RBA Clears Up Misunderstanding

Dean Popplewell | Jul 21, 2017 07:16AM ET

Friday July 21: Five things the markets are talking about

The EUR has surged to a new two-year high outright earlier this morning (€1.1679) while most major stock exchanges consolidated as the markets assess an investigation into the U.S. president that may stall his economic agenda – special counsel Mueller is reportedly expanding his Russia probe into Trump’s business transactions, as well as the financial dealings of his associates.

Yesterday’s meeting of the ECB did just enough to show that regional policymakers seem to be on course to rein in their two-year old emergency program of QA without upsetting the ‘apple cart.’ As expected, the ECB left rates unchanged and their lack of concern on a stronger EUR was enough to give the green light to investors to own even more.

President Draghi is now expected to use the Jackson Hole Federal Reserve conference in August (24-26) to prepare the ground for a bond-buying program tapering announcement in September.

This morning, Canada is expected to report a soft +1.1% rise in y-o-y inflation at 08:30 am EDT, while retail sales should come in at a +0.3% monthly gain.

1. Stocks finish on a flattish note

Following the flattish session in the U.S yesterday, most of the equity markets in Asia and Europe are slightly weaker overnight.

Global equities have continued hitting new fresh highs week amid corporate results that have reinforced faith in earnings and the economy. Asian shares are up more than +4% in the past fortnight, with markets in Japan and Hong Kong near two-year highs.

In Japan, the Nikkei share average retreated overnight as investors took profits on steelmakers and a firmer yen (¥111.68) also soured investors’ mood. For the week, the benchmark index dipped -0.1%. The broader Topix dropped -0.2%.

In Hong Kong, shares ended their nine-day winning streak, pulling back from their two-year highs. The Hang Seng index shed -0.1%, ending its longest streak of gains since April 2015. However, it rose +1.3% this week, its second week in the black. The Hang Seng China Enterprises Index was -0.6% lower.

In China, stocks slipped, but ended the week higher, led by strong gains in blue chips. The CSI300 index fell -0.3%, retreating from its 18-month high, while the Shanghai Composite Index lost -0.2%.

In Europe, equities trade are mixed in a lackluster session. The FTSE 100 is a tad higher with help from the telecommunications sector’s higher Q1 results.

U.S stocks are set to open in the black (+0.1%).

Indices: STOXX 600 +0.1% at 384, FTSE 0.3% at 7511, DAX +0.1% at 12457, CAC 40 +0.2% at 5208, IBEX 35 -0.1% at 10556, FTSE MIB flat at 21441, SMI +0.2% at 9046, S&P 500 Futures +0.1%

2. Oil nudges higher ahead of OPEC meeting, gold shine’s

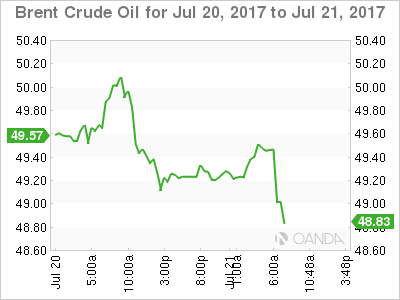

Ahead of the U.S open, oil prices have pushed higher ahead of a key meeting of major oil producing nations next week.

However, Brent crude is holding below the psychological +$50 per barrel level that was briefly breached yesterday for the first time in six-weeks.

Brent crude futures are up +10c, or +0.2%, at +$49.40 per barrel, while U.S West Texas Intermediate (WTI) crude futures are up +7c, or +0.2% at +$46.99 per barrel.

Note: Both benchmarks hit their highest levels yesterday, having been pushed higher by data showing U.S crude and fuel inventories fell sharply last week.

A global glut is putting pressure on oil prices and key members of OPEC are scheduled to meet non-members in St. Petersburg, Russia, on Monday (July 24) to discuss market conditions and whether more action is needed to support prices.

The ‘bears’ don’t believe there will be any action from Monday’s OPEC/non-OPEC working committee meeting – It’s OPEC itself that needs to take further steps to being inventories back to quasi-normal levels.

Gold hit a three-week high this morning and is on track for a second consecutive weekly gain as the dollar tumbled to a 13-month low. Spot gold is up +0.2% at +$1,247.17 per ounce, after hitting its highest since June 29 at +$1,248.30. It has gained about +1.5% so far this week.

3. Yields fall on ECB’s dovish comments

The ECB continues to struggle to push up inflation to its desired target, making it difficult for policy makers to dial back monetary stimulus even as the global economy has been showing broad improvement. Draghi’s ‘dovish’ remarks yesterday gave the green light to own more sovereign debt.

Fixed income buying sent the yield on the benchmark 10-year Treasury note to as low as +2.239% intraday, before settling at +2.25%, its lowest level since June 28. German Bunds fell -3 bps to +0.52%, while U.K Gilts eased -1 bps to+1.19%.

Down-under, comments from Reserve Bank of Australia (RBA) Deputy Governor Debelle stating that the central bank was far from tightening its policy (differs from recent minutes) had yields under pressure. Australia's 10-year yield fell -4 bps to +2.70%, while the three-year yield fell -7 bps to +2.02%.

In Canada, bonds are likely to be more reactive to today’s release of CPI and retail sales figures given the Bank of Canada (BoC) recent emphasis on economic data.

4. Dollar under pressure from all sides

The EUR (€1.1645) continues where it left off yesterday, trading atop its two-year high outright and eight-month high against sterling (€0.8973). In yesterday’s ECB’s press conference, Draghi failed to communicate any unwanted deflationary implications of EUR strength. Also providing support is the markets fixation that the ECB will announce its plan to taper or recalibrate its stimulus at the September 7 meet.

The ‘big’ dollar is broadly weaker versus G20 pairs on concerns about the U.S Trump administration, while the pound (£1.2995) is struggling on worries about lack of progress in Brexit talks.

Elsewhere, the AUD at one point tumbled -0.7% overnight to A$0.7880 after RBA commented on “neutral” interest rate (see below).

5. Comments from the Reserve Bank of Australia (RBA) Deputy Governor

Overnight, RBA Deputy Governor Debelle has cleared up any confusion around the central bank’s communication this week.

The AUD had surged after the release of the July minutes on Tuesday – the publication of the RBA’s thinking on the “neutral” cash rate suggested, to some, that Aussie policy makers thought that the current level of official interest rates were too low, and needed to rise soon.

Debelle insisted that that there was “no” significance to the discussion contained in the RBA’s minutes. The discussion was merely procedural. He also said there is nothing compelling the RBA to follow other central banks in hiking interest rates. The RBA makes policy based on domestic fundamentals.

Net result, the RBA seemingly regrets making that discussion public and is a strong sign that it was unhappy with the tightening in financial conditions.

Note: Governor Philip Lowe is due to speak next week.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.