RBNZ Holds, Refrains From A Dovish Meeting; New Zealand Dollar Spikes

City Index | Nov 12, 2019 11:52PM ET

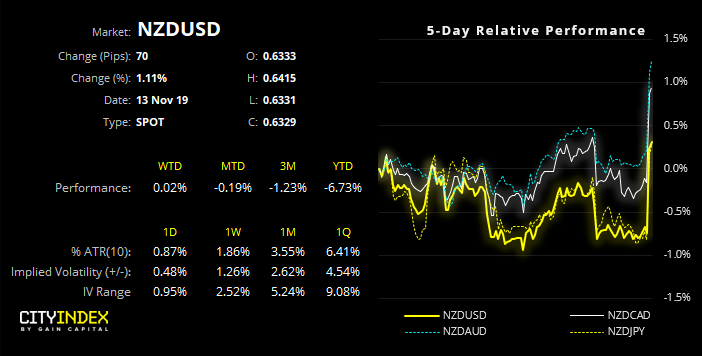

The Reserve Bank of New Zealand (RBNZ) held and refrained talking their currency down. The Kiwi dollar spiked higher across the board.

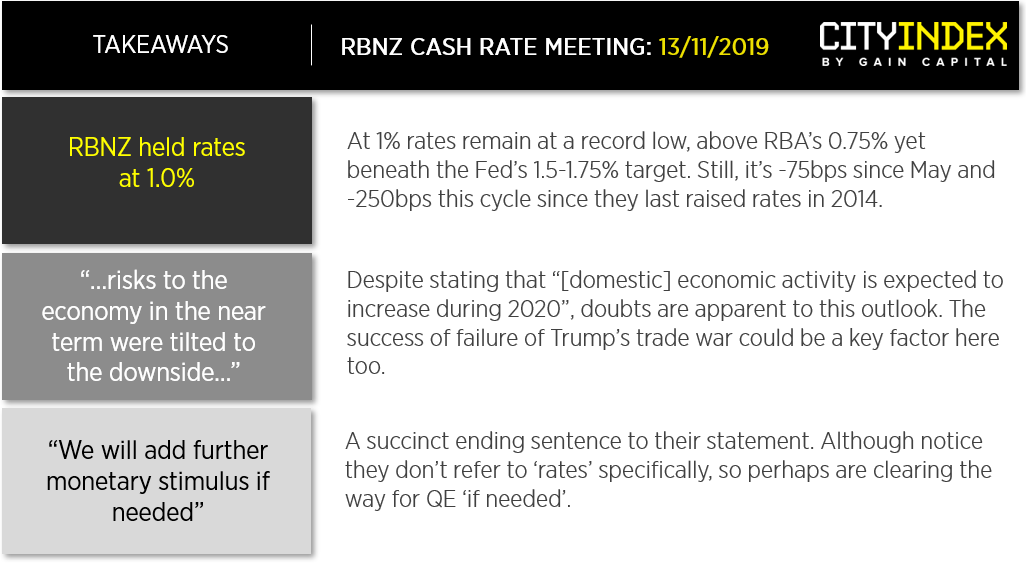

Official Cash Rate unchanged at 1 percent

Today’s hold caught markets and economists off guard. As of yesterday, 80% of economists polled expected a cut and markets were pricing in >85% chance of a cut, following a weak read on inflation expectations from RBNZ’s own survey. On that note, whilst markets focussed on inflation expectations of 1-2 years ahead, the minutes state that “long-term inflation expectations remain anchored at close to the 2 percent target mid-point” showing that, where CPI is concerned, they’re playing the long game.

Still, at -75bps over just 5 meetings, they could still be waiting for their actions to take effect on the economy. Furthermore, this means RBNZ have cut by -250bps since they last raised rates back in 2014 yet still have room to ease if they require.

However, the press conference was not dovish. During his speech, Adrian Orr stated “we have the ability to observe the data, knowing we’re providing plenty of monetary stimulus” after providing a “significant cut in August”. He also added that QE is not a tool that is currently part of their bigger plan. So, unless data is to deteriorate notably from here, perhaps the low is in at 1%. By the end of the press conference, markets were pricing in just a

AUD/NZD: At the time of writing, it’s the most bearish session since September 2017. It’s daily range has also expanded over 200% of its 10-day ATR and is just above key support, so there is potential for mean-reversion over the near-term. Yet, given its failure to break above 1.084 and the potential that RBNZ are to hold rates at 1% from here, AUD/NZD could be overbought and poised to eventually break to new lows.

Original Post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.