Risk-Off Sentiment Strengthens Slide In Treasury Yields

James Picerno | May 15, 2019 07:14AM ET

Maybe it’s a reaction to the recent escalation in the US-China trade conflict. Or perhaps the crowd is turning more cautious because of the runup in global equity markets earlier in 2019 before the trade row between Washington and Beijing undercut the bulls. Whatever the reason, yields on key Treasury maturities are trending down and the slide looks set to continue for the foreseeable future.

“We really need to get past trade negotiations, if we want to know what the next steps are for the Treasuries market,” says Subadra Rajappa, head of US rates strategy at Société Générale (PA:SOGN). “At the moment, the [Treasury] market is still priced to perfection given the current state of trade discussions.”

Bidding up Treasury prices (and thereby pushing yields down) is everyone’s favorite trade when the economic or geopolitical outlook looks more uncertain than usual. By that standard, it’s no surprise that the latest turmoil over trade between the planet’s two largest economies has investors running for cover by hiding in the safe haven of US government bonds.

A resolution to the trade issue would likely halt or even reverse Treasury yields. But at the moment, there’s no sign that the Trump administration is about to relent on its latest efforts to take a hard line on China’s trade policies. In fact, it’s not unreasonable to wonder if the situation could deteriorate further.

“An escalation scenario would be terrible all around,” advises Gabriel Sterne, head of global macro research at Oxford Economics. “A negative impact on trade flow is going to be bad for global growth for several years. It’s bad news for almost everybody.”

By some accounts, the higher tariffs imposed by the Trump administration are less about a negotiating tool vs. a goal. Douglas Irwin, a trade historian at Dartmouth College, tells The New York Times that raising tariffs is Trump’s plan for “a new status quo for the world economy.”

If we do have this consensus that we want to isolate ourselves from China, that’s a big historic shift in U.S. trade policy. We’ve moved away from tariffs as a bargaining chip to get a better deal to tariffs as a means to an end to decouple the economies.

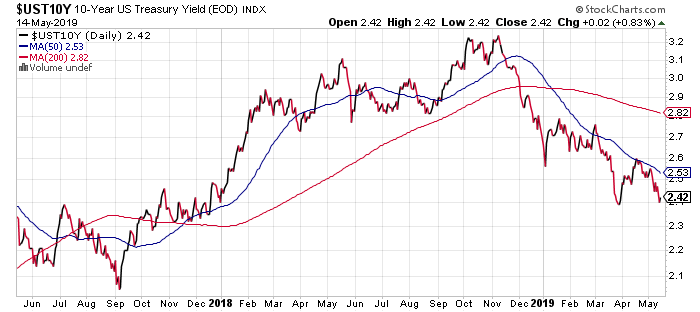

As for Treasury yields, downside momentum is strong. Indeed, the benchmark 10-year rate is close to slipping below the previous low of 2.39% (set in late-March). If that previous floor gives way, the 10-year yield will trade at the lowest level in nearly a year-and-a-half.

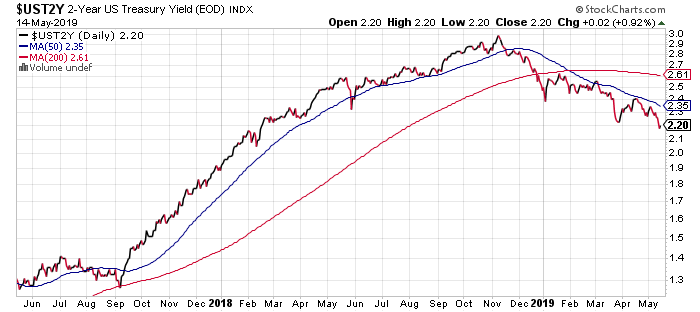

The policy sensitive 2-year yield (2.20% on Tuesday, May 14) is also just a tick above the lowest rate since early 2018.

A new round of falling yields on government bonds is hardly limited to the US. Notably, the German 10-year rate has again slipped into negative terrain, in part because of renewed concern that Italy’s preparing to allow the country’s deficit to rise above European Union limits, which in turn is creating fresh demand for safety to ride out any blowback from renewed fiscal turmoil on the Continent.

Will the current scenario convince the Federal Reserve to cut interest rates? That’s considered unlikely for the near term, in part because the US economy has remained strong this year. In particular, the labor market’s growth rate accelerated in April. Perhaps, then, it’s not surprising that Fed funds futures are pricing in a roughly 87% probability that the central bank will leave its current 2.25%-to-2.50% target rate unchanged at next month’s policy meeting, based on CME data.

But the crowd’s renewed appetite for Treasuries and the commensurate drop in yields suggests that the possibility of a Fed rate cut is growing — a possibility that may be rising via expectations that second-quarter GDP growth for the US is set to ease.

Right or wrong, the crowd is revising its outlook. “The bond market is betting the Fed would have to come off the sidelines and cut interest rates this year,” observes John Briggs, head of strategy at NatWest Markets.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.