Russia: GDP Growth Slows In 1Q19, Challenging The Policy Framework

ING Economic and Financial Analysis | May 20, 2019 12:52AM ET

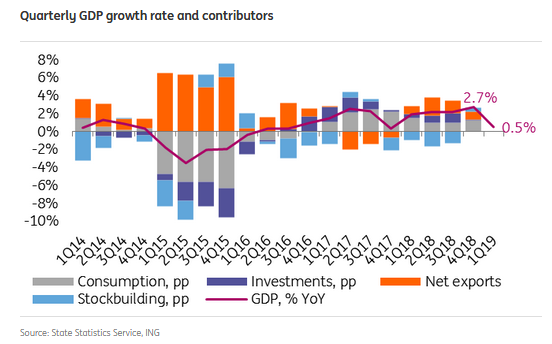

Russian GDP growth slowed from 2.7% year on year in 4Q18 to just 0.5% YoY in 1Q19, well below expectations. Unlike most commentators, we attribute this slowdown to a pause in the state CAPEX rather than to the VAT hike. We also believe a policy response is more likely to come from the Finance Ministry rather than the Central Bank.

1Q19 GDP growth well below expectations

The preliminary official estimate of Russian GDP growth for 1Q19 is 0.5% YoY, which is well below the 1.2% YoY consensus and our 1.1% YoY expectations. This also suggests a very material deceleration vs. the 2.7% YoY reported for 4Q18. The two key questions are: 1) what caused this slowdown and 2) what would be the policy response. The initial market comments suggest that the slowdown is attributed primarily to a VAT hike-related hit to consumption, and a more aggressive key rate cut is believed to be the most likely response. We cannot fully subscribe to this view.

The slowdown reflects a halt in investment growth, as suggested by zero construction growth...

Regarding the causes of GDP slowdown, there will be no official breakdown until mid-June, however, some preliminary conclusions could now be made. Retail trade, which is a proxy for household consumption (accounting for 50% of GDP), indeed showed deceleration from 2.8% YoY in 4Q18 to 1.8% YoY in 1Q19. This suggests, that the slowdown in household consumption could explain only around 0.5 percentage points out of 2.2 percentage point slowdown in the overall GDP growth in 1Q19.

...the slowdown in household consumption could explain only around 0.5 percentage points out of 2.2 percentage point slowdown in the overall GDP growth in 1Q19 vs. 4Q18.

We believe the bulk (1.7 pp out of 2.2 pp) of the slowdown is attributable to a drop in investments and inventories (accounting for c.25% of GDP) and stringent government consumption (c.15% of GDP), while the contribution of net exports remained flat. This view is supported by two key observations:

First, the growth in construction, which is a proxy for investment activity, slowed down materially from 4.1% YoY in 4Q18 to just 0.2% YoY in 1Q19; while industrial output, an indicator of producer activity also showed deceleration from 2.7% YoY to 2.1% YoY respectively. Also, according to the Ministry of Economic Development, the drop in imports of investment goods deepened from -3.2%

YoY in 4Q18 to -6.2% YoY in 1Q19.

Key indicators of consumer and producer/investment activity

* the right-hand axis related to retail trade has been rescaled to optically highlight higher weight of household consumption in GDP (50%) than that of investments and inventories (25%).

amid a 20% YoY drop in the state investment spending

Second, according to recently revised data, the budget was executed with a large RUB666bn (2.7% GDP) surplus in 1Q19, as the modest 6% YoY expenditure growth was significantly below the 18% YoY increase in non-oil revenues and lower than the 9% YoY spending growth budgeted by the Finance Ministry for the full year. The key drag on the budget spending is the 20% YoY drop in the spending on 'National economy', which represents the state investments and other support to the industries.

Key budget parameters

GDP growth may pick up later, as 'National projects' gain momentum, budget policy - the key watch factor

The key takeaways:

- The hike in the VAT from 18% to 20%, which came into effect 1 January, has contributed to the GDP slowdown only moderately, as some producers and retailers have likely sacrificed their margins and probably reduced inventories to absorb the PPI shock, resulting in below-expected CPI of just 5.3% YoY by the end of March and a very moderate slowdown in the consumption;

- The primary cause for the GDP slowdown is the interval between the big-ticket investment projects, as major infrastructure construction projects related to World Cup 2018, Kerch Bridge, Yamal LNG, were largely completed in 2018, while the 'National Projects', that assume 3.6% GDP worth of annual budget spending, including 2.5% GDP on infrastructure investments, have yet to start;

- Given that the slowdown is related primarily to the budget policy, we expect it to be addressed primarily through the budget means. The government will have to at least accelerate spending growth later this year in order to comply with the new annual 9% target. We also do not exclude that in case of continued GDP weakness the spending plan might be increased further;

While not directly caused by the tightness in the monetary policy, the GDP slowdown may still increase the pressure on the Central Bank (CBR) to ease the policy.

- While not directly caused by the tightness in the monetary policy, the GDP slowdown may still increase the pressure on the Central Bank (CBR) to ease the policy. This week the top CBR officials are expected to make comments on monetary policy. Should they express concerns with the economic activity, it could be interpreted as a strong sign of an upcoming key rate cut as early as June, i.e. earlier than we have assumed in our base-case scenario.

Overall, we take the weak GDP data as confirmation of our below-consensus 1.0% GDP growth expectations for 2019. Our current year-end key rate forecast is 7.25%, suggesting two 25 basis point cuts amid gradual CPI deceleration to 4.6%. We continue to believe that within the economic policy framework the budget policy is running a higher risk of easing than monetary policy.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.