Positive Sentiment For Gold Appears To Be Returning

Anna Coulling | Nov 13, 2012 07:48AM ET

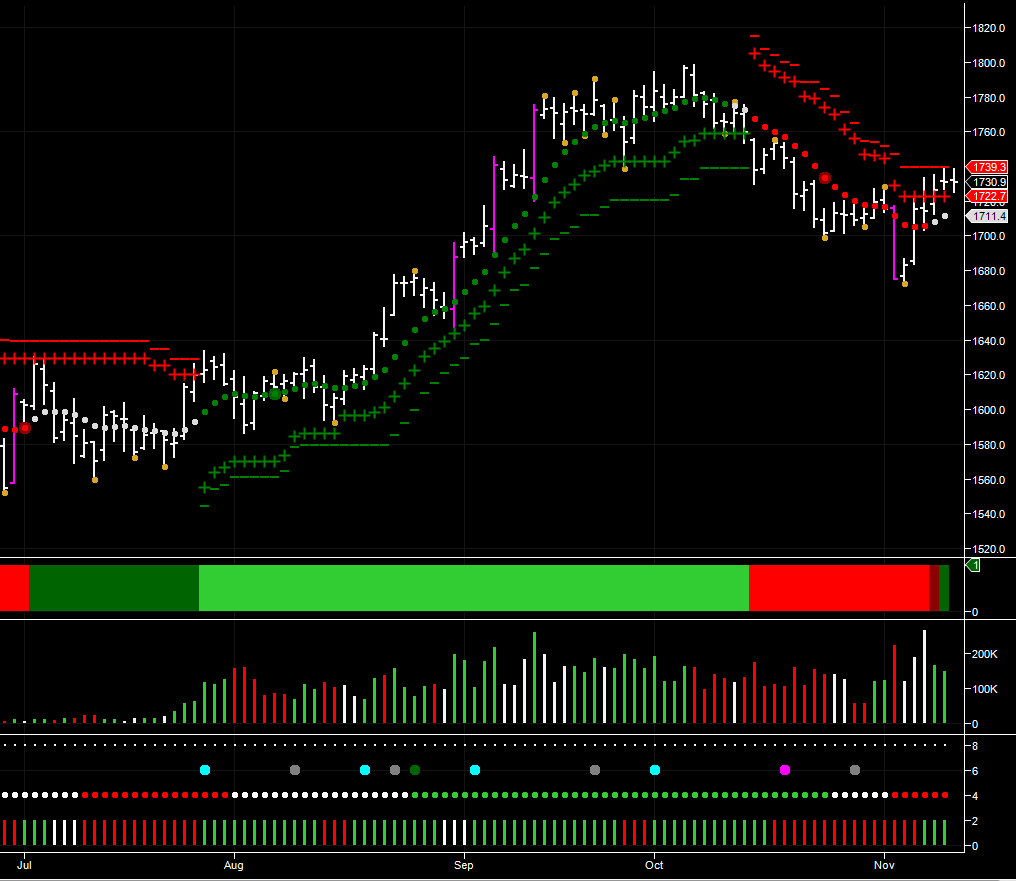

Some interesting changes in the gold trend over the last few days following the sharp move lower earlier in the month, which sent gold futures below the psychological $1700 per ounce level to test the $1675 per ounce region. This is duly signaled on the daily chart with a purple widebar.

The subsequent market price action failed to validate this price bar. Indeed, an isolated pivot low was duly delivered at this price point, with the gold market climbing higher to move back above the $1700 per ounce level once again as the precious metal recovers some of its recent bullish momentum once again.

Indeed this potential change in momentum is now clearly in evidence on the daily chart with the Hawkeye Heatmap having transitioned from bright red, to dark red, and currently through to dark green. Should this ultimately move back to bright green, then this could signal a return to the bullish momentum of the summer months and through September.

The move higher over the last few days has been accompanied by buying volumes on the daily chart. With the three day chart, also showing buyers coming back to the market, the positive sentiment for gold is returning. However, for a longer term trend run higher, we need to see the three day trend transition from bearish where it is currently, either to a white trend in transition, or through to green, which will then add further momentum to any sustained move higher.

From a technical perspective the key level of price resistance remains in the $1760 per ounce region. For any sustained move higher, this level will have to be breached. If this is cleared, then $1800 per ounce is the next psychological level. Should this level be breached, we can expect to see gold prices continue to climb higher with this solid platform of price support below.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.