Preferred Stocks: 8 Easy Ways To 6%-7% Yields

Contrarian Outlook | May 10, 2019 06:35AM ET

As investors near retirement, they tend to favor bonds, which provide income and less drama than stocks. However, less drama means less potential upside. With retirees living longer than ever before—which means much more time for inflation to eat away at your nest egg’s purchasing power—it’s important to not go too conservative too early in life. And fortunately, today even 65 or 70 may be too early.

One suggested solution for our long life expectancy “problem” is to stay with stocks longer. But stocks can go down as well as up, and a big pullback can inflict permanent damage on a portfolio.

So we want to capture the dividends that stocks pay and the upside potential that they provide by minimizing our downside risk. We can do this by focusing on hybrid stock/bond vehicles that are designed to extract payouts and provide downside buffers. Let’s focus on an underappreciated way to double your dividends from stocks that you may already own: preferred shares.

Not familiar with preferred shares? You’re not alone—most investors only consider “common” shares of stock when they look for income. You probably know the problem with this approach. Common stock in S&P 500 companies pays just 1.9% today, on average. But you can double your yields or better and actually reduce your risk by trading in your common shares for preferreds.

A company will issue preferred shares to raise capital, just as it offers bonds. In return it will pay regular dividends on these shares and, as the name suggests, preferred shareholders receive their payouts before common shares.

They typically get paid more, and even have a priority claim over common stock on the company’s earnings and assets in case something bad happens, like bankruptcy. They are “preferred” over common stock, and after secured debt, in the bankruptcy pecking order.

So far, so good. The tradeoff? Less upside. But in today’s expensive stock market—still pricey even after the late 2018 correction—that may not be a bad substitution to make. Let’s walk through a sample common-for-preferred exchange that would nearly double your current dividends with a simple trade-in.

As I write, the common shares from JPMorgan (NYSE:JPM) pay 2.8%. But the firm recently issued Series DD preferreds paying 5.75%. JPMorgan shareholders looking for more income may be happy to make this tradeoff.

Meanwhile, Bank of America (NYSE:BAC) common pays 2% today. But B of A just issued some preferreds that pay a fat 5.88%. That’s a 194% potential income raise for shareholders who want to trade in their garden-variety shares. But how exactly do we buy these as individual investors? Which series are we looking for again?

A big problem with preferred shares is that they are complicated to purchase without the help of a human broker. So, many investors attempt to streamline their online buys and simply purchase ETFs (exchange-traded funds) that specialize in preferreds, such as the PowerShares Preferred Portfolio (NYSE:PGX) and the iShares S&P Preferred Stock Index Fund (NASDAQ:PFF).

After all, these funds pay up to 5.9% and, in theory, they diversify your credit risk. Unfortunately, many ETF buyers have little understanding of preferred shares—let alone how a particular fund invests in them. Should we entrust the selection of preferred shares to a mere formula baked into an ETF?

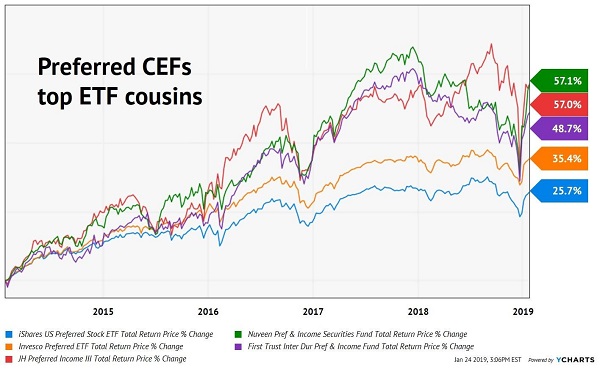

No! The problem with the ETF model is that it doesn’t account for credit risk as accurately as an expert human can. Which means a better idea is—you guessed it!—to find an active manager to handpick your preferred your portfolio. Buying a discounted closed-end fund (CEF) is the best way to do this. Here are three preferred CEFs that have all outperformed their more popular ETF cousins over the past five years.

You’ll rarely get a deal buying an ETF. They don’t trade at discounts because their sponsors simply issue more shares to capitalize on any increased demand. We CEF investors don’t have this popularity problem; we can get a deal. We simply wait and only purchase CEFs when they trade at a discount to their net asset values (or the sum of the market prices of the preferred shares they own minus any leverage).

The preferred ETFs, Invesco Preferred and iShares US Preferred, trade at their “par” value, which means we’re paying $1 for $1 in preferred shares. Meanwhile, Nuveen Preferred & Income Securities Fund (NYSE:JPS), a CEF, yields more (7.3%) and trades for just 96 cents on the dollar! Plus, it has the benefit of an active manager, which is why the fund regularly outperforms its ETF counterparts

When we’re shopping in the preferred aisle, it’s a “no brainer” to go with the CEF concierge service. They yield more, they appreciate in price more, and best of all, the money manager is free when we buy at a discount.

Now let’s walk through three more preferred funds so that you can appreciate the benefit of the former and pick up additional preferred ideas to boot.

VanEck Vectors Preferred Securities ex Financials ETF (NYSE:PFXF)

Dividend Yield: 6.0%

Expenses: 0.41%

My preference for preferreds is closed-end funds , where active management can sniff out quality issues and bargain-priced stocks, juicing yields and delivering far better performance than the PFF.

But some investors prioritize low costs and simple indexing. For those investors, one ETF stands head-and-shoulders above the rest : the VanEck Vectors Preferred Securities ex Financials ETF (PFXF).

Many preferred-stock funds are heavily weighted in the preferreds of financial companies such as banks and insurers. PFF, for instance, has roughly two-thirds of its portfolio invested in various financial-sector preferreds from the likes of Bank of America (BAC), Citigroup (NYSE:C) and Ally Finanical (NYSE:ALLY).

Financial stocks were slaughtered during the 2007-09 financial crisis and bear market, however, and their preferreds were no exception. So when America began to re-emerge, fund providers began offering products that excluded the financial sector, including VanEck’s PFXF.

PFXF holds a portfolio of more than 110 preferred shares outside of the financial sector, leaning instead toward areas such as electric utilities (34%), REITs (25%) and telecom (12%). The result is a portfolio that has outperformed PFF over every significant time period, and that tends to outperform most of its competitors. Better still, it also always tends to yield slightly more than PFF, and it’s also the second-cheapest ETF in the preferred space.

If you insist on holding preferreds via an ETF, this is the one.

John Hancock Preferred Income (NYSE:HPI)

Dividend Yield: 7.3%

Expenses: 2.48%

John Hancock Preferred Income (HPI) is more my speed – a closed-end fund that relies on skilled managers to be the difference-maker between it and index funds that blindly invest in whatever their rules mandate they buy. The fund is led by Joseph Bozoyan and Brad Lutz, who only have a combined six years with HPI … but more than a half-century of experience between the two.

HPI focuses on traditional preferred stocks, as well as preferred convertible securities, the latter of which can be “converted” into common shares at a certain date in the future. The CEF’s aim is to invest at least half its assets in investment-grade preferreds, and right now, about two-thirds of the fund meets that bar. The majority of its portfolio (62%) is in BBB – the lowest tier of investment-grade preferreds. Like most preferred funds, it does have a hefty chunk of its assets (39%) dedicated to financials, though that’s lower than what you’ll find in most index ETFs. Its top holdings are mostly electric utilities and banks – Dominion Energy (NYSE:D), JPMorgan Chase (NYSE:JPM), Duke Energy (NYSE:DUK) and BB&T (NYSE:BBT), among others.

As is typically the case with closed-end funds, HBI typically is more volatile than a basic index fund, but it typically pays a higher yield, and the performance has simply been stellar by comparison. That’s thanks in part to savvy management, as well as the use of leverage (about 35%) to amplify the effect of Bozoyan’s and Lutz’s decisions.

Cohen & Steers Select Preferred and Income Fund (NYSE:PSF)

Dividend Yield: 7.4%

Expenses: 2.40%

Cohen & Steers is one of the premier names in income funds, so it’s little wonder that the Cohen & Steers Select Preferred and Income Fund (PSF) is such a standout performer.

Portfolio managers William Scapell and Elaine Zaharis-Nikas oversee a basket of 158 preferred stocks across a wide range of sectors, though financials are king. Banks make up 54% of the portfolio, and insurance is another 22%. All other sectors – such as utilities, pipelines and telecom – are relegated to single-digit weightings.

But where you do get a bit more diversification is geographically. Just less than half of the portfolio (47%) is invested in American preferreds, with significant holdings in the U.K. (13%), France (7%) and Japan (7%), among several other developed-market countries.

Here, the credit quality is a bit lower than HBI, with just about 52% of PSF’s holdings above investment-grade. Still, management has been able to do plenty with that, its geographical reach and about 30% leverage, roughly tripling the total returns of the PFF over the past five years.

How to Retire on an 8% Yield Paid Each and Every Month

The suits at Merrill Lynch say you need $738,400 to retire on. Several investment experts say the magic number is $1 million. Suze Orman, and I quote, says, “You need at least $5 million, or $6 million. Really, you might need $10 million.”

If you’re holed up in low-yielding bonds or “safe” blue-chip stocks with underwhelming yields, they’re right. But if you stockpile the picks in my “8% Monthly Payer Portfolio,” – including my two favorite preferred stock plays, which each deliver uber-safe yields of more than 7% – you can bank on a comfortable retirement with a mere $500,000 nest egg.

This substantial-dividend strategy can net you nearly $3,300 in payouts every month, from an average 7.6% annual yield. (Mind you, that doesn’t even include the roughly 10%-plus average upside in these winners that will expand your nest egg!)

There’s no strange options tactics or complex trading routine. You can live off a $500,000 portfolio indefinitely by following just two simple steps.

- Sell off your “buy and hope” portfolio: The financial media has pushed so-called “safe plays” like Procter & Gamble (NYSE:PG), Kraft (NASDAQ:KHC) and Coca-Cola (NYSE:KO) onto investors for years. But these companies don’t deliver the kind of yield you need to maintain your current quality of life in retirement.

- Buy my 8 favorite monthly dividend payers.

That’s all!

This portfolio includes some truly amazing dividend stocks, including …

- An 8.4% payer that’s set to rake in huge profits from an artificially depressed sector.

- The brainchild of one of the top fund managers on the planet that’s giving out generous 9.4% yields.

- A steady Eddie high-yielder that barely blinks when stocks plummet.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement ."

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.