Risk Abounds For USD/JPY Bulls

Matthew Weller | Jun 10, 2015 10:13AM ET

It was a particularly eventful night of trade in the currency market and by far the biggest news was the coordinated “jawboning” of the yen by Japanese policymakers. The BOJ and Japan’s government are clearly becoming concerned with the big drop in the value of the yen and it looks like last week’s move above the psychologically significant 125.00 level ($0.8 cents per yen) may have been the final straw. At least three top-level public figures gave yen-negative speeches in today’s Asian session; a selection of their relevant quotes is presented below [emphasis mine]:

BOJ Governor Kuroda:

- Desirable For FX To Move In Stable Manner And Reflect Economic Fundamentals

- If US Fed Rate Hikes Are Fully Priced In, Then No Reason For USD To Rise vs. JPY

- Yen Has Returned To Level Set Before Lehman Crisis, Though That's Not To Say Pre-Lehman Levels Are Appropriate

- Yen's Excessive Rises Have Been Corrected In Past 3 Years

- Real Effective Exchange Rate Shows That Yen Is Weak

- Hard To See Yen Real Effective Rate Falling Further

- Yen Should Move In A Range Reflecting Economic Fundamentals

BOJ Member Sato:

- Sustainability Of BOJ’s JBP Purchases May Become An Issue If It Continues Buying At Current Pace While Investors Reduce JGB Holdings To Least Possible Extent

- Desirable For Forex To Move Stably Reflecting Economic Fundamentals

- Will Carefully Watch Forex Moves And Their Effect On Economy, Prices

- Weak Yen Hurts Small Firms, Non-Manufacturers And Consumers By Pushing Up Import Costs

- Want To Scrutinise Effect, Feasibility Of QQE At Each Policy Meeting Without Any Pre-Set Idea That Maintaining QQE Is A Given

Japan Finance Minister Aso:

- Important For Currencies To Move In A Slow And Stable Manner

The almost-identical “slow and stable” wording from each policymaker suggests that they coordinated behind closed doors to present a united front to the market. The yen’s value has been a critical monetary policy tool for the BOJ for years, and today’s comments suggest that the central bank has now decided that the costs of a weak yen are starting to outweigh the benefits.

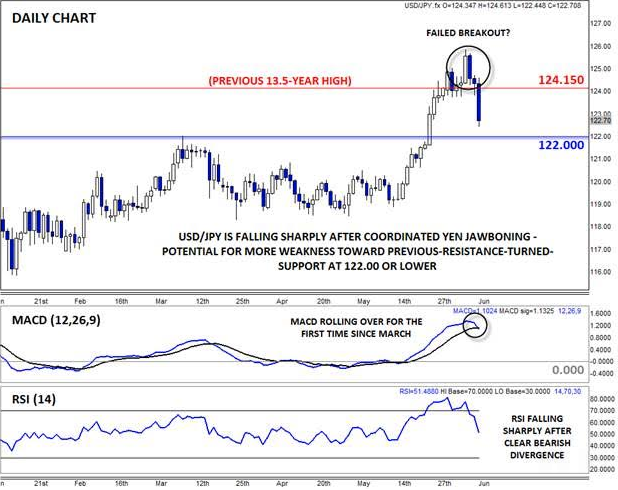

Technical View: USD/JPY

As you would expect, the BOJ’s message is coming through loud and clear for traders. After edging up to a 13.5-year high at nearly 126.00 to start the week, USD/JPY has shed 300 pips to trade back down below 123.00. The reversal is a particularly devastating blow for technical traders, who piled in to buy the pair after the big breakout. Those bullish traders are now in the unenviable position of trying to decide whether to close their positions at a loss or try to ride out the bearish storm. The secondary indicators further hint at a significant top, with the MACD rolling over to cross back below its signal line and the RSI dropping sharply after a clear bearish divergence.

From here, USD/JPY bears may look to target previous-resistance-turned-support at 122.00 next, and if that level gives way, a more significant fall toward 120.00 could be in play. While a short-term bounce is possible after such a dramatic drop, buyers may remain shell-shocked as long as rates remain below the 125.00 level.

Source: FOREX.com

For more intraday analysis and market updates, follow us on twitter (@MWellerFX and @FOREXcom)

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.