Powell Steps Up Tomorrow, Coronavirus At Podium As Cautious Air Continues

TD Ameritrade | Feb 10, 2020 11:25AM ET

(Monday Market Open) And the award goes to… Fed Chairman Jerome Powell, who steps onto stage tomorrow to face two days in front of congressional committees. He doesn’t get a little statue for that, but anyone who can get through it without losing composure arguably deserves some recognition.

Powell’s walk on the Capitol’s red carpet is a semi-annual occurrence that can sometimes give investors a little insight into what the Fed is thinking. You never know which direction things might go with this kind of event, because it depends partly on what sort of questions he gets from committee members.

Though Powell’s testimony and a packed earnings schedule normally would be enough highlights for any week, the biggest focus remains coronavirus. It’s the overhang of every conversation, kind of like tariffs were last year. There are a lot of parallels, especially that they’re both unknowns and no one is sure if or when they’ll end. Every conversation from companies seems to end with, “We’re going to do this...unless of course the impact of coronavirus gets worse.”

At this point, it feels like we’re in a watchful waiting period, with people feeling hesitant to jump back in but also not too eager to unload shares as things remain up in the air. Volatility climbed a bit this morning while crude and 10-year yields stayed under pressure amid anxiety about the Chinese economy and the virus impact.

There’s some potential deal-making in the news today as Xerox (NYSE:XRX) raised its takeover bid for HP (NYSE:HPQ) to $24 from $22 in a mixed cash-stock offer. We talk so much about flashy newer Technology stocks, but here are a couple of old schoolers getting some attention. We’ll see where it goes.

The other thing that deserves attention this week is earnings season. There’s a ton of earnings coming at us, though many of them are secondary names and not the sexier ones. That said, some of them are going to be pretty important to watch, including Cisco (NASDAQ:CSCO), UnderArmour (NYSE:UAA), Nvidia (NASDAQ:NVDA), PepsiCo (NASDAQ:PEP), Kraft Heinz (NASDAQ:KHC), Alibaba (NYSE:BABA), Lyft (NASDAQ:LYFT) and Roku (NASDAQ:ROKU).

Inflation and retail sales data later this week also are probably going to get a close look from investors.

Profit-Taking Could Return As Virus Concerns Linger

Profit-taking hit the market again last Friday, and that might be something to keep in mind later this week as we approach the long holiday weekend. Markets are closed for President’s Day a week from today.Anxiety levels remain elevated around coronavirus, as anyone who’s glanced at 10-year yields or the Cboe Volatility Index (VIX) lately probably knows. One way people tend to deal with anxiety is selling some stocks and going away before a weekend, especially when it’s unclear what sort of virus news might scare investors when markets are closed. The weekend is still far away, so perhaps things could change if the virus situation improves.Selling mainly hit the cyclical sectors last Friday—including Information Technology as Apple (NASDAQ:AAPL) reportedly extended the closure of some of its China stores through Feb. 15. Meanwhile, defensive sectors like Consumer Staples and Utilities outperformed, Briefing.com pointed out.Bonds also rallied, pushing the 10-year yield back below 1.6%, where it remains this morning. The VIX starts the week at 16, which is elevated relative to last month’s lows near 12 but isn’t historically high by any stretch of the imagination. And if you're looking for more evidence of an uptick in caution, crude oil futures (CL) dipped below the psychologically significant $50 a barrel level in the early hours Monday.

Virus Still A Weight, But Fed Sounds Optimistic Note

For now, the virus is probably the main thing that could derail the market. Anyone thinking about making trades should consider a day-to-day game plan at least for the next couple of weeks, because things could move sharply based on virus news on any given day. If we don’t have any major outbreaks in the next two weeks or so, investors might come to believe that all is clear and worry about something else. However, there’s no guarantee the situation won’t last longer.

One sector that could feel the virus bearing down is Consumer Discretionary, but not necessarily every big company there. The ones that did a better job the last few years expanding and refining their online business might handle any virus-related disruptions better, putting some leaders in a big lead and laggards in a bigger lag. In other words, the gap we’re already seeing in the sector could continue to grow.

The Fed weighed in on the economy Friday as part of its semiannual report to Congress, saying that risks of weaker-than-expected U.S. growth declined late last year, but also noting that virus represents a new risk to its outlook. In the report, the Fed noted “tentative signs of stabilization” in the economy, and added that “the global slowdown in manufacturing and trade appears to be nearing an end, and consumer spending and services activity around the world continue to hold up.”

The Fed also said the labor market is providing more than enough jobs to absorb new people coming into the workforce. Jobs growth of 225,000 in January, which was way above analysts’ expectations, appeared to reinforce the Fed’s mostly sunny forecast (see more below).

https://tickertapecdn.tdameritrade.com/assets/images/pages/md/labor-participation-jan-2020-fred.jpg 800w" media="(min-width: 36em)" sizes="(min-width: 36em) 33.3vw, 100vw" />

https://tickertapecdn.tdameritrade.com/assets/images/pages/xs/labor-participation-jan-2020-fred.jpg 2x" />

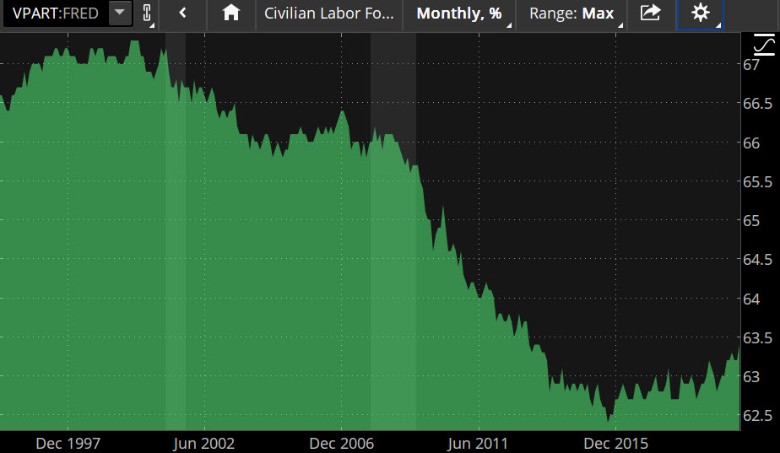

CHART OF THE DAY: PARTICIPATION TROPHY. It's been 20 years since the civilian labor force participation rate hit the postwar high of 67.3%, and it's been mostly downhill since then. But since making a new low of 62.4% in Sept. 2015, the rate has been grinding higher. And Friday's jobs data saw an extension of the uptrend in labor participation. Data source: Federal Reserve's FRED database. Chart source: The thinkorswim® platform from TD Ameritrade. FRED® is a registered trademark of the Federal Reserve Bank of St. Louis. The Federal Reserve Bank of St. Louis does not sponsor or endorse and is not affiliated with TD Ameritrade. For illustrative purposes only. Past performance does not guarantee future results.

U.S. trade deficit shrinks: That’s a first in six years. Data released last week showed the overall U.S. trade deficits in goods and services down by 1.7% from a year ago in December, with exports and imports registering a decline. One of the biggest contributors was the reduction of crude oil imports to the U.S.— mainly due to increased domestic production. Although one data point does not a trend make, it’s still an encouraging sign, especially if you focus on China. The overall goods trade deficit with China declined by 17.6%.

With trade tensions between the U.S. and China easing after the signing of the phase one deal, the trade deficit could continue to shrink, although the coronavirus outbreak could skew it to some extent. A shrinking trade deficit could be encouraging for the U.S. dollar. Although other variables can impact the greenback’s value, it’s possible there may be an uptick in U.S. dollar demand, which could give the dollar a boost in value. Something to keep on your radar as the U.S. Dollar Index (DXY) has been moving higher in recent days.

Technical Road Map for SPX: If there’s anything good you can say about the market’s temporary tanking in late January, it’s that at least it gives us some technical road signs moving forward. When major indices are at all-time highs and keep making new ones nearly every day as they did early last month, it can feel like working without a net. The major moving averages were way below current levels, so any sharp daily loss can feel like a swift ride down without knowing where support might come in. Now there’s conceivably a little more natural support under the market at recent lows, which for the S&P 500 Index (SPX) ended up being 3214 posted intraday on Jan. 31.

What’s interesting about 3214 is that it corresponds perfectly with another 3214 low from Jan. 6 down to the decimal points. In late December, another intraday low of 3212 also stands out. So it seems fair to say we now have a possible support area down at the 3210–3215 level, while the psychological 3300 mark also could be one to watch on any dip. If you’re wondering about the 50-day moving average—sometimes seen as a key technical point—it’s still way below current levels at 3231.

Second Look at Jobs Data: It was hard not to like last Friday’s jobs report. One particularly encouraging thing was seeing labor force participation grow (see chart above). With more people out looking for jobs, the unemployment rate rose a notch to 3.6%, but that could actually be seen as good news. The official rate doesn’t count people who’ve given up looking for work. It’s great to see that people have hope and want to get back out there into the workforce.

One talking point after the report was the continued slump in manufacturing jobs. That’s probably worth noting, but remember that the transportation sector added 28,000 new jobs in January. Why does that matter? Because it suggests the manufacturing downturn is somewhat contained. If manufacturing was really going through rough times, that might start to hit the trade and delivery of goods. So far it doesn’t appear to be, but it’s something to consider tracking in future reports. Sometimes you can get clues about one sector from looking at another.

Good Trading

TD Ameritrade® commentary for educational purposes only. Member SIPC. Options involve risks and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options .

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.