S&P 500: Sellers Fail To Seal The Deal On Topping Pattern

Dr. Duru | Dec 04, 2014 05:13AM ET

T2108 Status: 62.2% (2-day decline of 20% qualifies for quasi-oversold status)

T2107 Status: 52.0%

VIX Status: 12.5

General (Short-term) Trading Call: Hold bullish positions. Aggressive bears should have stopped out on fresh all-time highs. (That is the risk you take here!)

Active T2108 periods: Day #32 over 20%, Day #30 over 30%, Day #27 over 40%, Day #25 over 50%, Day #1 over 60%, Day #102 under 70%

Commentary

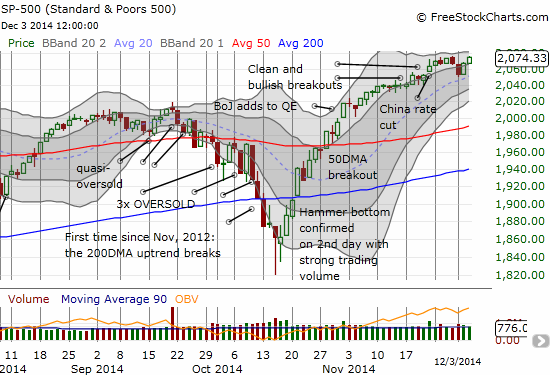

I am bullish yet even *I* am surprised to see the S&P 500 (via SPDR S&P 500 (ARCA:SPY)) already printing a fresh all-time high. Just two days ago, I was bracing for bearish follow-through selling to a topping pattern. Instead, sellers absolutely failed to capture the imagination of the market as buyers went right back to work snapping up early holiday season “bargains.”

The trend remains our friend as the S&P 500 prints yet another marginal all-time high

Even Caterpillar (NYSE:CAT) shocked me by jumping above $100 before hitting my lower price target first. Although the stock faded hard from its high of the day, CAT still put on a convincing enough show to suggest the 50DMA will be support for now.

The S&P 500’s latest celebration was preceded by a big blowback in the volatility index. The VIX dropped 10% and similarly sent ProShares Ultra VIX Short-Term Futures Fund (ARCA:UVXY) tumbling downward 11.2%. Needless to say, I took my profits on the put options I discussed in the last T2108 Update. With the help of some hindsight, that fresh plunge in the VIX becomes a telling signal for and strong precedence for the new all-time high.

My other two trades of the week remind me that it is difficult to use individual stocks to play expectations on the S&P 500. Amazon.com (NASDAQ:AMZN) held up well at the 200DMA Tuesday but swooshed again yesterday for a 3.0% loss. I stayed stubborn and pulled the trigger on one more call option as AMZN bounced from its 50DMA. The weakness in Baidu (NASDAQ:BIDU) continued and looks ominous enough that I decided to switch my bias to bearish and a 50DMA retest.

Most interesting in this quick snapback for the S&P 500 is that T2108 notably lagged. My favorite technical indicator failed to retest the overbought threshold at 70% and sits a full 8 percentage points below. This indicates that the index has left some stocks behind…like AMZN and probably a whole host of energy-related plays. The optimistic way to interpret the quasi-divergence is that the S&P 500 now has plenty of upside to go.

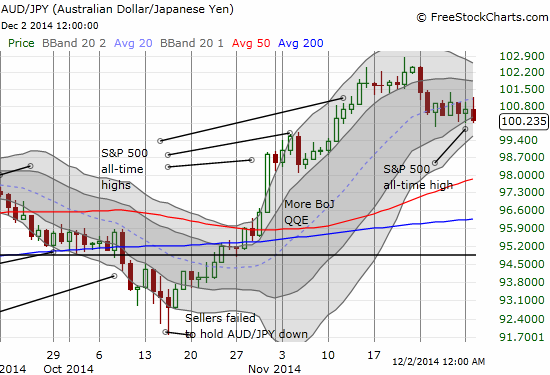

Note however that my favorite confirmation signal in the currency market is lagging in a bad way. The Australian dollar (Rydex CurrencyShares AUD Trust (NYSE:FXA)) is barely holding 100 against the USD/JPY (RYDEX CurrencyShares Japanese Yen (ARCA:FXY)) and could easily swoon to retest the 50DMA. This would be a MAJOR non-confirming signal if the S&P 500 continues to pull higher.

I am watching this action even more closely now. This week contained a LOT of important economic news for the Australian dollar. I hope to produce a summary by the end of the week.

The Australian dollar is losing ground against the Japanese yen (which itself continues to weaken against the U.S. dollar)

Regardless, failing follow-through selling to confirm the previous topping pattern, I am still happily holding onto my shares in ProShares Ultra S&P500 (ARCA:SSO). My recommendation for bears is that you should have stopped out of new shorts that were taken based on the bearish topping pattern. That pattern was effectively invalidated by yesterday’s fresh all-time high. Even Netflix (NASDAQ:NFLX) is showing signs of life again as the neat downtrend channel formed by the lower-Bollinger® Bands is starting to give way…

Netflix is showing signs of life as buying volume re-appears and sellers notably failed to hold the stock at the day’s lows

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Weekly T2108

Be careful out there!

Disclosure: long SSO shares; long put spread on CAT; long call options on AMZN, BIDU; long put options on BIDU; Long puts and a put spread on NFLX.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.