High Yield May Be Ready For Dramatic Improvement

Dragonfly Capital | Mar 10, 2016 07:27AM ET

High Yield Bonds became a big topic of discussion in the market last summer. With the big fall in oil prices the topic making the rounds was that all the High Yield debt used to finance the shale companies would be heading towards bankruptcy. I suppose that makes sense theoretically, but so far it has not happened.

The lack of bankruptcies has not helped the High Yield market recover though. Certainly it has not been helped by the fact that noted fixed income gurus like Gundlach and Gross and macro masters like Dalio have been very vocal about the economy shifting to (or already in) recession. By the way this has not happened yet either.

This can get all too complex so while I try to follow these stories and make sense of all the data, not just that selected by Gurus, I find it very difficult to actually act upon it. It is much easier to just follow price. And what is the price action saying about High Yield? It may be ready to improve dramatically.

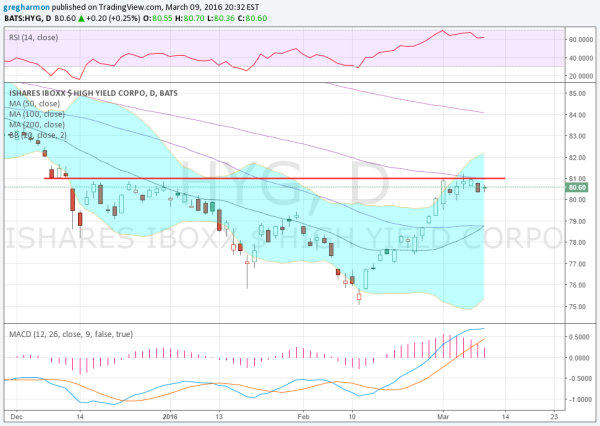

The chart of the iShares iBoxx $ High Yield Corporate Bond (NYSE:HYG) above holds the key. There are many bullish points in the chart. Start with the rise in price back to resistance. It has bullish momentum as well, with the RSI in the bullish zone and the MACD positive and rising. The Bollinger Bands® also opened to start this move higher.

But some of these also pose a potential problem for a High Yield recovery. The MACD is starting to level, a slowing of momentum. Of course there is that resistance as well and note that the 100 day SMA is also right there. It can overcome these obstacles with a move over 81, putting the 100 day SMA and the December consolidation highs in its rear view mirror. Keep an eye here as this has only played a backseat to oil prices themselves in 2016 in determining market direction.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.