Put Your Cash to Work in These 3 High-Performing REITs

Zacks Investment Research | Nov 23, 2021 07:26AM ET

While there has been a large focus on growth stocks this year, real estate investment trusts (REITs) continue to be a great way to balance your portfolio while gaining exposure to the real estate sector. Adding these income-producing investments can result in significant advantages over traditional real estate investing including increased liquidity, greater diversification, tax benefits and potentially higher returns with lower risk.

Real estate investment trusts either own or manage income-producing real estate, normally through directly investing in properties or the mortgages on those properties. The IRS mandates that REITs must pay out 90% of their taxable income to shareholders. This typically translates into much higher dividends than your average S&P 500 stock. One of the best ways to increase returns when investing in REITs is to compound the dividends received. Investors may also choose to utilize a Dividend Reinvestment Plan (DRIP), which automatically reinvests the dividends received into additional shares.

Investors have the option to buy REITs directly, or may choose to further diversify by investing in REIT ETFs or mutual funds. The iShares Cohen & Steers REIT ETF ICF boasts a Zacks ETF #1 ranking (Strong Buy) and has outperformed the broader market this year with a nearly 32% YTD return.

REITs not only offer above-average yields, but also the potential for future price appreciation. With interest rates historically low for many years, investors have turned to vehicles like REITs when searching for ways to increase yield. But given the recent chatter surrounding future interest rate increases, a potential issue for REIT investors is their sensitivity to interest rates. Let’s take a look from a historical perspective to see what we can learn regarding REIT performance during periods of interest rate increases.

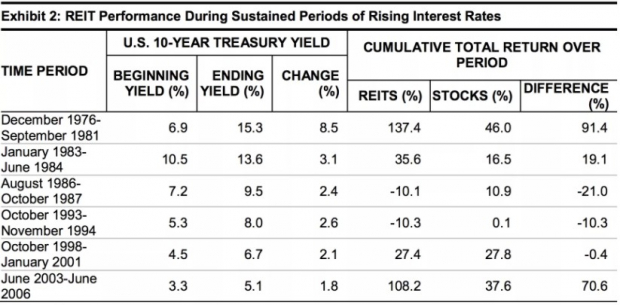

The table below illustrates six different historical periods beginning in the 1970s during which interest rates rose, measured by the 10-year treasury yield. During these times of increasing rates, the table compares the cumulative total returns over each period for both REITs and U.S. stocks.

The table shows that out of the six different periods, REITs generated positive returns in four of them, while outpacing the general stock market in three of the cases. This study shows that a rising interest rate environment does not translate to lower REIT prices. This is mainly due to the fact that during economic expansions, the value of the underlying real estate increases.

While REIT prices may react in the short-term to changes in the outlook for interest rates, over longer periods there is typically a positive correlation between rising rates and REIT returns. A stronger economic backdrop normally leads to higher occupancy rates, increased NOI (net operating income), and expanding property values. All of these components lead to higher dividend payments for REIT investors.

Now that we’ve established REITs can outperform even in rising rate environments, let’s take a look at three REITs with a healthy outlook that are outperforming the broader market.

Extra Space Storage (NYSE:EXR) (EXR)

EXR is the largest self-storage management company in the United States. Headquartered in Salt Lake City, the company is a fully integrated, self-administered REIT which owns and operates self-storage properties. These properties are comprised of many units and millions of square feet of rentable storage space.

Maintaining a Zacks #2 Buy ranking, we can see below that EXR has a strong history of EPS surprises. It most recently reported earnings in October for the prior quarter of $1.85, representing an 8.2% surprise over consensus.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Zacks Investment Research

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.