Post-Midterm Days Spell Good Time For Stocks: 5 Picks

Zacks Investment Research | Nov 06, 2018 09:36PM ET

Traditionally, the stock market tends to rise after a midterm election irrespective of the outcome. In fact, in the current situation where the Democrats have taken control of the House of Representatives while GOP retained the Senate, stocks are poised to perform even better. To top it, the U.S. economy is in sound shape and trade war fears have somewhat subsided.

Given such bullishness, investing in sound stocks that can make the most of the current scenario seems prudent.

After Midterms, Stocks Could Jump 20%

According to The Goldman Sachs Group, Inc. (NYSE:GS) , the S&P 500’s returns on an average has always improved in November especially after midterms, according to data going back to 1970. This has aided the month of November to generate a return of 1.09% during a presidential election, slightly more than 1.08% generated during November in an off year.

The current split Congress, in fact, further bodes well for the stock markets’ return in the near future. In the present situation, where Democrats control the House and Republicans’ the Senate, the S&P 500 is widely expected to gain 20% on an average in the following one year period. Meanwhile, if Republicans had won the House and Democrats the Senate, then the S&P 500 was anticipated to gain a meagre 3%.

However, if we still ignore the outcome, the equity market is widely expected to gain momentum post-midterm. Per S&P Capital IQ, the S&P 500 has increased on average 15.3% in the six months following midterm election in the third year of a given presidency, which is incidentally this year. The research also showed that the frequency of advance (FoA) for this occurrence was 94% of the overall time period of Oct 31, 1944-Sep 29, 2014.

(Source: S&P Capital IQ)

Stephen McBride, the editor of RiskHedge report, also chipped in and said that stocks have climbed an average of 17% in the year after a midterm election since 1946. McBride too acknowledged that it’s the third year of a presidential term and historically the strongest year for the stock market.

The stock market, by the way, historically gains in the November-through-May period or the so-called “winter” months, while markets have been more or less flat during the “summer” months (May-October). For instance, the Dow Jones has registered an average gain of 7.5% during the November-April period, while the blue-chip index yielded a meager 0.3% in the May-October period.

Healthy Economic Growth, Positive U.S.-China Trade Talks

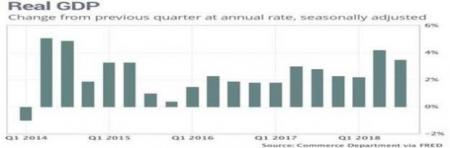

But, why just rely on historic trends? The U.S. economy is doing well and that should eventually help the stock market gain traction. In the last two quarters, the U.S. economy recorded the fastest six-month growth in four years and is on track to hit the Trump administration’s annual growth target of 3%. If that happens, it would be the best yearly performance since 2005, two years before the Great Recession.

The U.S. economy got a boost in the third quarter, with GDP increasing at an annualized pace of 3.5%, per the U.S. Commerce Department. In fact, the country’s total output of goods and services followed an even stronger 4.2% growth in the second quarter.

On the geopolitical front things are looking up as well. Trump recently had a “very good conversation” with President Xi Jinping of China. Trump tweeted that trade discussions with China were “moving along nicely” ahead of face-to-face talks between the two superpowers at the G20 summit in Argentina later this month. Beijing, in response, said that they are also ready for talks with the US to resolve trade issues. Needless to say, the United States and China have been involved in a tit-for-tat trade clash for a pretty long time, which could have derailed economic growth in the near term.

5 Top Picks

With markets all set to climb north after midterms and economic growth on track for a mind-boggling year, investing in solid growth stocks seems prudent at the moment.

With the help of our new Zacks Investment Research

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.