Pound Rebounds Ahead Of Busy Week; US Retail Sales In The Spotlight

XM Group | Jul 16, 2018 04:05AM ET

Here are the latest developments in global markets:

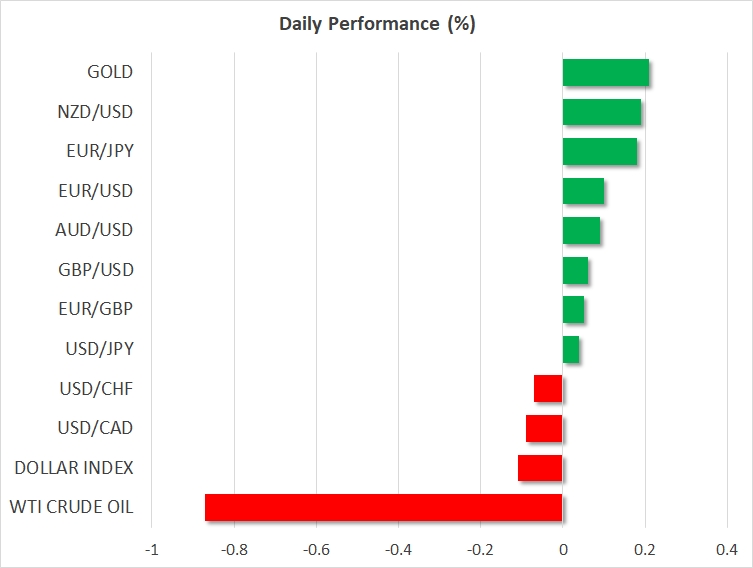

- FOREX: The US dollar index is down by 0.1% on Monday, extending the losses it posted in the previous session as longer-term US Treasury yields tumbled. The Japanese yen, meanwhile, is slightly lower against all its major counterparts on Monday, amid a lack of escalation in trade tensions.

- STOCKS: US markets closed higher on Friday, as trade concerns remained out of the spotlight. The Dow Jones led the way up, gaining 0.38%, while the S&P 500 advanced by 0.11% to reach a new five-month high. Meanwhile, although the Nasdaq Composite rose only by 0.026%, that was still enough for the tech-heavy index to post a fresh all-time high. The positive sentiment appears to have remained in place, as futures tracking the Dow, S&P, and Nasdaq 100 are currently signaling a higher open today. Indices in Asia, however, were a sea of red, following a mixed batch of data out of China overnight. In Hong Kong, the Hang Seng dropped by 0.14%, while in South Korea, the KOSPI 200 was down by 0.43%. Japanese markets remained closed for a public holiday. Meanwhile in Europe, futures suggest most major indices are set to open lower today, albeit not significantly so.

- COMMODITIES: Oil prices are lower on Monday, with WTI crude oil and Brent being down by 0.88% and 0.97% respectively. Note that on Friday, media reports hit the wires that the Trump administration is considering releasing oil from the US strategic petroleum reserves to offset high prices. These reserves are an emergency supply the US implemented back in 1975 to mitigate any future supply shocks. Any official confirmation the US is considering such a course of action could spell further trouble for oil prices. In precious metals, gold is up by 0.21% on Monday, currently trading near $1,243 per troy ounce. The yellow metal posted a fresh low for 2018 on Friday, briefly touching the $1,236 mark on the back of an appreciating dollar, before it rebounded in the subsequent hours as the greenback retreated.

Major movers: Sterling rebounds, yen remains under pressure

The British pound was once again in the spotlight on Friday. Whereas the currency tumbled early during the session on reports US President Trump “shot down” the prospect of a US-UK trade deal, it recovered all its losses during the European afternoon to finish the day higher against its major peers. The rebound came as Trump and UK PM Theresa May held a joint press conference, where the US President refuted the media reports – characterizing them as “fake news” – and keeping the option of a US-UK trade deal firmly on the table.

This week promises to be particularly interesting for the pound, amid a raft of crucial data releases that could seal the deal for a BoE rate increase at the August meeting, a prospect currently priced in with a 73% probability according to UK OIS. Besides monetary policy, the other driver for sterling will be the EU’s response to the UK Brexit White Paper. In particular, investors will look at whether the EU negotiators will reject the plan as “unworkable,” hence sending the talks back to square one, or whether they’ll acknowledge it’s a position for negotiating and come back with counterproposals. The next remarks from EU chief negotiator Michel Barnier will likely provide a taste of what’s to come.

The dollar index reversed course on Friday, paring the gains it posted early in the session to finish the day lower overall. There was little in the way of news flow, so the move appears to be owed primarily to a tumble in longer-term US Treasury yields.

The yen, meanwhile, remains on the back foot. It’s lower on Monday against all its major counterparts, with euro/yen and sterling/yen touching fresh 10-week and seven-week highs respectively. Risk appetite stayed firm on Friday, amid speculation that the next step in the US-China trade standoff may be another round of negotiations.

Overnight, China’s quarterly GDP data for Q2 were mixed. Whereas GDP growth was stronger-than-anticipated in quarterly terms, it slowed down in line with consensus expectations on a yearly basis. Retail sales and fixed asset investment were in line with their forecasts in June, while industrial production disappointed.

Day ahead: US retail sales due; Trump-Putin meeting and UK Brexit vote on the agenda as well

US retail sales are gathering most interest out of Monday’s releases. In the meantime, a Trump-Putin meeting is on the agenda, while lawmakers in the UK will be voting on amendments to legislation on the government’s post-Brexit customs relationship with the EU.

The US will be on the receiving end of retail sales data for June at 1230 GMT. Sales are anticipated to grow by 0.5% m/m, a weaker pace relative to May’s 0.8% which constituted the largest gain since November 2017 and added to views for robust US economic growth during Q2. Additionally, core retail sales, this being the measure of sales that excludes automobiles and which more closely aligns with the consumer spending component of GDP, are projected to expand by 0.4% on a monthly basis, again reflecting a slowdown compared to May’s 0.9%. Fed funds futures currently project a 54% probability for two additional rate hikes by the US central bank during 2018. Stronger-than-expected retail sales readings today have the potential to more conclusively put on the table a second rate increase – something which would put the total number of hikes for 2018 to four – consequently boosting the greenback.

Data on retail control, as well as July’s New York Fed manufacturing survey will be made public alongside retail sales numbers, while figures on May’s business inventories are due out of the world’s largest economy at 1400 GMT.

During today’s UK vote, “Brexiteers” are set to support amendments promoting a harder Brexit, against PM Theresa May’s plan for closer alignment with the EU. May is not expected to be defeated on the amendments, though rising differences with fellow Conservatives may add to political uncertainty, casting fresh doubts on her leadership.

An EU-China Summit is underway in Beijing. Among the EU representatives are the President of the European Council Donald Tusk and the President of the European Commission Jean-Claude Juncker. Among others, they will be meeting the Chinese President Xi Jinping, who will also be seeing World Bank President Jim Yong Kim.

Meanwhile, President Trump’s meeting with his Russian counterpart Vladimir Putin in Helsinki today will be closely watched.

In equities, Bank of America (NYSE:BAC) and BlackRock will be reporting quarterly earnings before the US market open, with Netflix’s respective report hitting the markets after the closing bell on Wall Street.

Technical Analysis: USD/JPY bullish bias eases

USD/JPY has declined a bit after touching a six-month high of 112.79 on Friday. The Tenkan-sen remains above the Kijun-sen line, this supporting the case for a bullish bias, though the two lines have flatlined. The latter is an indication that positive momentum has eased. Fresh catalysts such as today’s retails sales release out of the US can push the momentum in either direction.

Better-than-expected retail sales prints are likely to generate buying interest for USD/JPY. Immediate resistance seems to be taking place around the current level of the Tenkan-sen at 112.49. Further above, the attention would turn to the region around last week’s six-week high of 112.79, including the 113 round figure.

On the downside and in case of weaker-than-anticipated readings, support may come from the zone around the middle Bollinger line® – a 20-period moving average line – at 112.20, including the 112 handle. Sharper losses would shift the focus to 111.78, this being the current level of the Kijun-sen.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.