Russell Rebalancing Day: A Cause For Concern?

Dr. Alan Ellman | Nov 26, 2017 12:41AM ET

Covered call writers and put-sellers are aware of the value to avoiding risky events like earnings announcements. An impending FDA announcement regarding the efficacy of a new drug being tested is another example. This article will define and explore the potential concerns of trading on or though Russell Rebalancing Day.

What is Russell Rebalancing Day?

This is the annual reconstitution of the Russell Indexes, where the index provider makes rule-based changes to the its indexes, to ensure that market shifts that have occurred in the past year reflect that investors continue to have the most accurate market benchmarks. It usually occurs mid-calendar year.

What are the Russell US Indexes?

- Russell US Indexes are the leading US equity benchmarks for institutional investors. This broad range of US indexes allow investors to track current and historical market performance by specific size, investment style and other market characteristics.

- All Russell US Indexes are subsets of the Russell 3000® Index, which includes the well-known large cap Russell 1000® Index and small cap Russell 2000® Index.

- The Russell US Indexes are designed as the building blocks of a broad range of financial products, such as index tracking funds, derivatives and Exchange Traded Funds (ETFs), as well as being performance benchmarks.

Notable changes in the past year

- Moves in financials (up significantly) and energy shares (down significantly) over the past year will represent the most notable alterations in the Russell indexes, which will offer investors a chance to reassess their own portfolio makeup amid sizable moves in those sectors, much of which occurred in the wake of Donald Trump’s surprise presidential election victory on Nov. 8th.

- Much of this year’s reconfiguration also has been shaped by the “Trump bump,” or the rally in sectors and stocks tied to Trump’s campaign promises around Wall Street deregulation, tax cuts and a boost to infrastructure spending.

- In total, nearly 200 companies will be added to the Russell 3000 this year. Total market capitalization for Russell components increased more than 10% to around $27 trillion since last year.

- Technology has been the main driver of these gains, rallying nearly 40% since last reconstitution.

- The “value stocks”, which trade at a relative discount to peers based on measures like price-to-earnings, have lagged behind growth names, or shares of companies that increased in value at a faster-than-average rate. But those value names, including financials, energy companies and retailers, could garner more traction if Trump’s policy pledges are enacted.

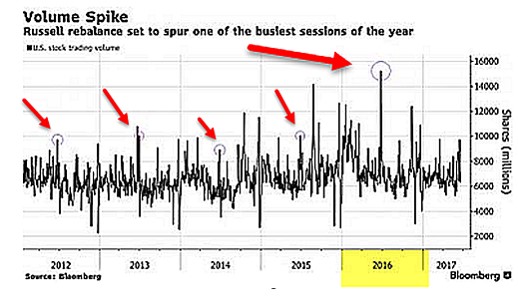

One of the busiest trading days of the year

With approximately $6 trillion in assets tracking the Russell indexes as of December 31, 2015, Russell Reconstitution is a notable event for US equity investors. The annual Russell rebalance, traditionally one of the busiest trading days of the year: according to Bloomberg, last years rebalance helped propel a near record turnover of over 15 billion shares, as a result of the $10 trillion in stocks currently linked to the various Russell indices, many of which will be forced to find new owners after an index recomposition. In fact, in four of the last five years, reconstitution day ranked in the 10 busiest trading sessions.

Is this a high-risk event we should avoid?

Surprisingly no. Despite the traditional annual surge in volume, the rebalance rarely leads to spikes in volatility or major market moves: since 2008, the S&P 500 has moved more than 0.5% on the day of rebalancing only twice, in 2011 and 2016. The reason why the transition at the end of the rebalancing day rarely leads to turmoil is because investors are prepared for the changes.

Discussion

High-risk events like earnings and FDA announcements should be avoided as they lead to increased implied volatility in the underlying securities and therefore make us susceptible to additional market risk. Russell Rebalancing Day does result in a substantial increase in trading volume and liquidity but does not cause a significant change in volatility risk so trading can proceed normally during this annual event.

Upcoming speaking event

Orlando Money Show

February 8th – 11th, 2018

Market tone

Global markets moved up this holiday-shortened week with the CBOE Volatility index closing down at 9.67. This week’s economic and international news of importance:

- Leading economic indicators +1.2% (previous +0.1%)

- US: Existing home sales 5.48 million above expectations

- Weekly jobless claims 239,00 slightly below expectations

- Durable goods orders (-)1.2% below expectations

- Consumer sentiment 98.5 better than expected

- Markit manufacturing PMI 53.8 (growth)

- Markit services PMI 54.7 (growth)

THE WEEK AHEAD

Mon Nov 27th

- New home sales (Oct)

Tue Nov 28th

- Case-Shiller home price index (Sept)

Wed Nov 29th

- GDP

- Pending home sales

- Beige book

Thu Nov 30th

- Weekly jobless claims (11/25)

- Personal; income (Oct)

- Consumer spending (Oct)

- Core inflation (Oct)

Fri Dec 1st

- Markit manufacturing PMI (Nov))

- ISM manufacturing (Nov)

- Construction spending (Oct)

- Motor vehicle sales (Oct)

For the week, the S&P 500 rose by by 0.91% for a year-to-date return of 16.24%

Summary

IBD: Market in confirmed uptrend

GMI : 6/6- Buy signal since market close of August 31, 2017

BCI: My portfolio makeup remains in a neutral bias, selling an equal number of out-of-the-money and in-the-money calls. Waiting to see how the vote on the new tax plan plays out before taking a more bullish stance. Outside of this concern the global economy is performing well.

WHAT THE BROAD MARKET INDICATORS (S&P 500 AND VIX) ARE TELLING US

The 6-month charts point to a slightly bullish outlook. In the past six months, the S&P 500 was up 14% while the VIX (11.43) moved down by 4%.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.