Real Yields On T-Notes Still Attractive

Wall Street Daily | Mar 09, 2016 05:42AM ET

Last month, Japan’s 10-year government bonds traded with a negative yield for the first time in history.

Germany’s 10-year bonds are yielding 0.24%.

And you thought we had it bad?

By comparison, the 1.89% rate on 10-year U.S. Treasuries offers a smorgasbord of yield.

However, in order to make a fair comparison, we have to take the differences in inflation into account. A high yield may be completely consumed by a loss of purchasing power.

If we subtract the inflation rate from the nominal yield, we’re left with the real interest rate. “Real” just means inflation adjusted.

We can compute real interest rates in a couple of ways. We can either use the market’s estimate of inflation or use actual inflation data seen in the rise of the consumer price index (CPI).

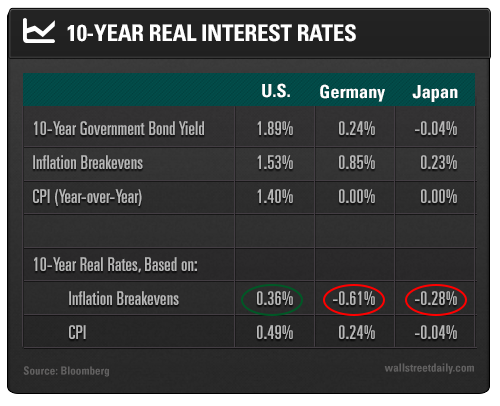

The table below illustrates both of these calculations:

Inflation “breakevens” are just the market’s expectations of future inflation implied by the pricing of Treasury inflation-protected securities (TIPS) and traditional Treasuries.

As you can see, both Germany and Japan have much lower inflation levels – both projected and historical.

I prefer using inflation breakevens over CPI because breakevens are forward looking. The market’s inflation estimates may not prove to be right, but at least we’re not looking in the rearview mirror.

Based on the breakeven method, the U.S. 10-year real interest rate is 0.36%. That’s not large, but it’s still higher than the -0.61% or -0.28% real rate in Germany and Japan, respectively.

Basically, T-Notes continue to be attractive for global bond investors and should benefit from capital flows. The real rate differential should continue to keep a lid on U.S. interest rates.

I’ve been bullish on T-Notes for a while, but I’m always on the lookout for risks that yields will move substantially higher (yields and bond prices are inversely related).

It’s not the case now, but I’d be concerned if U.S. real rates were solidly negative. For example, U.S. 10-year real rates moved below -0.5% in mid-2012. That wasn’t a great time to be long T-Notes, as rates moved from below 1.7% to above 2.75% in 2013.

Luckily, real rates are currently positive.

Of course, the longer-term mega-trends – debt supercycle, demographics, and technological deflation – will continue to keep downward pressure on interest rates for the foreseeable future.

Add it all up, and U.S. T-Notes are still attractive from an investment standpoint. They’re excellent portfolio diversifiers and the risk of a backup in rates seems low.

Safe (and high-yield) investing,

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.