Prepare For Uncertainty With These "Quality" ETFs

Zacks Investment Research | Dec 05, 2016 11:14PM ET

The month of December is meaningful for investors in many ways. After an unsuccessful constitutional referendum in Italy, the month is highly likely to see the sole Fed rate hike of this year and will continue to mull over how effective and prolonged the Trump rally will be in the U.S. market (read: 2017 budget in the coming days.

With this, market watchers expect political uncertainty and the likelihood of an early election in Italy. The anti-referendum movement was led by the anti-establishment Five Star Movement party commanded by Beppe Grillo. And if Grillo wins in an early election, he might dump euro, reintroduce the Italian lira and call for a situation like Brexit (read: UK Votes for Brexit: ETFs Winners & Losers ).

Asset Classes Losers

Such a threat was strong enough to send the common currency Euro to a Short the Euro with These ETFs ).

Coming to inverse equity exposure, investors can play ProShares Short MSCI EAFE over 60% exposure to European stocks.

Though investors have not yet reacted that negatively to the defeat of the Italian government as evident from 0.8% gains in EWI on December 5, the coming days could be choppy. Already, shares of Italian banks took a hit on the vote.

Global markets also stayed stable with all-world ETF iShares MSCI ACWI ACWI adding 0.7% on December 5, the U.S. gauge SPDR S&P 500 ETF (NYSE:SPY) advancing 0.6% and Europe ETF Vanguard FTSE Europe ETF (VGK) tacking on 1.55% gains.

Notably, this year's fastest growth rate in Euro zone business activity in November explains VGK’s unexpected gains that ignored the likely threats from the Italian referendum. Analysts are of view that investors may have probably taken Italian risks lightly as nothing horrid is less likely to happen in the near term.

Still, investors not wanting to expose themselves to market risks may choose to play quality ETFs. This is especially true given the likely Fed rate hike this month and probable talks of faster policy tightening which may cause a crash in global markets. Below we highlight a few quality ETF options.

Quality ETFs in Focus

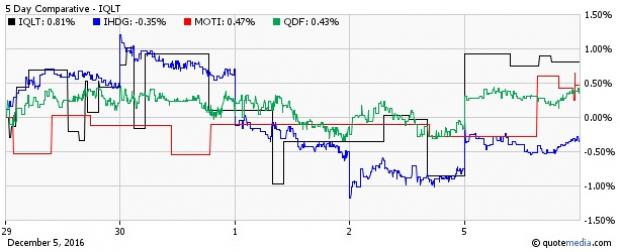

iShares Edge MSCI International Quality Factor ETF IQLT

The 285-stock fund gives exposure to large- and mid-cap developed international stocks with positive fundamentals like high return on equity, steady year-over-year earnings growth and low financial leverage. No stock accounts for more than 3.47% of the portfolio.

The $19.35-million fund is heavy on UK (19.36%), Switzerland (13.3%) and Japan (12.45%). France (8.85%), Germany (8.36%) and Canada (8.15%) round out the next three spots. Financials (22.82%) is the top sector of the fund followed by Industrials (13.83%) and Consumer Discretionary (11.68%). It charges 30 bps in fees.

WisdomTree International Hedged Quality Dividend Growth Fund IHDG

With the Fed preparing for policy tightening in the near term and most other developed economies pursuing easy money policies, a currency-hedged approach would be intriguing to set off the effect of a surging greenback.

IHDG serves this purpose. Moreover, IHDG takes care of investors’ income as the fund selects dividend-paying companies with growth features in the developed world ex U.S. and Canada. This Zacks ETF Rank #3 (Hold) ETF charges 58 bps in fees. UK (18.54%), Switzerland (11.96%), Japan (11.33%) and the Netherlands (11.02%) take the first four positions in the fund (see all Broad Developed World ETFs here).

FlexShares Quality Dividend ETF QDF

Investors fearing the spillover of the Italian referendum debacle to the U.S. shore can consider this U.S. quality ETF too. QDF here uses a proprietary model that includes factors like profitability, management efficiency and cash flow. The fund looks to provide exposure to the growth potential of U.S. securities that offer dividends as well. The fund yields 2.93% annually while it charges 37 bps in fees (read: Trump Rally to Wane? Buy These Quality ETFs ).

VanEck Vectors Morningstar Intl Moat ETFMOTI

The fund gives exposure to global quality stocks that Morningstar believes have sustainable competitive advantages. Australia (20.9%), China (12.4%) and Singapore (9.6%) get considerable focus in the fund. The 75-stock fund charges 56 bps in fees.

Want key ETF info delivered straight to your inbox?

Zacks’ free Fund Newsletter will brief you on top news and analysis, as well as top-performing ETFs, each week. Zacks Investment Research

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.