RBNZ Expected To Cut Rates, The Key Is By How Much?

City Index | Nov 12, 2019 12:50AM ET

Whilst RBNZ are expected to cut rates again, but it remains unclear how dovish the statement will be, given the mixture of weak economic data of late alongside a lower currency and improved US-China trade sentiment.

According to Reuters, 80% of economists polled expect RBNZ to cut rates by 25 bps. This would place their rates at 0.75% and on par with RBA, who are also at record low rates. Money markets are also pricing in a cut, with the 1-month OIS suggesting a 72.2% chance of a cut.

With a 25-bps cut so widely expected, we’d likely need a dovish cut to sustain further downside on the Kiwi. Domestic data could warrant a cut given its underperformed relative to expectations over recent weeks (according to the CESI index). Most notably, unemployment unexpectedly rose, business sentiment remains weak and inflation expectations fell to their lowest level since Q4 2016 today.

Given their ability to move fast and exceed market consensus, the potential for negative rates and / or QE further down the road, then we should be on guard for some form of a surprise given their ability to do so in the past. There’s certainly no harm in being over-prepared.

That said, there’s also a case to be made that an aggressively dovish cut may now be less likely.

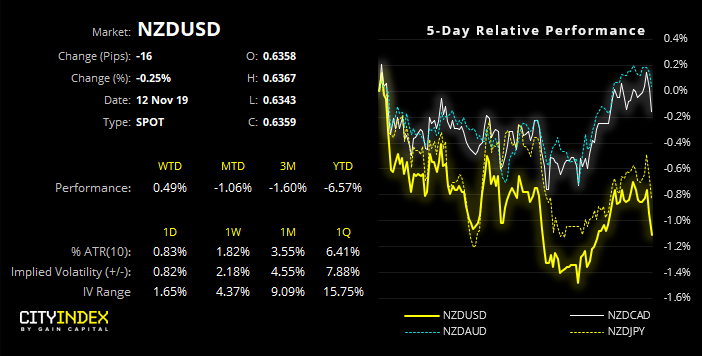

NZD/USD: The USD has seen a strong rebound from support, although yesterday’s bearish inside day on DXY suggests momentum could be waning. In turn, this has allowed NZD/USD to produce a 2-bar reversal above 0.6320 which leaves the potential for a move higher over the near-term.

The degree to how high it can bounce is likely down to RBNZ tomorrow.

NZD/CAD: The commodity FX cross also shows potential for a rebound, yet it remains within an established bearish channel and of course Canada’s interest rates are at a premium over New Zealand’s, meaning any upside move it likely to face headwinds due to the differentials.

Original Post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.