Proxy Bitcoin ETFs In The U.S. Killing Grayscale Premium

Crypto Briefing | Mar 04, 2021 04:30AM ET

The availability of Bitcoin ETFs in Canada is dissolving the Grayscale premium.

Key Takeaways

- Canadian Purpose Bitcoin ETF - CAD ETF Non-Currency Hedged Units (TSX:BTCCb) by Purpose Investments added $600 million Bitcoin since launch in mid-February.

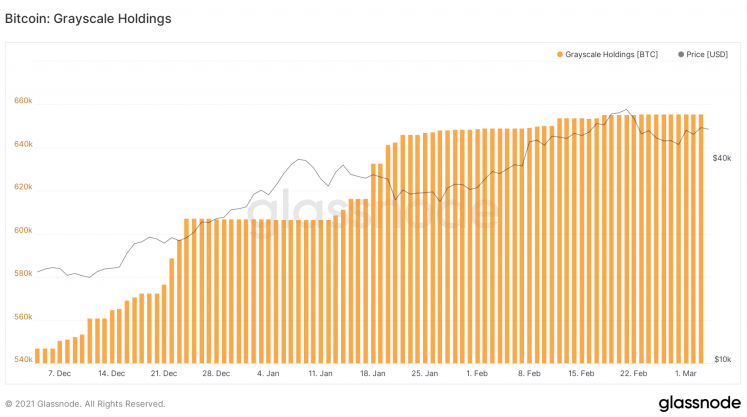

- Grayscale's Bitcoin Investment Trust (GBTC) saw a significant drop in inflows from January and compared to the total unlocking in February.

- As Grayscale's (GBTC) premiums slide into negative territory, J. P. Morgan's analyst cites profit booking and competition as the primary reasons.

Two Bitcoin ETFs in Canada by Purpose Investments and 3iQ added a total of 10,700.9033 BTC in February, more than two-thirds of Grayscale’s monthly inflow.

Canadian Firms Add Bitcoin Faster Than Grayscale

Grayscale is losing the number one spot as the most popular Bitcoin investment product for institutional investors.

The GBTC trust saw a net inflow of 6,599.9 BTC in February, as measured by Glassnode. The inflow was significantly less—about 85 %—than the previous month when the fund added 41,568 BTC.

In comparison, Purpose’s Bitcoin treasury added 10,215.9033 BTC last month. Canada’s securities regulator cleared Purpose Investment to launch the Bitcoin ETF product on Feb. 12. The stock tickers for the investment products are BTCC.U CN (denominated in USD) and unhedged Canadian dollar BTCC.C CN.

The second Bitcoin ETF by the 3iQ fund saw an inflow of 485 Bitcoins, following the addition of 4,889.9 BTC in January.

Evolve Funds has already procured approval from the securities regulatory with Horizons ETFs’ application still pending.

A “Premium” Issue

According to J.P. Morgan’s analysis shared by media outlet The Block, the Canadian Bitcoin ETF is one of the two reasons behind a Grayscale premium drop.

The second reason is profit-booking by investors after the end of the six-month lock-up period. The inflows in August 2020, six-months prior to February, were around 31,900 BTC, according to data from Bybt. The fund, in turn, only added around 6,600 BTC.

In their earlier report in January, the investment bank had stated that the introduction of an ETF in the U.S. would eat into GBTC’s premium and cause a downturn in Bitcoin’s price. J. P. Morgan’s analyst added this week:

Get The News You Want

Read market moving news with a personalized feed of stocks you care about.Get The App“We had also argued that erosion of GBTC inflows and a collapse of its premium would likely have negative near-term implications for bitcoin markets given the flow and signalling importance of GBTC.”

Grayscale’s premium in crypto trust shares is driven by demand from investors on professional brokerages like Fidelity, Charles Schwab, TD Ameritrade, and others. The new Bitcoin ETFs do not come with a lock-in period. Thus, the supply of these products is not limited to the issuance of GBTC shares.

The premium for GBTC slid negative yesterday and is currently below the fund’s annual management fee of 2%—effectively a negative premium—at 1.82%.

Given that arbitrage opportunities drove institutional investment, the reduced premium alternates as cause and effect, starting to hurt the demand due to the reduced intensity of the “Grayscale effect.”

Original Post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.