Rupee Treading In Unchartered Territory

Anjana Mittal | Jun 25, 2013 05:32AM ET

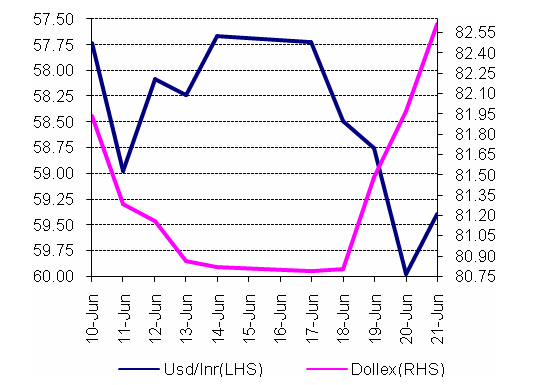

Rupee’s attempt to stabilise over the first half of the week was completely squashed as it was subjected to renewed selling pressure over the second half and it dipped to fresh record lows near 60 against the US dollar. There was a marked deterioration in wider emerging-market sentiment following the Federal Reserve meeting which had a serious rupee impact. The Indian rupee fell 1.72 percent in the week, its seventh successive weekly loss. It slumped to a record low of 59.9750/9850 on Thursday amidst an emerging market sell-off sparked by the Federal Reserve's signal of a rollback in its monetary stimulus.

Last week started with RBI’s announcement of Mid-Quarter monetory policy review and as widely expected there were no changes in the key policy rates. RBI highlighted the upside risk to inflation due to increase in administered prices. It further added that the future stance of Monetary Policy will be determined by growth, inflation and balance of payments situation in the coming months. The Trade data for the month of May was also released and it showed that the trade deficit had risen to $20.14 billion as against $17.8 billion in the month of April -2013. The exports fell by 1.1% while imports rose by 6.9%. The gold imports rose by $15.88 billion in the months of April and May 2013. There were some inflows from the HUL open offer which could give support to rupee for a very brief period only. Markets continue to remain wary of central bank intervention, while government officials are expected to soon unveil measures directed at opening more sectors for foreign investment. The rupee is among the most vulnerable emerging market currencies given its hefty current account deficit. That makes the current account deficit data this week a key indicator for currency markets, which will also closely monitor global movements in the dollar. Differential between US Treasuries and Indian G-Secs is narrowing thus resulting in limited returns if one takes into account hedging costs. Forward premia ended higher. Annualized forward premia for 1mth, 3mth and 6mth ended at 6.67%, 6.10% and 5.85% respectively.

Asian currencies tumbled by the most in 21 months this week as Federal Reserve Chairman Ben S. Bernanke said the central bank will probably taper stimulus that has fueled fund flows to emerging markets. Malaysia’s ringgit had its worst week in three years after Bernanke said June 19 that $85 billion a month of debt purchases, known as quantitative easing, may be trimmed this year and ended in 2014 as long as the U.S. economy performs in line with Fed estimates. The Bloomberg-JPMorgan Asia Dollar Index (ADXY), which tracks the region’s 10 most-active currencies, dropped 1.1 percent since June 14 to 115.51 as of 5 p.m. in Hong Kong, the biggest decline since Sept. 23, 2011. The ringgit fell 2.7 percent to 3.2 and the Philippine peso lost 2.1 percent to 43.735. Global investors pulled a combined $2.1 billion from Taiwanese, South Korean, Thai and Indonesian stocks in the first four days of this week, exchange data show.

INDIAN STOCK MARKET

Markets slipped this week after US Federal Reserve signaled that it may reduce the amount of monetary stimulus it provides. Global concerns about the health of the Chinese economy and FIIs remaining sellers in India took the Sensex lower by 403 points or 2% at 18,774. Nifty ended down 141 points or 2.5% at 5,667. Markets reversed early losses shrugging off RBI's neutral stance on key policy rates to end higher on Monday, owing to buying in index heavyweights. Tuesday saw the markets snapping two days of gains as investors turned cautious and booked profit in financials ahead of the US Fed meet. The indices recorded their steepest fall since February 27, 2012 after comments by the US Fed that it would start runing its monetary stimulus measures sooner-than-expected and weak China manufacturing data led to a selloff in global equities on Thursday. Foreign funds have been heavy sellers of rupee debt and have turned negative on Indian equities. FIIs have sold cash shares for eight straight sessions, totalling 59.49 billion rupees, as per exchange and regulatory data. ndia's benchmark 10-year bond yield rose 4 basis points to 7.43 percent. An auction of government bond quotas for foreigners attracted moderate demand on Thursday.

OUTLOOK

Fundamental

The consequence of a potential shift in Federal Reserve policies will continue to dominate market sentiment in the short-term. The Chinese outlook will also be an important focus given fears over a sustained credit crunch which would also tend to damage global growth prospects. There will be a further unwinding of carry trades which would also tend to support the US currency, although there will be corrective pressures at times with volatility set to remain higher. With the last week of the month and quarter, investors will want to rationalize their portfolios especially in context of what occurred this past week and prepare themselves for earnings season. Japan will unleash its data for the month of May.

In Europe, the EC sentiment index along with the German Ifo will give a reading of European sentiment. Final GDP data from the UK and France for the first quarter are also on tap. On the domestic front, commodity tailwinds have worked well for India. Inflation is down, there is some cushion on the current account, and some fiscal adjustment challenges have eased. However, there are now challenges on the capital account side. With it's 4%+ CAD and rising external debt, India is vulnerable to the expected tapering of equity and debt inflows. Even though policymakers have expressed concerned over Rupee’s slide and said that they will keep a close watch on the market but the factof the matter is that RBI is really not left with much ammunition todefend the Rupee even though they will keep stepping in at appropriate times to stem volatility. However, USD strength story still seems far from over and it looks in a mood to explore further un-chartered territories. Hence, USD/INR pair remains buy on every dips. In the current scenario hope for India can come from (1) continued expansionary policy by other Central Banks, (2) further declines in commodity prices and (3) pro-active measures by domestic policy makers (on both policy change and execution). The announcements by the Cabinet Committee on Economic Affairs (CCEA) on 21st June were a positive step in this direction and looks like there is more to come. The Economic secretary Mr. Mayaram has proposed new FDI liberalization plan which has been endorsed by the Prime Minister and will be put to GOM in a week or two for final decision.

Technical

Upside trend in USD/INR pair is still intact and a break of 60 levels in pair cannot be ruled out. However several technical indicators are suggesting that the pair is in overbought condition and a corrective pullback is due. On the daily time frame in technical chart 58.60 is the crucial level for Rupee to gain any further. 60.50 seems to be crucial resistance and 58.60 support level in this week for USD/INR pair. For short term upside trend in USD/INR pair will emain intact till it breaches 56.70 level in near future.

Weekly Trend: Slightly bearish with mild correction expected in USD/INR pair. Expected Range : 58.60 - 60.50.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.