with tops in the S&P.

The VIX could easily continue sideways for another few weeks until it gets to the huge blue downtrend line. At that point, there will be some serious soul searching among traders and investors.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.