3 Big Dividends The Government Pays You To Own

Contrarian Outlook | May 30, 2019 06:49AM ET

What if I told you I’d found a way to protect your portfolio from this twitchy market without giving up big gains (and income)?

My guess is you’d be interested—if a little skeptical.

I get that. A skeptic is a good thing to be, in investing and pretty much everything else.

So let me tell you right away that I’m talking about one of the most unsexy investments you can think of—but also one poised for some very nice gains as volatility drives scared investors to look beyond stocks.

I’m talking about municipal bonds, debts issued by state and local governments to fund badly needed infrastructure projects.

And no matter how much the politicians bicker, you can take this to the bank: trillions of infrastructure cash will be spent. The economy depends on it.

The Only Investment the Government Pays You to Own

Here’s the funny thing: not only do governments issue “munis,” they pay you to own them! They do it through an indirect subsidy: muni bonds’ dividends are tax-free for most Americans.

That can make a huge difference.

Let’s say you buy municipal bonds through a closed-end fund (CEF) —a move I recommend for reasons I’ll explain shortly. And let’s say you buy the Invesco Muni Opportunities Trust (VMO)—one of three muni CEFs ripe for buying now (more on VMO below).

Right now, VMO pays a 5% yield, which is terrific—more than triple what you’d get from the typical S&P 500 stock. But without tax applied, the fund’s real yield could hit 8% for some folks.

Nearly double!

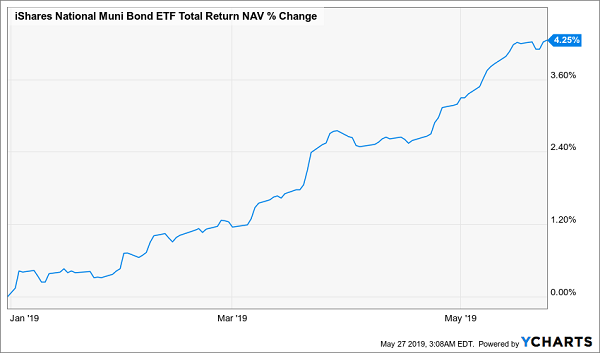

And when you consider the smooth upside munis are famous for, you can see why they have a place in your portfolio. Look at the performance of the benchmark iShares National Municipal Bond ETF (NYSE:MUB) since January 1:

Munis’ Whisper-Quiet Ride

Year to date, muni bonds’ rise hasn’t seen a single major reverse, with a solid 4.3% total return.

And get this: of the 171 muni-bond CEFs tracked by service , 141 are beating the index for 2019. In other words, over 82% of the actively managed municipal-bond funds are crushing the “dumb” index fund.

You might wonder how this is possible. After all, the press loves to tell us that active investing isn’t worth the fees, because low-cost index funds almost always outperform. Yet here we have 82% of higher-cost active funds crushing the ETF—and their performance figures include fees.

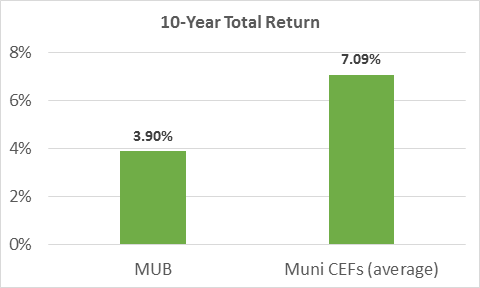

This isn’t a blip, either.

The average 10-year total return for a muni CEF is nearly double the return on the passive MUB in the same period, when looking at the compound annual growth rate for each:

Crushing the Index by a Mile

It gets better.

Of the 138 CEFs that have been around over the last 10 years, only one has underperformed MUB over that period (the Nuveen Select Maturities Municipal Bond Fund {NYSE:NIM}—don’t buy that one). The best performer is the PIMCO Municipal Income II Fund (NYSE:PML), which is up a shocking 11.6% annualized, nearly three times better than MUB!

ETFs: the Worst Way to Buy Muni Bonds

You might be wondering why these actively managed funds, with their high-paid managers and big research budgets, are beating the low-cost index fund, and why we don’t hear more about this.

The answer: unlike the stock market, which gets lots of attention, the municipal-bond market seems boring on the surface. But in reality, it’s packed with profit opportunities.

Because muni bonds aren’t traded as frequently as stocks, and because average investors don’t have the same access as big players, the muni-bond market has a ton of inefficiencies money managers can—and do—jump on.

That, by the way, is why I recommend buying munis through a CEF, rather than trying to navigate this market on your own.

This is also great news if you’re worried about the big swings in stocks these days, because muni CEFs are poised to outperform at a time when stocks may be threatened by headlines (trade wars, for example) that don’t bother munis one bit.

Which leads me to the three high-yielding muni funds I want to show you today.

3 “No-Drama” Muni Dividends Up to 8%

Let’s start with the Nuveen Quality Muni Income Fund (NYSE:NAD), one of the largest muni-bond funds, with over $2.7 billion in assets under management.

That heft, combined with Nuveen’s massive presence in the muni-bond market, has helped NAD snap up the best issuances for years. You can see the results in how the fund has mauled MUB:

NAD: The “Boring” Fund That Soared

But that’s not the best part. NAD also trades at a huge 11.7% discount to net asset value (NAV, or the combined value of the muni bonds it holds), while MUB trades at the intrinsic value of its portfolio. That nicely sets up NAD for stronger outperformance as its discount narrows.

Finally, NAD yields 4.7%, over double MUB’s 2.3%. And its real dividend is, of course, much higher, as its dividends are tax-free to most Americans. And NAD is far from the only outperformer trading at a big discount.

Our second muni CEF, the BlackRock (NYSE:BLK) BLK MuniYield California Fund (NYSE:MCA) trades at a 9.8% discount to NAV while paying a luxurious 4.5% tax-free yield.

MCA’s management firm, BlackRock, is one of the best in the bond world. With over 7 trillion dollars under management, they have the kind of market access the rest of us can only dream of. And that’s why MCA has done this over the last decade:

Savvy Insiders Power MCA

With its long history of outperformance and its high dividend, MCA is an obvious choice if you’re looking to sidestep volatility and grab a high-income stream.

Finally, there’s the Invesco Muni Opportunities Trust (NYSE:VMO)—the CEF I mentioned off the top. It’s geographically diversified, with its $810 million in assets across every part of the country. VMO’s 9.3% discount to NAV is also amazing, considering this fund has also crushed the index for a long time:

VMO Trounces Its Benchmark and Pays a Tax-Free 5% Dividend

If that isn’t enough, as I mentioned earlier, VMO also pays a 5% tax-free dividend, which is equivalent to an 8% yield for some taxpayers.

My Top Muni-Bond CEF Buy: 15% Gains (and Up to 8% Dividends) Ahead

VMO’s dividend is solid, but its upside is nowhere near that of my very best muni-bond pick. This overlooked fund pays almost exactly the same yield as VMO, but with a twist: its discount is far wider—a full 11.3%!

That may not mean a lot until you realize that this freakishly undervalued fund trades at more than double its 10-year average discount (which, by the way, is just 5.4%).

The bottom line?

We’re set up for a quick 7% price gain as that discount swings back to normal. And I’m expecting that gain to rise into double digits as skittish investors come around to the safety, (tax-free) income and upside this steady-Eddie muni fund boasts.

This kind of fast return is unheard of in the “slow and steady” world of muni bonds—and it’s exactly why I’m pounding the table on this one today.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.