S&P To Test Lower Support Levels

Alexandros Yfantis | Dec 04, 2013 09:06AM ET

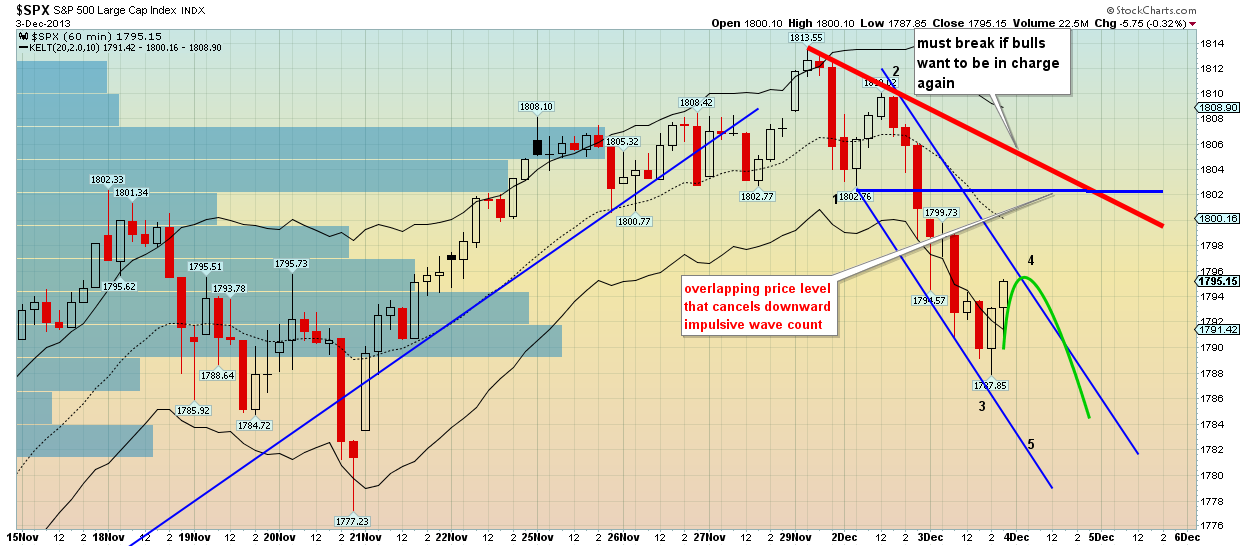

The S&P has broken its short-term support at 18000 and the rising wedge formation has given a sell signal. The upward move from 1646 seems complete and a tradeable corrective move is at its beginning. Prices are falling in an impulsive pattern and are looking to find support at lower levels. Prices have unfolded 3 waves down from 1813,55 and it is very possible to see wave 4 and 5 during today’s session. The downward sloping blue channel shows the possible wave 4 area and the blue horizontal line at 1802 shows the price level where our wave count is invalidated as price action becomes overlapping.

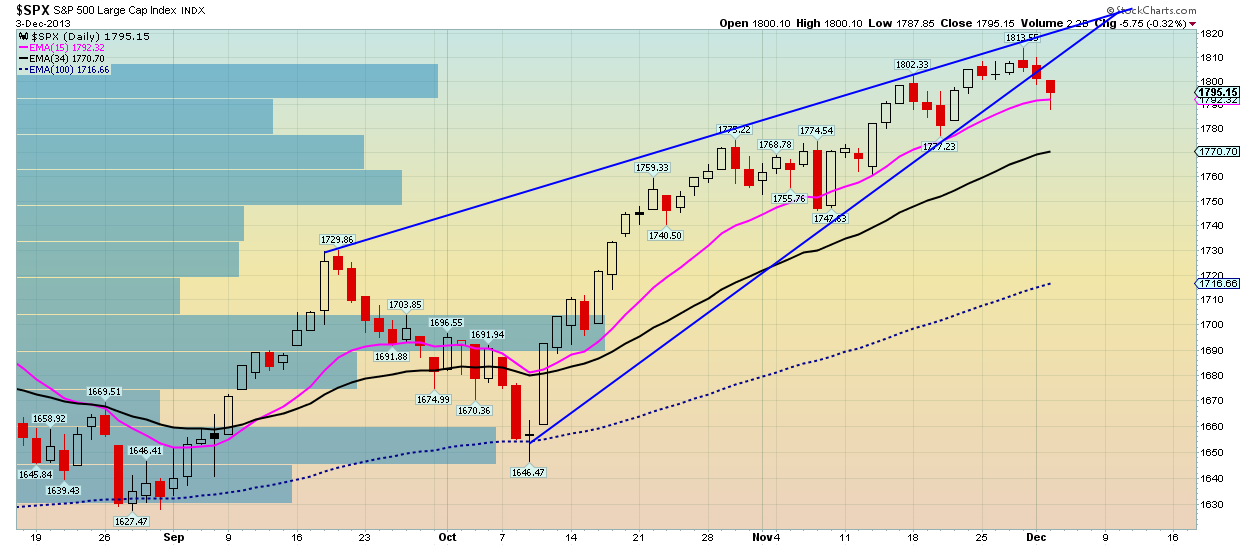

The daily chart shows us that prices have closed right above the 1790 support, but we feel that there is more downside to be expected. Short term resistance is found at 1802 and 1810, while support is found at 1778-82 and then at 1740-50.

Prices have reached our first sell trigger as shown in the chart below. We expect for this trigger to be enabled today and prices to fall towards 1778-82. The decline will complete 5 waves down and what we believe just wave A of the corrective move that started at 1813,55. Breaking above the high will only cancel our wave count. We believe that a selling opportunity will come once prices complete wave B up.

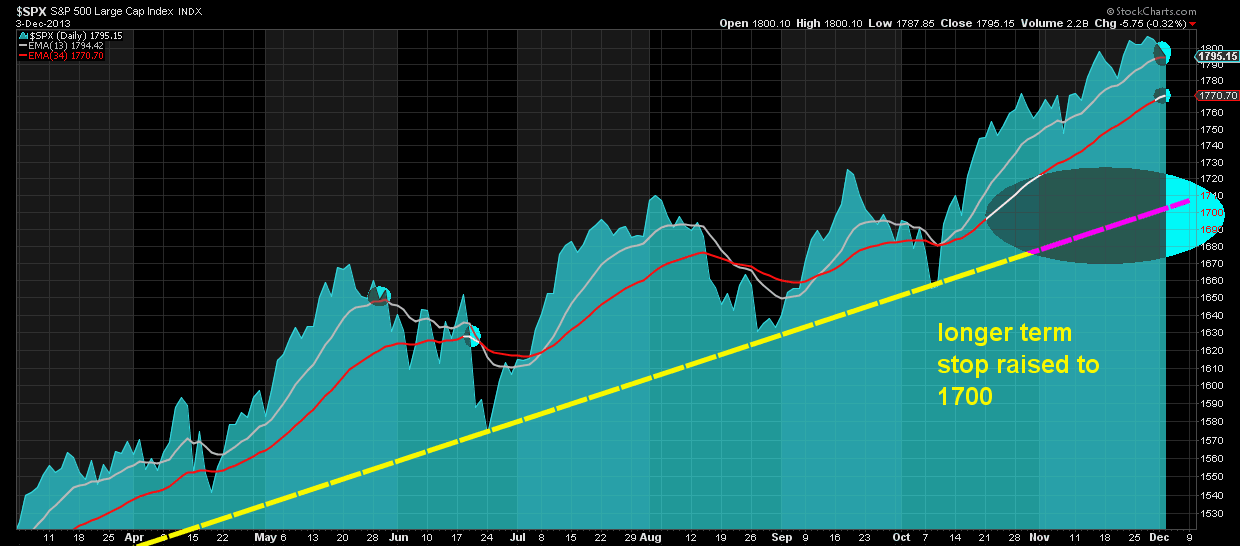

The opportunity to sell with 1740-50 target will come only if certain criteria are met by the market. We have to be patient to wait and see how the current wave unfolds and how the expected wave B up behaves.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.