RBA Minutes Stick To The ‘Steady As She Goes’ Script | AUD/USD

City Index | Aug 20, 2019 02:23AM ET

Whilst AUD remained confined within its range, we continue to look out for range expansion.

Summary of RBA’s August minutes

RBA opted to hold rates at the record low rate of 1% in August meeting and, whilst their statement left the door open for further easing, it was s very much a “steady as she goes” approach. Today’s minutes pretty much stick to this script, so the market reaction was muted.

Ultimately the RBA want to see a lower unemployment rate accompany higher wages to fend off further easing on the domestic front. However, actions from other central banks (particularly the Fed) will also impact their policy timing, as to avoid getting left behind for a race to the bottom.

RBNZ surprised markets with a 50bps cut just one day after RBA’s meeting, which puts their OCR on par with RBA’s 1% record low rate. However, it’s likely to be Fed action (or lack of) which could force RBA to ease and sooner. Therefore we’ll keep a close eye on RBA rate indicator sees just a 20% chance of a 25 bps cut in September whilst OIS markets, down from 40% over a week ago. A cut is full priced in for November, whilst OIS doesn’t full price in a cut until February.

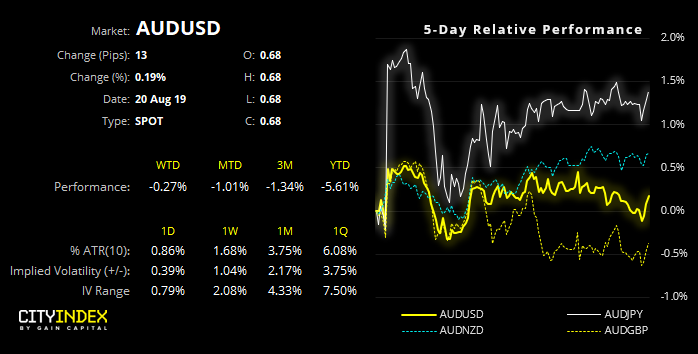

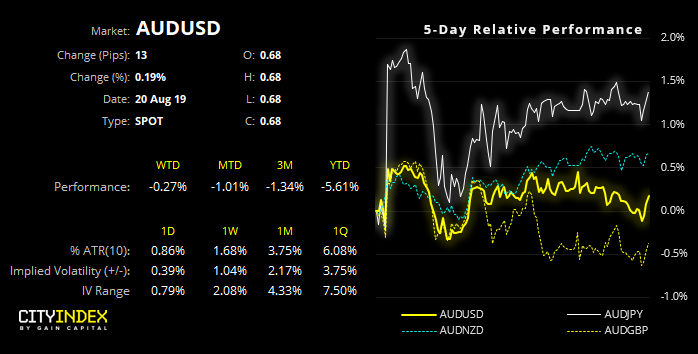

The daily trend structure for AUD/USD remains bearish, and as the fall from 0.7082 saw a notable pickup of downside momentum it suggests new lows could eventually be on the cards. However, given the lack of mean reversion we’re on guard for the potential of a deeper retracement. But ultimately, we’re on the look-out for range expansion to mark its next directional move.

- AUD/USD is now consolidating within a 90-pip range, with support and resistance residing around 0.6735 – 0.6832 respectively. If range expansion is to break above the June low, a deeper retracement is likely on the cards to satisfy counter-trend traders.

Original Post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.