Review Of Lumber

Eric De Groot | May 01, 2016 02:00AM ET

Lumber, a leading indicator of domestic and global construction, implies future weakness not only US home construction but also the global economy. The general observation of mark down across the commodity sector despite numerous countertrend rallies suggests deflationary forces and deflation throughout the global economy. This interpretation will gain acceptance when the business cycle transitions from prosperity to liquidation and the public loses money on the expectation that it can be prevented or managed.

Investors, largely driven by emotions rather than discipline, tend to focus on volatility rather than the message of the market. This tendency prevents them from recognizing better opportunities in 'quieter', less-followed markets such as Lumber.

Summary

The BULL (Price) and BULL (Leverage) trends under Q3 accumulation after the seasonal high position lumber as a focused bull opportunity since the the second week of March.

Price

Interactive Charts: Lumber, LUMBER

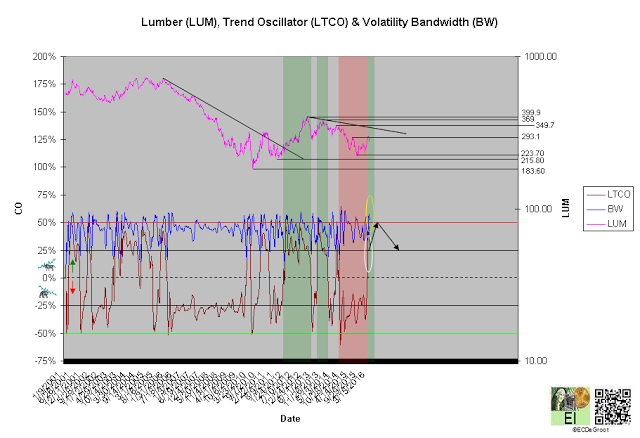

The long-term trend oscillator (LTCO) defines up impulse from 288.10 to 284.10 since the second week of March (chart 1). The bulls control the trend until reversed by a bullish crossover. Compression, the final phase of the CEC cycle, generally anticipates this change.

A close above 399.9 jumps the creek and transitions the trend from cause to mark up, while a close below 1830 breaks the ice and transitions it to mark down. A close above 293.10-299.20 maintains a bigger rally and favors testing of 2013 or 2014 resistance.

Chart 1

Leverage

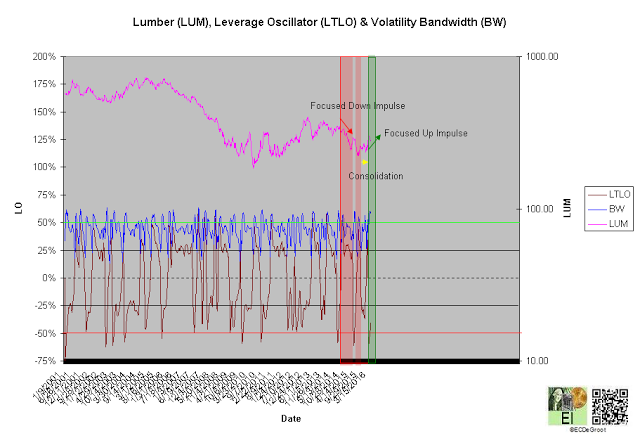

The long-term leverage oscillator (LTLO) defines a bull phase since the second week of March (chart 2). The focuses the up impulse (see price).

A diffusion index (DI) of -39% defines a Q2 accumulation (chart 3). A capitulation index (CAP) of -8% supports this message (chart 4). DI and CAP's trends, broader flows of leverage and sentiment from accumulation to distribution and fear to complacency supporting the bulls (red arrows), should not only continue to extreme concentrations but also restrain downside expectations until reversed (see price). A decline under these trends, a sign of weakness (SOW), would be bearish for lumber longer-term.

Chart 2

Chart 3

Chart 4

Time/Cycle

The 5-year seasonal cycle defines weakness until the fourth week of September (chart 5). This path of least resistance restrains upside expectations (see price).

Chart 5

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.