Reflecting On E-commerce Software Stocks’ Q2 Earnings: VeriSign (NASDAQ:VRSN)

Stock Story | Oct 11, 2023 08:35AM ET

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to other peers in the same sector. Today we are looking at VeriSign (NASDAQ:VRSN), and the best and worst performers in the e-commerce software group.

This article was originally published on Stock Story

While e-commerce has been around for over two decades and enjoyed meaningful growth, its overall penetration of retail still remains low. Only around $1 in every $5 spent on retail purchases comes from digital orders, leaving over 80% of the retail market still ripe for online disruption. It is these large swathes of the retail where e-commerce has not yet taken hold that drives the demand for various e-commerce software solutions.

The 6 e-commerce software stocks we track reported a mixed Q2; on average, revenues beat analyst consensus estimates by 1.64%, while on average next quarter revenue guidance was 0.03% above consensus. There has been a stampede out of high valuation technology stocks as raising interest rates encourage investors to value profits over growth again, but e-commerce software stocks held their ground better than others, with share prices down 2.63% since the previous earnings results, on average.

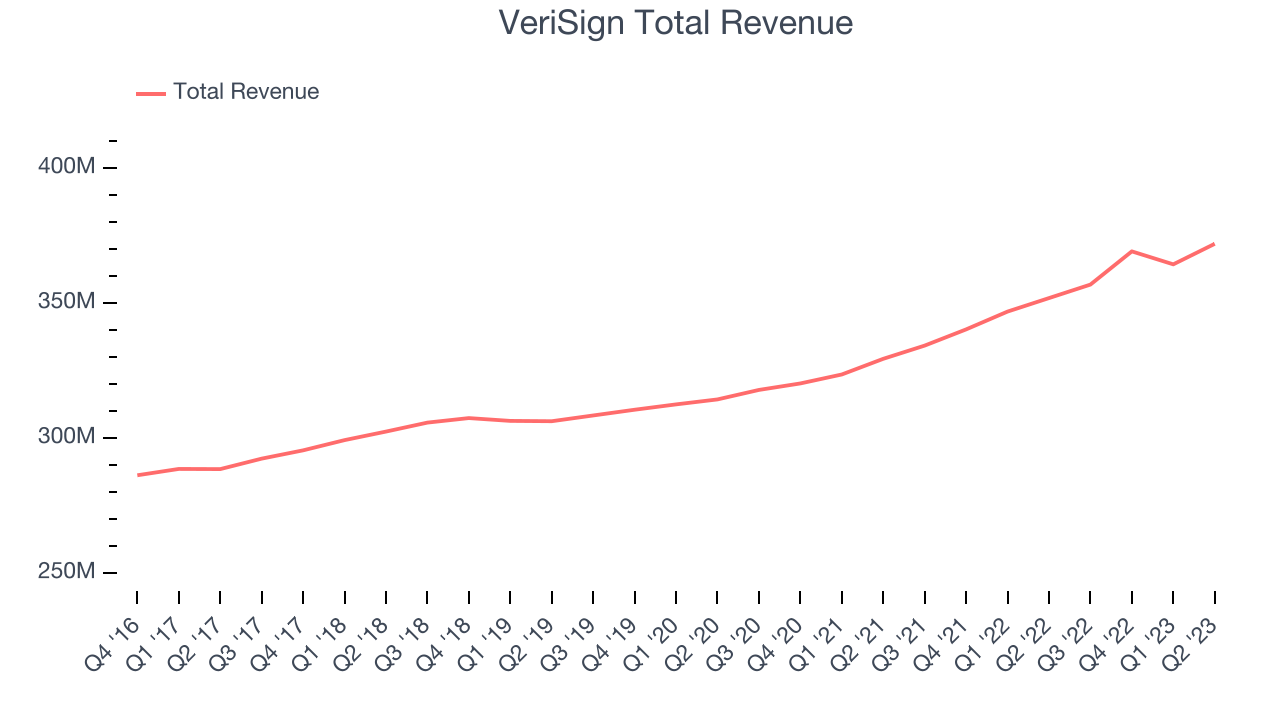

VeriSign

While the company is not a domain registrar and does not directly sell domain names to end users, Verisign operates and maintains the infrastructure to support domain names such as .com and .net.

VeriSign reported revenues of $372 million, up 5.71% year on year, missing analyst expectations by 0.29%. It was a mixed quarter for the company, with a miss of analysts' revenue estimates. On the other hand free cash flow was still strong and in line with last year.

The stock is down 0.92% since the results and currently trades at $207.46.

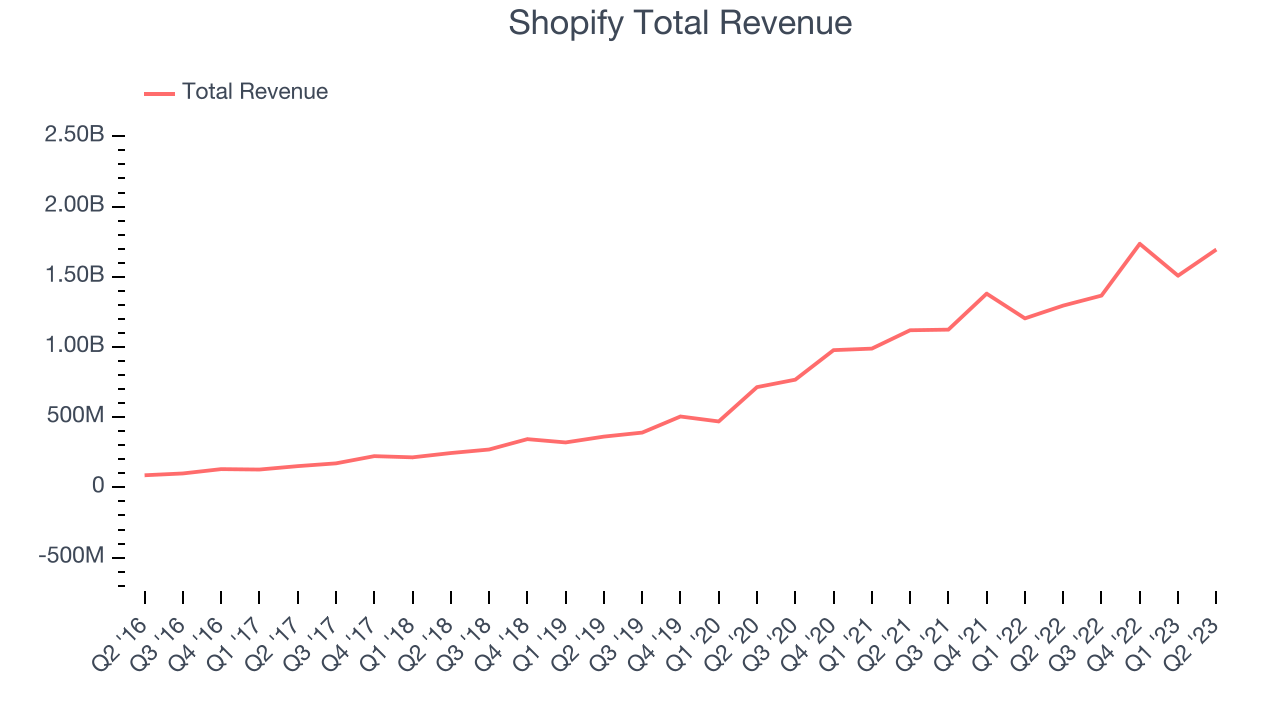

Best Q2: Shopify (NYSE:SHOP)

Originally created as an internal tool for a snowboarding company, Shopify (TSX:SHOP) provides a software platform for building and operating e-commerce businesses.

Shopify reported revenues of $1.69 billion, up 30.8% year on year, beating analyst expectations by 4.27%. It was a very strong quarter for the company, with a significant improvement in its gross margin compared to the previous quarter and a decent beat of analysts' revenue estimates.

Shopify achieved the strongest analyst estimates beat and fastest revenue growth among its peers. The stock is down 11.2% since the results and currently trades at $55.4.

Weakest Q2: GoDaddy

Founded by Bob Parsons (NYSE:PSN) after selling his first company to Intuit (NASDAQ:INTU), GoDaddy provides small and mid-sized businesses with the ability to buy a web domain and tools to create and manage a website.

GoDaddy (NYSE:GDDY) reported revenues of $1.05 billion, up 3.21% year on year, missing analyst expectations by 0.61%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and a miss of analysts' revenue estimates.

GoDaddy had the weakest performance against analyst estimates and slowest revenue growth in the group. The stock is down 0.09% since the results and currently trades at $75.65.

BigCommerce

Founded in Sydney, Australia in 2009 by Mitchell Harper and Eddie Machaalani, BigCommerce provides software for businesses to easily create online stores.

BigCommerce (NASDAQ:BIGC) reported revenues of $75.4 million, up 10.6% year on year, beating analyst expectations by 2.84%. It was a weaker quarter for the company, with underwhelming revenue guidance for the next quarter.

BigCommerce had the weakest full year guidance update among the peers. The stock is up 4.72% since the results and currently trades at $9.98.

Squarespace

Founded in New York City in 2003, Squarespace is a platform for small businesses and creators to build their digital presences online.

Squarespace (NYSE:SQSP) reported revenues of $247.5 million, up 16.4% year on year, beating analyst expectations by 1.71%. It was a solid quarter for the company, with strong sales guidance for the next quarter and full-year revenue guidance topping analysts' expectations.

The stock is down 6.18% since the results and currently trades at $30.08.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.