Precious Metals Could Rebound But 200-DMA Resistance Looms Large

Jordan Roy-Byrne, CMT | Mar 20, 2017 01:10AM ET

The precious metals complex enjoyed a strong week mostly due to a post-Fed explosion on Wednesday. Although gold stocks sold off to end the week, they finished up almost 5% for the week. Gold gained 2.4% on the week while silver gained 2.9%. The miners enjoyed massive gains following the previous two rate hikes and that has some optimistic about a repeat scenario. However, the miners and metals need to prove they can recapture their 200-day moving averages before we become optimistic.

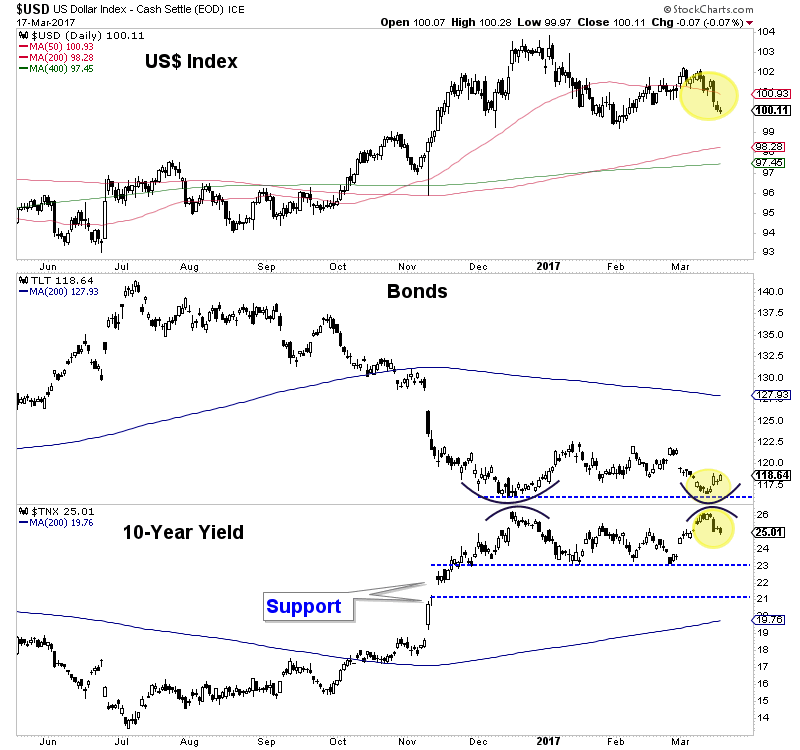

Precious metals should trend higher in the short-term if the current macro technical landscape does not change. The US Dollar index has fallen below its 50-day moving average and could fall another 2% to moving average support. Also, despite the Fed rate hike, the 10-year yield did not make a new high. Bonds could rebound and the huge speculative short position, if unwound could add to the rebound. A rally in bonds coupled with a weak US dollar would help precious metals.

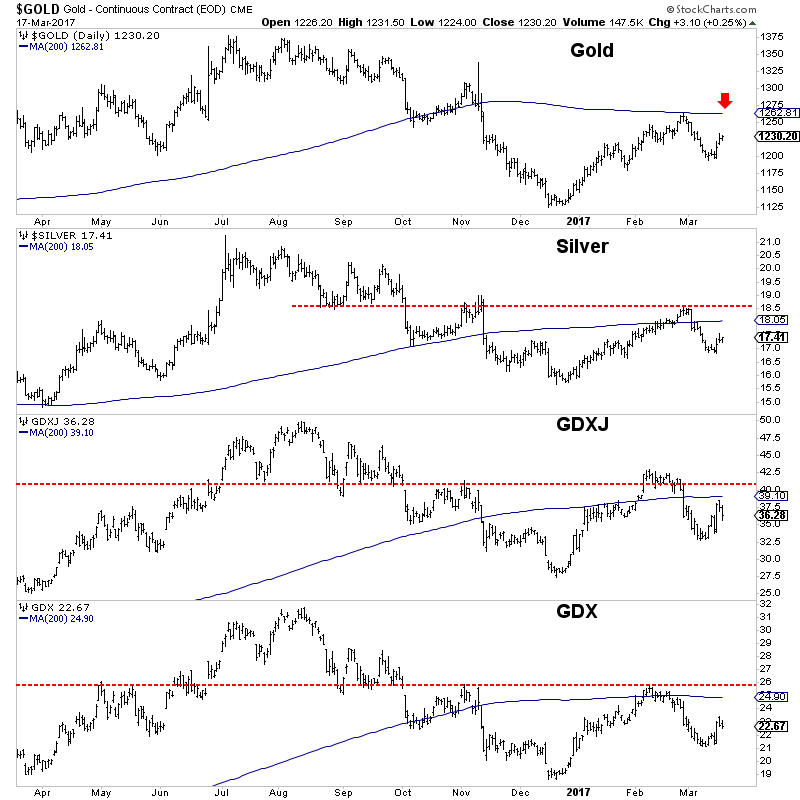

Precious metals could rebound farther but resistance in the form of the 200-day moving average looms large. In the chart below we plot gold, silver, VanEck Vectors Junior Gold Miners (NYSE:GDXJ) and VanEck Vectors Gold Miners (NYSE:GDX) along with their 200-day moving averages. In addition to the 200-day moving average, the February highs will also provide resistance. We should note, while the metals remained above their late January lows, the miners did not. It would not be a good sign to see a continued rally led by the metals rather than the miners.

We should see some upside follow through in precious metals if our read on the US dollar and bonds is correct but take note of February highs and 200-day moving averages as resistance. I would not be chasing any strength until the sector proves itself. The first step would be a return to the February highs. If this rally fades below those levels then miners are again at risk for a retest of the recent December lows. We continue to look for bargains that we can buy on weakness and hold into 2018.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.