Return Of Rising Yields

Sunshine Profits | Mar 19, 2021 11:09AM ET

March Madness started on Thursday, but stocks got the jump on their own brackets this week. Let’s dive in.

Although Wednesday, March 17, saw the indices have a nice St. Patrick’s Day green reversal thanks to Jay Powell babying us on inflation thoughts again, Mr. Market isn't stupid. Manic, but not stupid. We saw a return to the strong rotation trend out of growth stocks the day after Powell's testimony on March 18.

That day saw bond yields surge to their highest levels in what seems like forever. The 10-year yield popped 11 basis points to 1.75% for the first time since January 2020, while the 30-year rate climbed 6 basis points and breached 2.5% for the first time since August 2019.

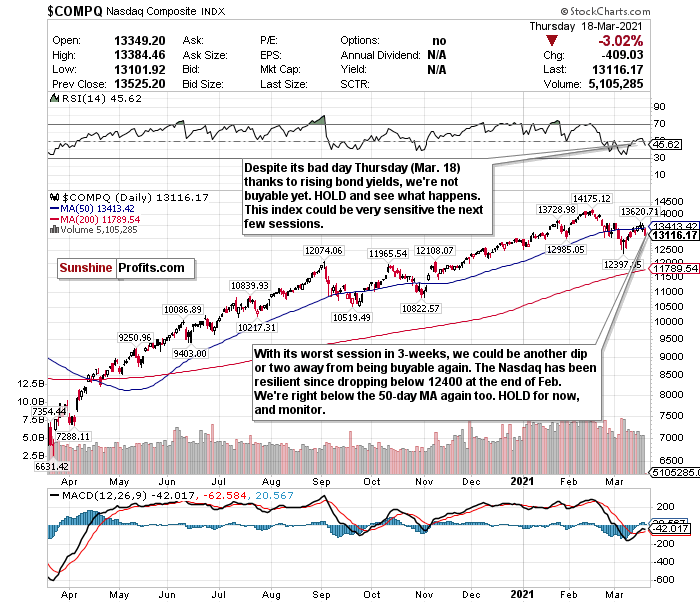

Predictably, the NASDAQ Composite tanked by over 3% for its worst session in three weeks.

Powell and bond yields are the most significant market movers in the game now. Get ready for the market next week, when he testifies to Congress. That'll be a beauty. What's coronavirus anymore?

So after what's been a relatively tame week for the indices, we can officially say bye-bye to that.

Bond yields, though, are still at historically low levels, and the Fed Funds Rate remains at 0%. With the Fed forecasting a successful economic recovery this year, with GDP growth of around 6.5% – the fastest in nearly four decades – the wheels could be in motion for another round of the Roaring '20s.

The problem, though, is that the Great Depression came right after the first Roaring '20s.

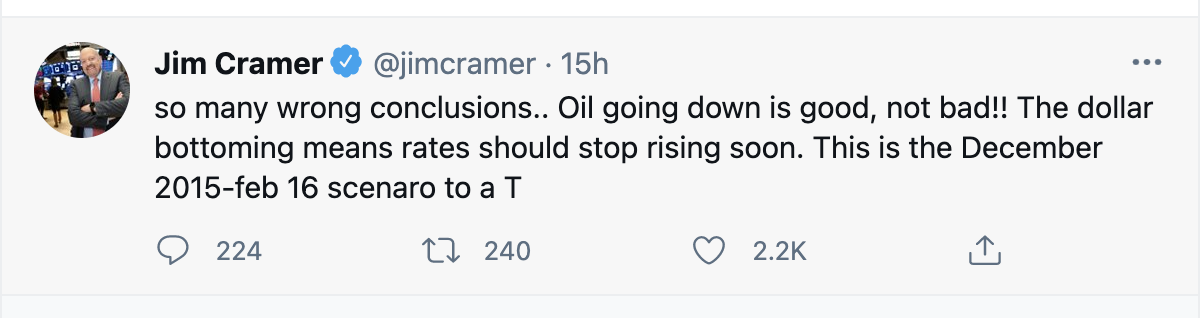

Many are sounding the alarm. However, like CNBC's Jim Cramer, others think the current headwinds are overblown, and a mirror of the 2015-2016 downturn is based on similar catalysts.

Figure 1:

Cramer argued that Powell is a talented central banker willing to "let the economy continue to gain strength so that everyone has a chance to do well."

Nobody can predict the future, and these growth stock jitters from rising bond yields may be overblown. But for now, it's probably best to let the market figure itself out and be mindful of the headwinds.

With that said, to sum it up:

There is optimism, but signs of concern. The market has to figure itself out. A further downturn is possible, but I don’t think that a decline above ~20%, leading to a bear market, will happen any time soon.

NASDAQ - Another Buyable Dip?

Figure 2- Nasdaq Composite Index $COMP

The last time I switched my Nasdaq call to a 'buy' on Feb. 24 it worked out very well. I will use the same criteria again for the Nasdaq as the market figures out bond yields: The RSI and the 13000 support level. I need the Nasdaq’s RSI to dip below 40 while also falling below 13000 before buying.

We’re not quite there. This is an excellent dip, but it’s really only one down day and its worst down day in weeks. I think we may have some more buying opportunities next week if bond yields pop due to Powell’s testimony. I mean, it seemingly always happens after he speaks.

Pay very close attention to the index and its swings.

If the tech sector takes another big dip, don’t get scared, don’t time the market, monitor the trends I mentioned and look for selective buying opportunities. If we hit my buying criteria, selectively look into high-quality companies and emerging disruptive sub-sectors like cloud computing, e-commerce and fintech.

Hold, and let the RSI and 13000-support level guide your Nasdaq decisions. See what happens over subsequent sessions, research emerging tech sectors and high-quality companies, and consider buying that next big dip.

For an ETF that attempts to correlate with the performance of the NASDAQ directly, the Invesco QQQ Trust (NASDAQ:QQQ) is a good option.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.