Positive Action In The Gold Complex

David Tablish | Feb 19, 2020 12:23AM ET

Over the last few weeks I’ve been writing a lot on the critical inflection point the PM complex was showing. Yesterday’s price action is an important step in confirming the potential bullish outcome. There is still more work to be done from a longer term perspective, but its one step at a time until total confirmation is attained.

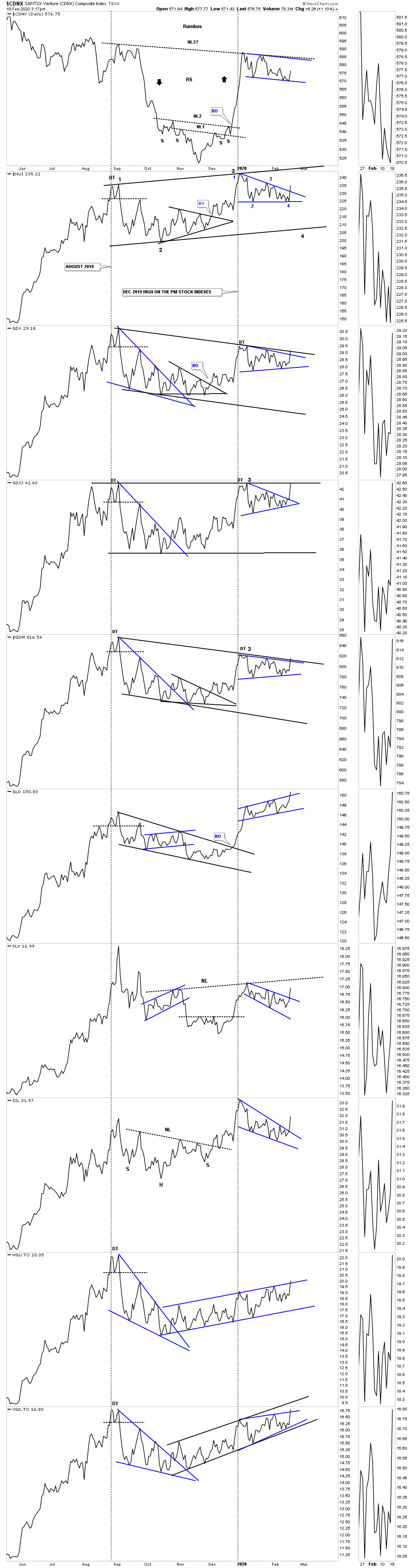

Let's start with the daily line combo chart we’ve been following very closely which shows many of the smaller blue trading ranges that were breaking out yesterday. I’ve been looking for one more decline back toward the bottom of the August 2019 trading range to complete a possible 4th reversal point. You can use the ARCA Gold BUGS Index (HUI) as a proxy for the rest of the PM stock indexes which shows where the possible 4th reversal point would be.

If we don’t get that 4th reversal point, and the PM complex rallies strongly above its August 2019 high, then the trading range will have to be either a H&S consolidation pattern or a cup & handle. Note the S&P/TSX Venture Composite (CDNX) which looks like it is trying to put the finishing touches to its 2019 H&S. The SPDR® Gold Shares (NYSE:GLD) is still the strongest area within the PM complex as it is hitting new highs for this rally phase.

The two Canadian ETFs (BetaPro Canadian Gold Miners 2x Daily Bull (TSX:HGU) and iShares S&P/TSX Global Gold (TSX:XGD)) have been building out a nearly five-month parallel rising channel. Those types of patterns can break out in either direction but yesterday's price is suggesting that the HGU.TO is likely to break out to the upside as it cracked the top rail yesterday.

This next chart is the weekly combo chart for the PM complex which shows the potential H&S consolidation patterns that have been forming. So far none of the possible H&S consolidation patterns have given way yet. It looks like the VanEck Vectors Junior Gold Miners ETF (NYSE:GDXJ) may be one of the first PM indexes to take out its neckline, which would be bullish for the rest of the PM complex.

This last chart is the Invesco DB U.S. Dollar Index Bullish Fund (NYSE:UUP) / HUI combo chart we’ve been following for most of the rising channel on the UUP. This chart shows a good example of how negative divergences can fail just when you think they will work out. You can see the big breakout move out of the blue bullish falling wedge on the dollar bullish ETF, UUP, while the HUI has only traded sideways, chopping out the blue triangle.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.