S&P 500: A Weak And Unconvincing Bounce

Dr. Duru | Jun 23, 2013 02:55AM ET

: 21.9% (intraday low of 18.0%)

VIX Status: 18.9 (failed at resistance from level that launched summer swoon in 2011)

General (Short-term) Trading Call: Hold (only buy after oversold readings)

Active T2108 periods: Day #2 under 30% (underperiod), Day #3 under 40%; Day #21 under 70% (underperiod)

Commentary

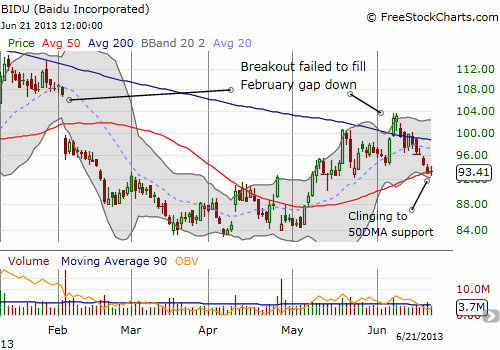

Although the T2108 Trading Model (TTM) nailed yet my piece describing the breakout on Baidu (BIDU). Since then, BIDU sure enough gave up the bullish move within two days. After giving up its desperate cling to its 200DMA, BIDU is now retesting 50DMA support. I like the chart only because the 50DMA is sloping upward and the day ended on a “doji” showing a dissipation of selling pressure. Moreover, unlike the last false breakout, selling volume has not surged to an extremely high level. If the market somehow cooperates next week, BIDU could quickly rally back to 100, directly above the 200DMA. I expect the general stock market will need to stage an on-going rally to assist BIDU to rally past the high from the previous breakout.

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes) Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Be careful out there!

Disclosure: long SSO calls, long AAPL shares and calls, net long Australian dollar, long BIDU calls

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.