Riding The Equity Yield Curve

Keith Summers, CFA | Jan 06, 2013 04:52AM ET

One year ago, we suggested that the forward Price-to-Earnings ratio for global stocks might rise from 10x to 12x. It did. And that is what led global stocks higher in 2012. P/E ratios rose for US stocks as well (and were further supported by rising earnings). It was a good year to be a shareholder.

Being a bondholder was, generally speaking, not a good a thing to be. Bond prices have fallen over the last year and miserly coupon rates provided little solace. However, we live alongside a generation of investors who equate bond-owning with principal protection.

Many of us will remember the double-digit interest rates of the early 1980’s, and long before Paul Volcker set his sights on prop trading desks at banks, he set his sights on the runaway inflation of the late 1970’s and early 1980’s.

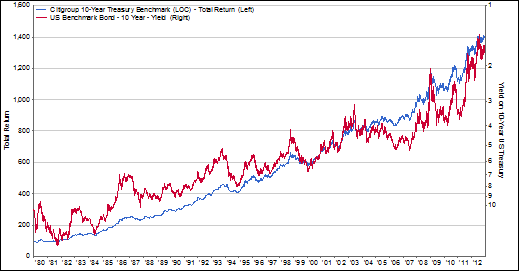

The anti-inflation policies of the Federal Reserve triggered a bond market rally while an expanding federal debt led to trillions of dollars being invested in the bond market at ever declining rates. And for a generation of bond fund managers, “riding the curve” was a simple strategy of buying bonds at a high yield (low price) and selling them later as rates fell to lower yields (high prices). This highly profitable strategy worked. And investors bought it in droves.

The chart shows how well this strategy worked for a generation. The Citibank 10Year US Treasury Benchmark Index has risen 1400% over the last 30 years ago through a period when US Treasury yields tumbled from over 15% to under 2%. At this point, the only thing that will make bondholders money is if bond prices rise as yields go even lower; the coupon interest rate is already lower than the inflation rate.

At these levels, we’re not bullish on bonds.

However, the strategy of “riding the curve” isn’t limited to bonds; equities also have yields – earning yields – and over this past year, investors profited from riding the equity yield curve.

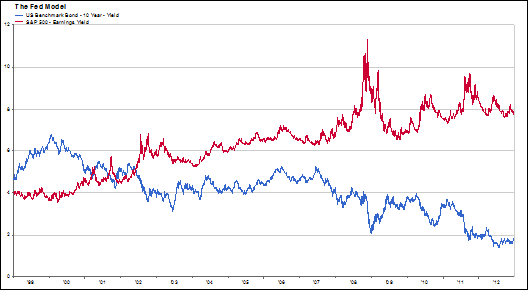

Back in the 90s, the “Fed Model” was a widely discussed method to value the US stock market. In brief, it suggested that the stock market was at fair value when the yield on US 10 Year Bonds was equal to the earnings yield on stocks.

Other than being embraced by Fed Chairman Alan Greenspan, academics have had difficulty in finding when this relationship holds (except for a period in the 1990’s when Greenspan was in charge). But whether you think the difference between the two yields should be zero (like Chairman Greenspan did) or some other number, the difference between these two yields has never been greater.

Right now, stocks are yielding 7.75% and bonds are yielding 1.71%, a 600 bps difference, a record high (for now anyway). Simply put, investors have a choice: to lend money for a fixed coupon and (one hopes) a full repayment at maturity, or to own a share of a profitable business with varying profitability and (one hopes) a rising value.

For the last several years, a lot of money has been put into “lending”. Stock price volatility isn’t fun, and the easy capital gains in bonds from declining interest rates have been alluring. But now that the Federal Reserve is buying much of the net new issuance of federal government debt, there aren’t enough bonds to go around; investors are being pushed out of bonds and into the stock market and the basics of supply and demand will determine stock prices. We’ve seen this before – in the 1990s the supply of bonds was also constrained, as Washington was borrowing very little back then – and we remember what happened to the stock market in the 1990s.

We called for 12x earnings in 2012. Fifteen years ago, stocks traded for 16x earnings – we may yet see those levels again as we ride the equity yield curve down.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.