Risky Assets Rally For 4th Week In A Row

James Picerno | Mar 14, 2016 07:30AM ET

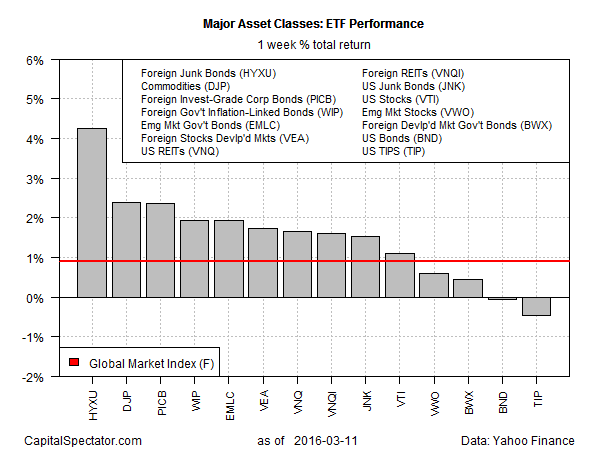

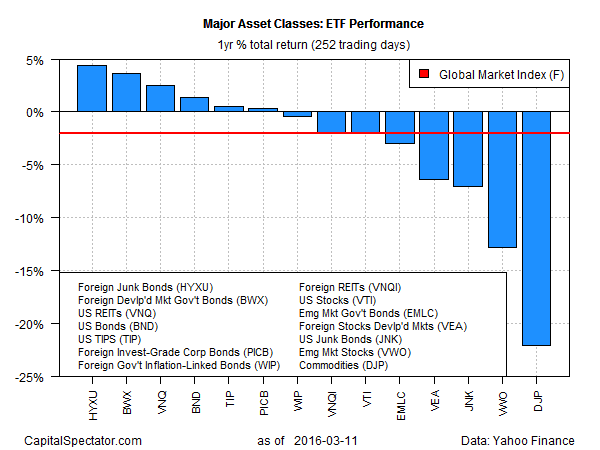

Positive momentum continued to lift risky assets last week, based on a set of proxy ETFs for the major asset classes. For the fourth straight week, the risk-on trade prevailed. The ongoing rally continues to pare the red ink in the trailing one-year-return column, which is inching closer to an even split between winners and losers.

Leading the winners last week: foreign junk bonds via iShares International High Yield Bond (NYSE:HYXU). The latest pop in markets around the world left only two losers last week: investment-grade US bonds Vanguard Total Bond Market (NYSE:BND) and inflation-indexed Treasuries iShares TIPS Bond (NYSE:TIP), which posted fractional declines for the week through March 11.

Last week’s buying spree continued to lift an ETF-based version of the Global Market Index (GMI.F)–a passively managed benchmark that holds all the major asset classes in market-value weights. GMI.F climbed 0.9% for the five trading days through March 11, marking the fourth weekly gain for the benchmark.

Meantime, the one-year ledger is no longer mired with across-the-board losses. The four-week rally has lifted nearly half of the major classes into positive territory. Foreign junk bonds iShares International High Yield Bond (NYSE:HYXU) are also in first place for the trailing 252-day period, climbing by nearly 5% through Friday vs. the year-earlier level on a total-return basis. But there’s still plenty of red ink, and broadly defined commodities iPath Bloomberg Commodity Total Return Exp 12 June 2036 (NYSE:DJP) are still in last place with a hefty slide in excess of 20%.

Despite the improvement for the one-year profile, GMI.F remains underwater for the trailing one-year period. Although the losses have eased recently, the benchmark remains in the red by 2.0% for the year through Mar. 11.

From a US perspective, the upbeat economic reports of late have thrown cold water on the notion that a new recession is near for the world’s largest economy. But the mood is still weak, according to the latest survey data for investors. The Wells Fargo/Gallup Investor and Retirement Optimism Index slipped to a two-year low in this this year’s first quarter, Gallup reported last week. But as recent market action suggests, the markets are inclined to climb a wall of worry these days.

“While things aren’t great, they’re not the disaster we thought,” Bill Strazzullo, chief market strategist at Bell Curve Trading, told AP on Friday. “We’ve rallied after a horrendous start to the year.”

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.