‘Poker Face’: The Yield Curve Inverts As Investors Call The Fed’s Bluff

Palisade Research | Dec 04, 2018 11:21PM ET

Last week when Jerome Powell – the Federal Reserve Chairman – said that we were now “just below” the neutral rate of interest, markets soared and bonds rallied.

In case you didn’t know – the ‘neutral rate’ is a term coined by 19th century economist Knut Wicksell. It’s the theoretical rate at which monetary policy is neither stimulating nor restricting economic growth.

But now that Powell said that the neutral rate is lower than he previously indicated two months ago – this is a problem.

The market now believes that Fed tightening via rate hikes and Quantitative Tightening (QT) is too tight. Meaning if they continue hiking, they will raise rates above the neutral rate – which will impede growth.

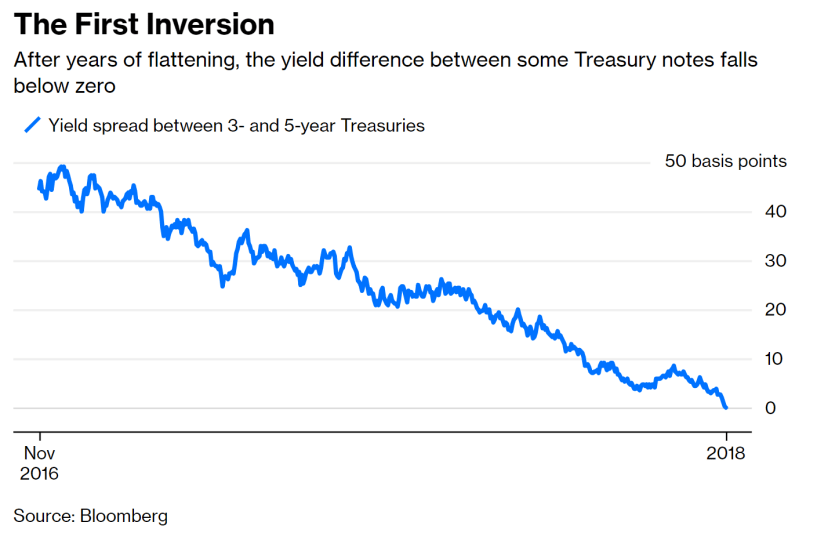

All this and more is why yesterday we saw a section of the yield curve – the 3-year and the 5-year spread – finally invert for the first time since the Great Recession of 2008.

This move shows us a big revelation. Which is: the bond market’s calling the Fed’s “booming economy” and “rising inflation” bluff. . .

I wrote about this a few months ago – back in May – that Wall Street (specifically bond investors) weren’t sold on the inflation and growth story that Trump and the Fed was pushing (read here ).

What do I mean by this?

Simply put – optimism about global growth, the inflation rate rising, and the Fed hiking many more times was all supposed to push long term rates much higher. Specifically well above the psychologically important 3% 10-year U.S. Bond threshold.

But instead of long-term rates rising parallel with the Fed’s short-term rate hikes – they’ve actually collapsed.

This caused the yield curve to turn sideways (flat) – and now finally inverting.

If you open your eyes and ignore the Fed’s cheap ‘soaring economy’ chatter – things aren’t looking so good in the global economy.

Here are just a few things. . .

First – global growth is showing weakness.

For example – in October – China reported their weakest GDP (economic growth) numbers since 2009. Also – their on-shore bond defaults hit a record high amid liquidity problems.

World trade has also drastically declined over the last year.

And the European Union – even with their rampant monetary stimulus from the ECB (European Central Bank) – is suffering from slowing growth as well.

Second – global corporate earnings expectations have declined.

The strong-dollar has ravaged global companies alongside rising short-term interest rates – making it more expensive to service debts.

I’ve written about this a lot throughout the last year – so if you’ve missed it, you can get caught up here

Third – higher inflation expectations fade.

Even with the unemployment rate at multi-decade lows, rising inflation expectation have declined as of late.

For instance, the Fed’s favorite inflation measure – the Personal Consumption Expenditure Index (PCE) – has sharply declined since the second-half of 2018. And has barely stayed above the Fed’s 2% target.

A sudden collapsing crude oil price also hasn’t helped (bond investors look at oil prices as a short-term inflation gauge).

Fourth – the Fed’s now approached “just below” the neutral rate

Investors are now expecting less rate hikes as the Fed Funds Rate (FFR) approaches the ‘neutral rate’ (like I wrote at the beginning of this article).

Remember – the ‘neutral rate’ is the theoretical point where monetary policy neither boosts nor restricts economic growth.

This means that if the Fed’s just below the neutral rate now – they can only hike one or two more times. Any more and it will begin restricting U.S. growth.

All these things – and more – indicate what we’ve seen for many months.

That the Bond Market’s called the Fed’s ‘rosy outlook’ bluff.

It appears now as if bond investors are expecting a recession and deflation over inflation and higher growth. Hence the inversion.

Don’t forget – yields inverting have preceded the last seven straight recessions. But it doesn’t happen immediately – it’ll take a few months (maybe even a year or two).

Why? I go into a deeper explanation about this all here . Make sure to check it out.

So – what’s next?

In 2018 – because of the Fed’s tightening – many investors piled into trades betting against Treasuries. Thus we saw over-crowded short positions in U.S. Treasuries notes and Bonds.

It only makes sense. If the Fed’s forcing short-term rates up and telling us that growth and inflation are on the rise – why wouldn’t investors short bonds?

But even with all this Fed “growth” jawboning alongside selling and shorting pressure – long term yields haven’t risen that much. Indicating that most didn’t believe them or that their tightening would last.

Now longer-term bond yields are falling (meaning bond prices are going up).

This will most-likely cause a ‘short-squeeze’ – pushing longer-term rates even lower – as investors try closing out their positions before getting too deep in the red (losses).

Because of this we’re already seeing the 5-year and 10-year bond shorts unwinding at a quick pace (yet the 30-year still standing stubborn).

Before this is all over – I expect more sections along the yield curve to invert. And relatively soon.

For instance – the popular one we look at – the spread between the 2-year note and 10-year bond (aka the 2 n’ 10 Rule) – is close to inverting. Only 0.14 basis points separate the two.

Don’t be surprised once the Fed suddenly changes their ‘rosy’ outlook and markets drastically re-price.

I said it in May and I say it again now –

Mr. Powell, I call your bluff.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.