S&P Not Yet Ready For Fall Toward 1666

Alexandros Yfantis | Sep 27, 2013 08:34AM ET

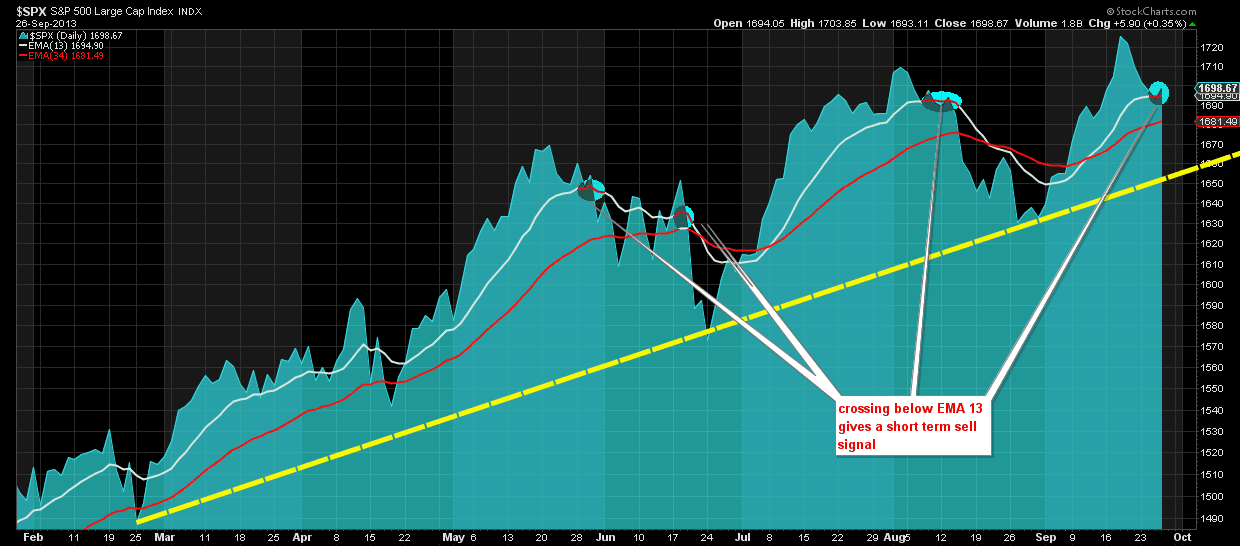

S&P (SPX ) according to our Elliott wave analysis has completed wave A down and is now in the process of making wave B up towards 1710-15. The fact that we label this move that started at 1730 as a correction is only because the chances are slightly in favor of this bullish scenario. Although this is our first choice we do not believe that it is worth entering long at this price levels. The bearish scenario and all my personal trades are presented to our subscribers only. Moving on now to our wave count, as we mentioned in a previous post, the entire upward move from 1627 to 1730 is confirmed over and complete. The first leg down for our bullish scenario is just wave A. This is depicted in the chart below.

Our target for S&P as mentioned in our last post is 1666 (61,8% Fibonacci retracement). Our first target of 1688-90 has been achieved and we now believe it is time for a small bounce towards 1710. This bounce should take two days to develop and then we should see from next Tuesday or Wednesday a new downward move as wave C towards 1678 or 1666.

The weekly view in S&P is for the time being saved from signalling a sell. The EMA has not been crossed and therefore we should wait for the confirmation as support at 1690-95 is held and it seems a bounce is more probable now than a break of support. As per our wave analysis, we expect prices to make a moderate upward move and then re-test and break the 1690-95 support level.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.