Political Saber Rattling Supports Safe-Haven Demand

MarketPulse | Apr 11, 2017 06:56AM ET

Tuesday April 11: Five things the markets are talking about

North Korea’s saber rattling combined with Russia’s role in Syria is spooking investors.

Global stocks are on the back foot; the yen has strengthened along with U.S Treasuries on investor caution about geopolitical risks and the path of U.S interest rates.

In North Korea, Kim Jong has vowed the “toughest” counteraction against President Trump’s response to dispatching a U.S naval destroyer to the region over the weekend. While in Syria, there is talk that Russia knew more about Assad’s intentions than originally thought.

The question is when, not if? After Friday’s weaker-than-expected nonfarm payroll (NFP) print, investors are also speculating on the path for U.S interest rates. The Fed is aiming to ease back significantly this year on the level of support the central bank is providing the U.S economy as they close in on their goals of full employment and their +2% inflation target.

Note: Volumes across the various asset classes are down in a week that’s shortened in many countries by Easter holidays.

1. Global stocks see red on investor uncertainty

In Japan, the Nikkei fell overnight (-0.3%), as rising geopolitical tensions in the region, a stronger yen (¥110.65) and renewed uncertainty in the French presidential election continues to spook investor sentiment. The broader Topix fell -0.3%, after a two-day advance.

The regional anomaly was in Australia where the S&P/ASX 200 gained +0.3% as energy shares advanced. In South Korea, the KOSPI fell -0.4% and extended its selloff to a sixth consecutive session.

In Hong Kong, the Hang Seng lost -0.8% and the Hang Seng China Enterprise (CEI) Index slid -1.2% amid concern that China may ramp up oversight of financial markets.

Note: The gauge of Chinese shares traded in Hong Kong has dropped -4.8% from its 17-month high reached in March.

In Europe, equity indices are trading generally lower despite the FTSE 100 outperforming and trading positive. Financial stocks are weighing heavily in the major indices.

U.S stocks are set to open in the red (-0.1%).

Indices: Stoxx50 -0.4% at 3,471, FTSE +0.4% at 7,375, DAX -0.2% at 12,181, CAC 40 -0.1% at 5,105, IBEX 35 -0.4% at 10,400, FTSE MIB -0.4% at 20,121, SMI flat at 8,617, S&P 500 Futures -0.1%

2. Crude oil prices ease on U.S shale production

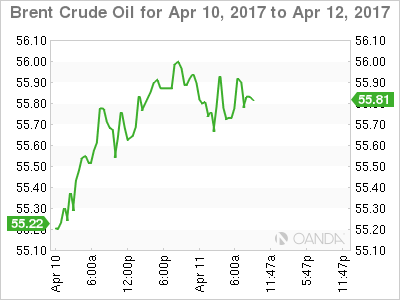

Oil prices have eased away from their five-week high overnight, as rising U.S shale oil production offsets investor concerns over geopolitical tensions in the Middle East and OPEC output cuts.

Note: Current price levels current prices have attracted shale oil producers in the past.

Brent crude futures are down -20c, or -0.36% from Monday’s close at +$55.78 per barrel, while U.S West Texas Intermediate (WTI) have given up -15c, or -0.3%, to +$52.93 a barrel.

In oil supply fundamentals, the global market remains oversupplied, even with efforts led by the OPEC to cut supplies to support global prices.

Brent has risen in each of the previous six sessions, while WTI has gained for the last five-days. U.S data also shows that crude inventories have touched record highs in Cushing, Oklahoma (storage hub), and in the U.S Gulf Coast in recent weeks.

Nervous investors are turning to the safety of gold. Prices (+0.2% to +$1,257.22 an ounce) remain buoyed by the yellow metal’s safe-haven status amid rising political tensions over North Korea, Middle East and the upcoming French presidential election.

3. Fixed income enjoys safe haven status

Aside from the safe haven status that U.S Treasury’s hold, bond yields have added to their declines in the overnight session after the Fed Chair Janet Yellen confirmed yesterday that the central bank has shifted its focus to “sustaining economic gains from post-crisis healing.” Ms. Yellen indicated that its appropriate to gradually raise Fed Funds rate as the U.S economy was now “pretty healthy.” Their estimate of “neutral rate was really not that high.” The Fed is now trying to “give it some gas, but not so much that we’re pushing down hard on the accelerator.”

Treasuries have rallied, with the yield on the 10-year note dropping -4 bps to +2.33%, after a -2 bps decline yesterday.

Elsewhere, uncertainty surrounding the French presidential election on April 23 continues to drive investors to sell French government bonds (OAT’s) and migrate cash into German government bonds and U.S Treasury debt. The yield on French 10s has backed up to +0.947%, while 10-year Bunds trade atop of their technically critical level of +0.2%.

Down-under, Aussie 10-year yields fell -4 bps to +2.53%.

4. Euro trades nervous on French election

This morning, with a number of Euro-inflation reports coming in below expectations supports the ECB to maintain loose monetary conditions. This has led to EUR cross selling as the predominant FX theme ahead of the U.S open.

The upcoming French election has the single unit (€1.0597) under pressure. Even EUR/JPY (€117.32) is softer as Japan-based entities hold around +12% of all outstanding French sovereign bonds.

Note: A gauge of how much investors are willing to pay to shield them against a sharp move in the EUR hit levels not seen since the height of the eurozone sovereign debt crisis this morning.

Elsewhere, the pound (£1.2436) has edged a tad higher towards the psychological £1.2450 area after U.K Mar CPI inflation (+2.3%) remained above the BoE’s +2% target for second consecutive month. This may prompt market talk of the BoE looking to raise interest rates.

5. German Economic Sentiment Beats Forecasts in April

Data this morning showed that German economic sentiment has improved sharply in April, possibly pointing to a pickup in economic growth in the months ahead.

Germany’s ZEW headline print for economic expectations rose to 19.5 points from 12.8 points in March – this is the highest level since August 2015.

Note: The ZEW survey signals ongoing optimism among financial analysts and institutional investors.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.