Ready For More Hot Gold And Stocks Profits

Monica Kingsley | May 07, 2021 02:59PM ET

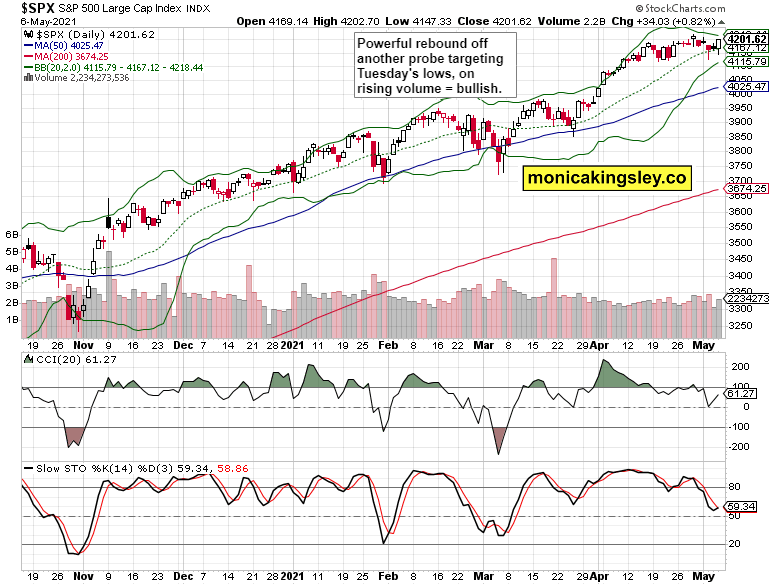

One final attempt to go down before reversing to strong gains all the way to the closing bell. The S&P 500 returned to trading back at the upper border of its prolonged consolidation range. Again at 4,200, new all-time highs are back in sight – that's at least what the impression from declining VIX says, and the option traders might disagree here all they want. They're likely to be the next cannon fodder in the bullish advance.

Needless to say that my reasonably and justifiably aggressive long positions in both S&P 500 and gold, are inundated with rising profits. Initiated in the vicinity of Tuesday's lows, I look for more gains in stocks in spite of small caps still lagging behind.

Keep an eye on the big picture presented yesterday :

(…) no change in the reflationary positive dynamics for stocks, let alone the red hot commodities. These (copper, agri-foods, base metals, lumber, oil) continue appreciating in spite of nominal yields pulling back a little these days. Make no mistake though, .

Lower yields finally coincided with the defensive sectors the way they ideally should – technology bottom searching is over, Dow Jones Industrial Average is spurting higher, utilities recovered and consumer staples continued upwards as if nothing happened at all.

Gold and silver fireworks arrived, and there is more is to come! What better proof than a broad-based advance across the sector, starting with both metals, and extending to gold and silver miners left and right. Not to mention the copper fires burning brightly. If you were listening to my incessant red metal bullish calls, you're very happy now. And just as in the precious metals, there is more to come here too. So happy for all you who had the patience to wait out a couple of adverse sessions, because:

(…) The key metrics such as nominal or real yields support the precious metals rebound increasingly more – don‘t be fooled, gold would break above the $1,800 resistance, whether you look at it as a purely psychological one, or as a neckline of an on the daily chart.

The advance across the real assets, the precious metals and commodities super bull, would be more well rounded then.

As for Bitcoin, such was my assessment yesterday in a series of updates of the leading, but currently lagging crypto when compared to Ethereum or Dogecoin, the latter being a true middle finger to the financial system.

Let‘s move right into the charts (all courtesy of www.stockcharts.com ).

S&P 500 Outlook

Yesterday's rebound happened on rising volume, lending it credibility for the sessions to come. The bears weren't obviously convinced enough to sell as yesterday's volume lagged behind Tuesday's one.

Credit Markets

The corporate credit markets kept yesterday and still keep today signalling higher stock prices next. Notably, both iShares iBoxx $ High Yield Corporate Bond ETF (NYSE:HYG) and iShares iBoxx $ Investment Grade Corporate Bond ETF (NYSE:LQD) rose again in spite of long-dated Treasuries turning up as well.

Technology And Value

Technology did indeed bottom, and the heavyweights contributed reasonably enough to its advance. Semiconductors could have fared a little better, but that's not a major issue. At the same time, value stocks continued their steep ascent, as reliably as ever.

Summary

S&P 500 is readying another reach for the highs, finally supported (aka not being hampered by) technology. Risk on is returning and high-beta stock markets pockets are expected to keep doing well.

Gold, silver and miners have firmly positioned themselves to extend yesterday's much awaited and well deserved gains.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.