S&P 500 Goes Overbought As It Breaks Out From Wedge

Dr. Duru | Oct 05, 2012 01:18AM ET

: 70.4%

VIX Status: 14.6

General (Short-term) Trading Call: Hold

Commentary

The S&P 500 made a bullish breakout from the wedge formation I have been following this week.

This breakout is occurring directly ahead of tomorrow’s jobs report and suggests that the market is likely to react well to it. This breakout also means that the bearish divergence I noted yesterday between the S&P 500′s gains and T2108′s losses are now null and void. Instead, the apparent bottoming in the Australian dollar (FXA) won the day.

T2108 is right back in overbought territory, but I am not yet rolling out the standard T2108 trading rules. Typically at this time, I would recommend starting a bearish position. Instead, I am recommending holding onto bullish positions (in my case my remaining SSO calls) to allow the bullish formation to run its course. If the S&P 500 rallies strongly tomorrow, I will most likely sell these remaining calls. I am still avoiding going short until the bears prove they are breaking the market. I may consider a short position if T2108 gets to an extreme overbought position over 80%.

Finally, I am not yet ready to reconsider using the extended overbought strategy because of earnings season and a whole host of negative reports and warnings that I have seen so far.

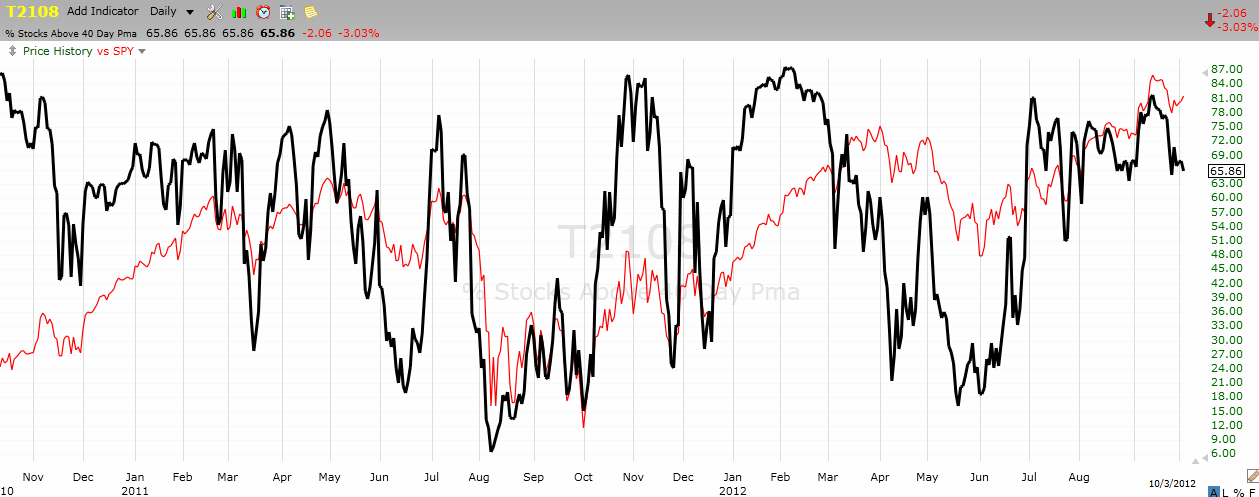

Daily T2108 vs the S&P 500

Click chart for extended view with S&P 500 fully scaled vertically (updated at least once a week)

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Be careful out there!

Full disclosure: long SSO calls

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.